By Madison's Lumber Reporter

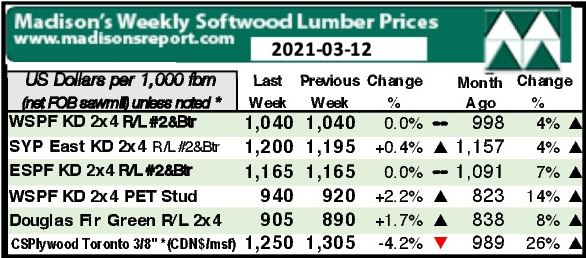

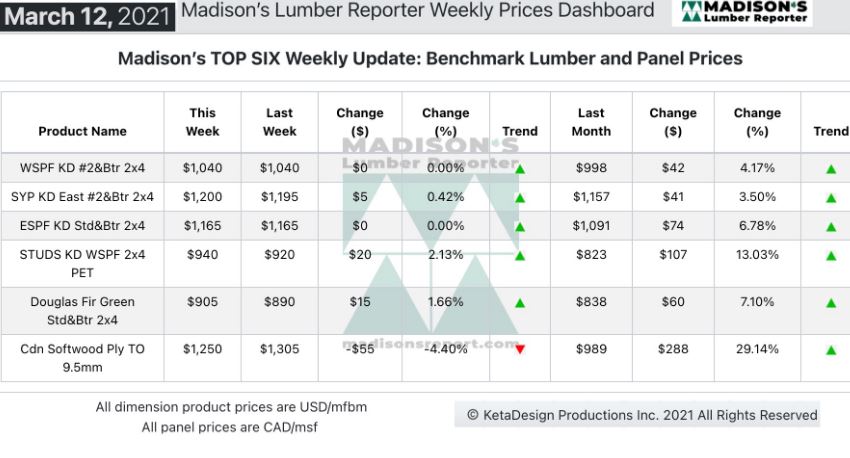

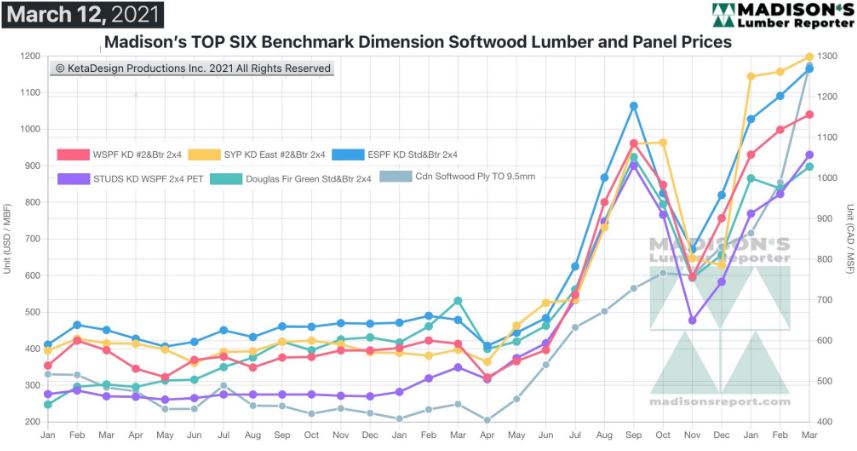

Potentially signalling a plateau in lumber

prices, at least for the time being, benchmark

softwood lumber commodity items stayed flat

again last week while plywood prices lost almost

all the gains of the previous week. However,

supply remained incredibly tight as customers

still had to search around for the specific

items they wanted at prices that didn’t make

them balk. Many players consider this a

temporary lull, due to recent harsh winter

weather across most of North America. As

temperatures move toward spring balmy

conditions, expectations are that building

activity in Canada and the U.S. will ramp up to

the frenzy seen last year.

Reversing increases of the previous week by

half, prices of benchmark panel item Canadian

Softwood Plywood Toronto 9.5 mm dropped back

-C$55, or -4.4%, to C$1,250 msf from C$1,303 the

previous week. This item is now +C$288, or +29%,

higher than one month ago when it was C$989 msf.

“The upward trend in many commodity prices appeared to be

slowing, even as strong demand persisted.” — Madison’s Lumber Reporter

For the week ending March 12, Western S-P-F purveyors in the U.S. were

busy again. Players noted there was no room for hesitancy in this

market, as anyone who slept on an order lost it. Sawmill order files

were pushing into April.

Canadian Western S-P-F dealers saw demand perk back up as order files at

sawmills extended into the week of April 5 and rail car supply improved

marginally. WSPF 2×4 prices topped out last week at an astonishing

$1,040 and demand didn’t miss a beat as customers searched for other

items.

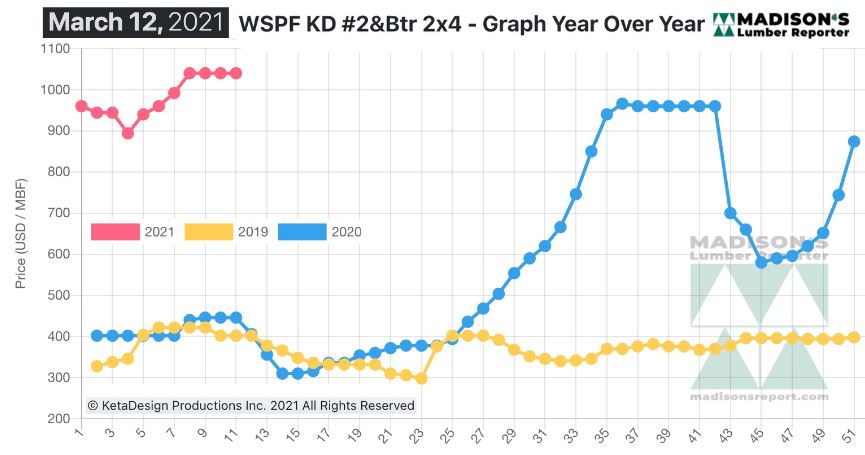

Again staying flat from the previous week, in the week ending

March 12, 2021, the price of benchmark softwood lumber commodity

item Western S-P-F KD 2×4 #2&Btr remained level at US$1,040 mfbm.

That week’s price is again +$42, or +4%, more than one month ago

when it was $998.

“Sales activity slowed down a trifle in the U.S. northeast, but

stocking wholesalers on the U.S. eastern seaboard expected any

pushback would be temporary. Prices advanced again significantly,

giving many customers sticker shock after they thought they’d grown

numb to that.” — Madison’s Lumber Reporter

Compared to the price one-year-ago, still at US$446 mfbm, that week

benchmark softwood lumber item Western S-P-F KD 2×4 #2&Btr was again

selling for US$1,040 mfbm which is +594, or +133% more.

Related News:

-

U.S. & Canada softwood and panel markets - week

09 2021 (Mar

17,

2021)

-

U.S. & Canada softwood and panel markets - week

08 2021 (Mar

10,

2021)

-

U.S. & Canada softwood and panel markets - week

07 2021 (Mar

03,

2021)

-

U.S. & Canada softwood and panel markets - week

06 2021 (Feb

24,

2021)

-

U.S. & Canada softwood and panel markets - week

05 2021 (Feb

16,

2021)

-

U.S. & Canada softwood and panel markets - week

04 2021 (Feb

04,

2021)

-

U.S. & Canada softwood and panel markets - week

03 2021 (Jan

29,

2021)

-

U.S.&nb303& Canada softwood and panel markets - week

02 2021 (Jan

22,

2021)

-

U.S. & Canada softwood and panel markets - week

01 2021 (Jan

15,

2021)

-

U.S. & Canada softwood and panel markets - week

49 2020 (Dec

16,

2020)

-

U.S. & Canada softwood and panel markets - week

48 2020 (Dec

09,

2020)

-

U.S. & Canada softwood and panel markets - week

47 2020 (Dec

02,

2020)

-

U.S. & Canada softwood and panel markets - week

46 2020 (Nov

25,

2020)

-

U.S. & Canada softwood and panel markets - week

45 2020 (Nov

18,

2020)

-

U.S. & Canada softwood and panel markets - week

44 2020 (Nov

11,

2020)

-

U.S. & Canada softwood and panel markets - week

43 2020 (Nov

4,

2020)

-

U.S. & Canada softwood and panel markets - week

42 2020 (Oct

28,

2020)

-

U.S. & Canada softwood and panel markets - week

41 2020 (Oct

21,

2020)

-

U.S. & Canada softwood and panel markets - week

40 2020 (Oct

14,

2020)

-

U.S. & Canada softwood and panel markets - week

39, 2020 (Oct

07,

2020)

-

U.S. & Canada softwood and panel markets - week

38, 2020 (Sep

30,

2020)

-

U.S. & Canada softwood and panel markets - week

37, 2020 (Sep

23,

2020)

-

U.S. & Canada softwood and panel markets - week

36, 2020 (Sep

16,

2020)

-

U.S. & Canada softwood and panel markets - week

35, 2020 (Sep

09,

2020)

-

U.S. & Canada softwood and panel markets - week

34, 2020 (Sep

02,

2020)

-

U.S. & Canada softwood and panel markets - week

33, 2020 (Aug

26,

2020)

-

U.S. & Canada softwood and panel markets - week

32, 2020 (Aug

19,

2020)

-

U.S. & Canada softwood and panel markets - week

31, 2020 (Aug

12,

2020)

-

U.S. & Canada softwood and panel markets - week

30, 2020 (Aug

05,

2020)

-

U.S. & Canada softwood and panel markets - week 29, 2020 (Jul

29,

2020)

-

U.S. & Canada softwood and panel markets - week 28, 2020 (Jul

22,

2020)

-

U.S. & Canada softwood and panel markets - week 27, 2020 (Jul

17,

2020)

-

U.S. & Canada softwood and panel markets - week 26, 2020 (Jul

10,

2020)

-

U.S. & Canada softwood and panel markets - week 25, 2020 (Jul

02,

2020)

-

U.S. & Canada softwood and panel markets - week 24, 2020 (Jun

25,

2020)

-

U.S. & Canada softwood and panel markets - week 23, 2020 (Jun

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 22, 2020 (Jun

10,

2020)

-

U.S. &

Canada softwood and panel markets - week 21, 2020 (Jun

3,

2020)

-

U.S. &

Canada softwood and panel markets - week 20, 2020 (May 27,

2020)

-

U.S. &

Canada softwood and panel markets - week 19, 2020 (May 21,

2020)

-

U.S. &

Canada softwood and panel markets - week 18, 2020 (May 15,

2020)

-

U.S. &

Canada softwood and panel markets - week 17, 2020 (May 8,

2020)

-

U.S. &

Canada softwood and panel markets - week 16, 2020 (May 1,

2020)

-

U.S. &

Canada softwood and panel markets - week 15, 2020 (Apr

23,

2020)

-

U.S. &

Canada softwood and panel markets - week 14, 2020 (Apr

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 13, 2020 (Apr

08,

2020)

-

U.S. &

Canada softwood and panel markets - week 12, 2020 (Mar

31,

2020)

-

U.S. &

Canada softwood and panel markets - week 11, 2020 (Mar

24,

2020)

-

U.S. &

Canada softwood and panel markets - week 5, 2020 (Feb

11,

2020)

-

U.S. &

Canada softwood and panel markets - week 4, 2020 (Feb

4,

2020)

-

U.S. &

Canada softwood and panel markets - week 3, 2020 (January

27,

2020)

-

U.S. &

Canada softwood and panel markets - week 2, 2020 (January

20,

2020)

-

U.S. &

Canada softwood and panel markets - week 1, 2020 (January

13,

2020)

-

U.S. &

Canada softwood and panel markets - week 50, 2019 (December

17,

2019)

-

U.S. &

Canada softwood and panel markets - week 49, 2019 (December

10,

2019)

-

U.S. &

Canada softwood and panel markets - week 48, 2019 (December

3,

2019)

-

U.S. &

Canada softwood and panel markets - week 47, 2019 (November

26,

2019)

-

U.S. &

Canada softwood and panel markets - week 46, 2019 (November

19,

2019)

-

U.S. &

Canada softwood and panel markets - week 45, 2019 (November

12,

2019)

-

U.S. &

Canada softwood and panel markets - week 44, 2019 (November

5,

2019)

-

U.S. &

Canada softwood and panel markets - week 43, 2019 ( October

29,

2019)

-

U.S. &

Canada softwood and panel markets - week 42, 2019 ( October

22,

2019)

-

U.S. &

Canada softwood and panel markets - week 41, 2019 ( October

15,

2019)

-

U.S. &

Canada softwood and panel markets - week 40, 2019 ( October

8,

2019)

-

U.S. &

Canada softwood and panel markets - week 39, 2019 ( October

1,

2019)

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|