Into the end of March markedly improved weather across the continent perked

up demand for lumber, pushing out sawmill order files to almost a month. As

such, suppliers were able to boost prices higher. The annual spring break

brought a noticeable absence of players, as families took off work while the

kids were out of school. As the market adjusted to this beginning of a

seasonal increase in sales, prices of some items remained even while others

did increase slightly. Transportation continued to be tricky, especially in

areas of longer travelling distances where there was snow on the ground.

Expectations were for another boost in demand as folks return to the office

for the last week of March.

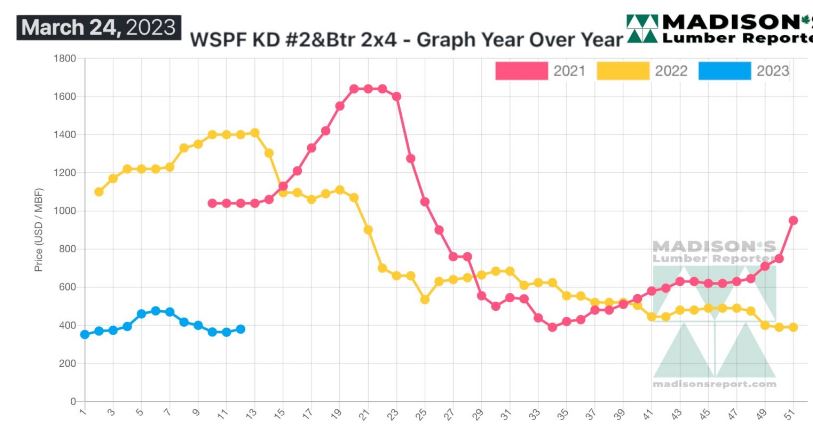

In the week ending March 24, 2023, the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$380 mfbm, which is up by +$16, or +4%, from the

previous week when it was $364, said weekly forest products industry price

guide newsletter Madison’s Lumber Reporter. That week’s price is down by

-$76, or -17%, from one month ago when it was $456.

Traders pointed out that many customers were absent from the market enjoying

spring break with their kids, and voiced their hope for a boost in business

when school resumes.

“Depending on species, commodity, and region, varying levels of activity

made the North American lumber market a hit-and-miss affair.” – Madison’s

Lumber Reporter

As spring weather continued to percolate through some key consuming regions,

Western S-P-F producers in the United States were less flexible with their

asking prices. Improved overall demand resulted in mid-April order files,

with big box customers apparently among the more prominent buyers lately.

Players reported a wave of Euro SPF arriving to the continent, which pushed

many suppliers to discount deeper than they would have liked to keep

material flowing. Sawmill order files were stretching into mid-April on most

items.

Canadian purveyors of Western S-P-F lumber described a middling market as

prices and sales activity continued to stabilize. Discounted offerings could

be found if buyers were persistent, but several key items were booking

increased sales, thus prices appeared to show a broader trend of firming up.

Demand for four- and six-inch #2&Btr R/L dimension led the way, with the

price gap between the two a common topic of conversation.

“In mid-March prices of most species of stud lumber took another step

forward, and Western S-P-F was no exception. Growing demand was evident all

week. Producers rode the wave and boosted their asking prices on four-inch

trims, while all other studs were firm at the previous week’s levels. Stud

mill order files slowly marched forward, now into the weeks of April 10th or

17th. Buyers continued to focus on short-term coverage, but there were

noticeably more transactions overall. Players reported large gaps in truck

freight rates depending on origin and destination pairings. Drivers who had

to run longer empty kilometres charged a premium for those trips.” –

Madison’s Lumber Reporter

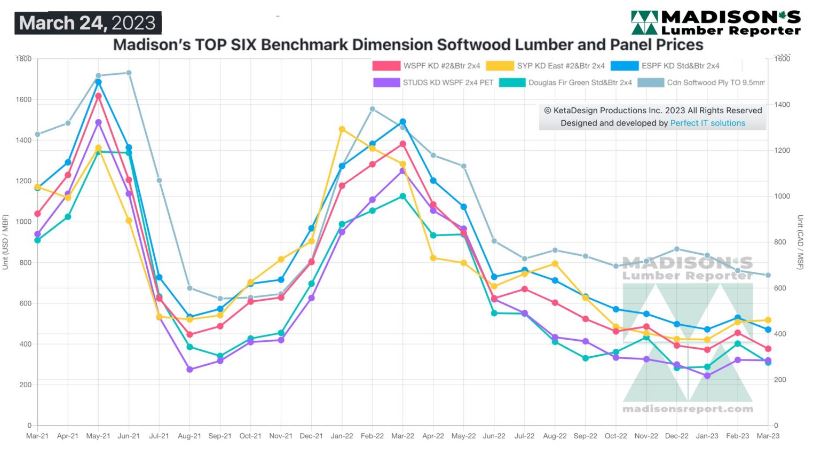

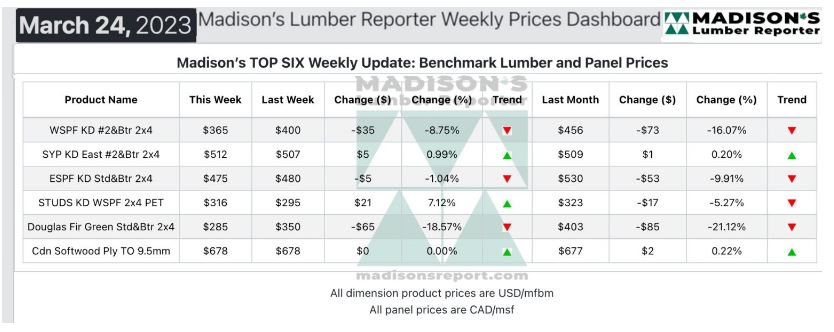

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly

Averages

Compared to the same week last year, when it was US$1,400 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending March 24,

2023 was down by -$1,020, or -73%. Compared to two years ago when it was

$1,040, that week’s price is down by -$660, or -63%.

More Reports: