The seemingly never-ending winter had barely moved into spring when an

enormous amount of forest fires broke out in Alberta. Raging wildfires

forced the evacuation of roughly 25,000 residents, so far. More than 350,000

hectares burned since January 1st, compared to an average of 800 hectares by

this time of year. Both road and rail transport lanes near Edson, Alta., saw

immediate negative effects from the fires. The town of Fox Creek, including

the Canfor sawmill (previously Miller Western), are also evacuated. This is

a brand-new occurrence; never before have such a large number of such severe

wildfires broken out so early in the season in an important timber supply

area of North America.

Thus what this means for lumber manufacturing, sales, and prices going into

summer 2023 is also unknown.

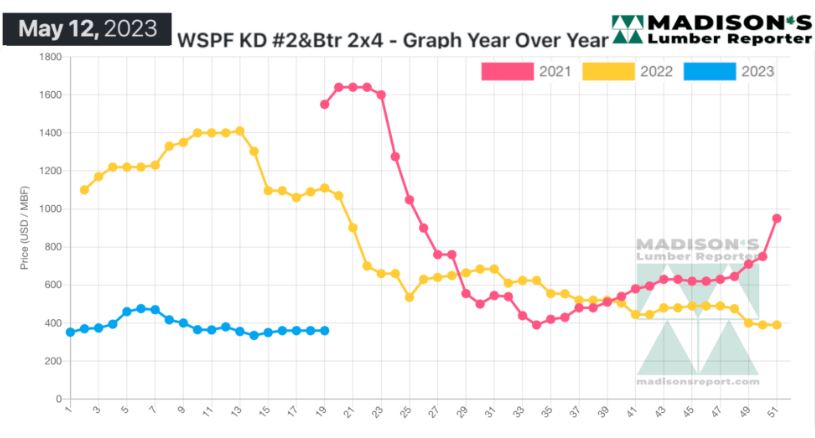

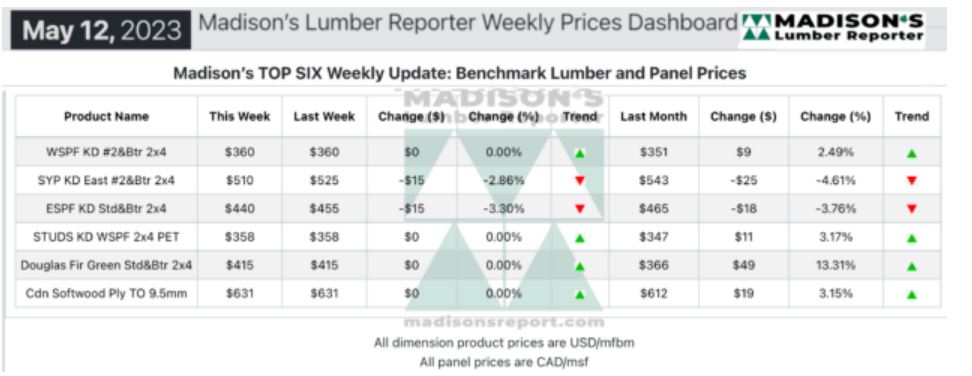

In the week ending May 12, 2023, the price of benchmark softwood lumber item

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was again US$360 mfbm, which is

flat from the previous week. This is up by $9, or two per cent, from one

month ago when it was $351.

Producers didn’t adjust their asking prices much as they waited to assess

near- and long-term impacts on fibre supply of this catastrophic and early

start to fire season.

“The largely-unchanged North American lumber market collectively held its

breath in anticipation of knock-on effects from catastrophic wildfires in

Western Canada.” — Madison’s Lumber Reporter

The Western S-P-F market was largely unchanged according to traders in the

United States. Horrific wildfires in Western Canada briefly pushed futures

up-limit, but cash didn’t follow. Then the run subsided. Pockets of inquiry

were observed across the country, with special attention paid to studs as

buyers began to secure coverage for June. Overall sales volumes remained

subpar for the time of year however, particularly in bread-and-butter

dimension. Buyers remained hesitant to build inventory, fearing another

unpredictable year like the past three. Sawmills maintained late-May order

files for the time being..

Suppliers of Western S-P-F in Canada all had forest fires on their minds as

out of control blazes swept across large swathes of Alberta and some of

British Columbia. The Alberta government declared a provincial state of

emergency. Demand overall remained subdued, with buyers leaning on their

well-established inventories and dipping into the distribution network when

needed. Four-inch dimension was again the most obviously oversupplied

commodity, while all other widths have also had trouble gaining traction

lately.

“

Prices of Eastern S-P-F continued to recede amid lukewarm demand

according to traders. Eastern Canadian producers showed plentiful

availability on weaker items such as narrow dimension and were open to

reasonable counter offers from pokey customers. Studs were less-susceptible

to this prevalent downward pressure by comparison. By midweek sales activity

picked up and much of that accumulated material had been spoken for as

buyers and suppliers found amenable numbers. Sawmills were able to

strengthen their order files into late May on most items and grades.” —

Madison’s Lumber Reporter

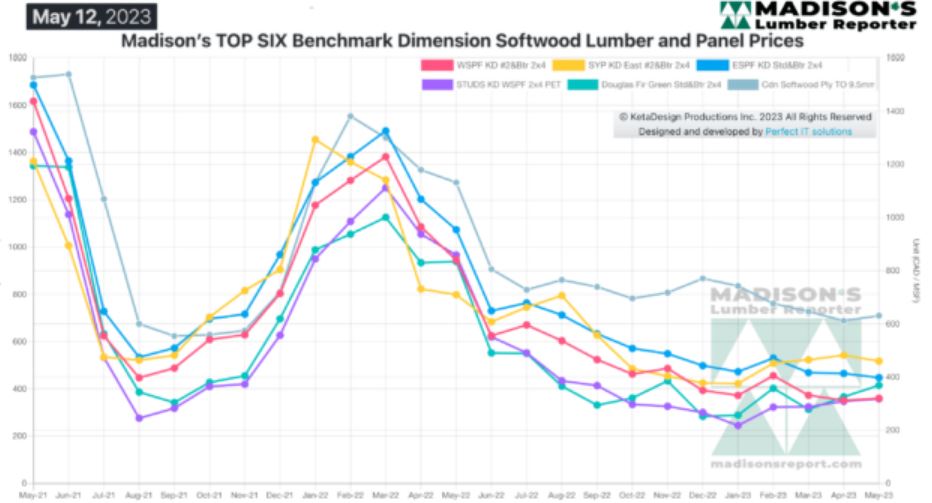

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly

Averages

Compared to the same week last year, when it was US$1,110 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending May 12, 2023,

this price was down by $750, or 68 per cent. Compared to two years ago when

it was $1,550, that week’s price is down by $1,190, or 77 per cent.

More Reports: