By Madison's Lumber Reporter

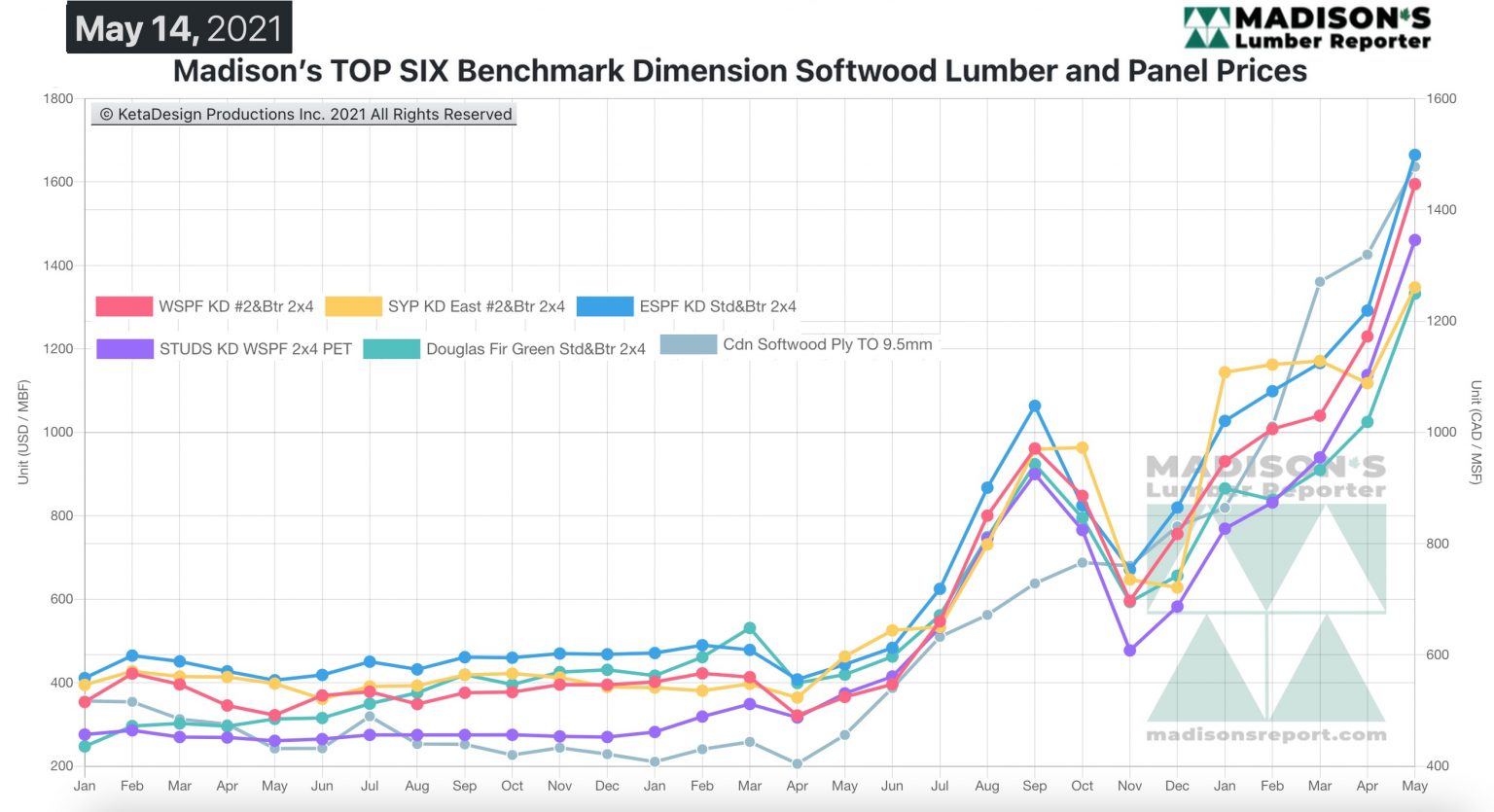

Lumber prices rose yet again for the week ending

May 14; however, volumes sold were lower as

customers refused to pay the higher prices.

Those who needed wood for ongoing projects or

purposes that could not be delayed sought out

the specific products they needed only and paid

whatever the asking price was. Accepting

delivery as soon as possible was more important

to them than price. However, actual sales were

down because buyers did not accept how high

prices have become. Does it mean we have reached

the top? Perhaps. Does it mean prices will start

going down? Possibly; but, more likely it means

prices will flatten out at least for a while

until the wood still in the supply chain that

customers have been waiting for arrives at its

destination. Currently, sawmills are selling

lumber that will go into production in

late-June, with delivery times approximately

three weeks after that.

U.S. housing starts and permits for April were

down so slightly from March they are basically

flat, but compared to one year ago, U.S.

construction activity is up a lot. This ongoing

strong building underscores high materials

prices – not just lumber, but all building

materials. Next week, updated home sales and

house price data will provide a better picture

of expected construction projects for the

summer. If the real estate market continues

red-hot, and house prices stay up or go up

higher, there is no reason for lumber prices to

soften any time soon.

“Yo-yoing Futures activity threw a wrench in the spokes, prices

advanced again, and frustration continued to build.” — Madison’s Lumber

Reporter

Conversations in the Western S-P-F market among players in the U.S. were

largely dominated by Futures activity and buying hesitation caused

thereby. After reaching dizzying heights which surpassed cash by a good

$200, toward the close of the May contract, lumber Futures on the

Chicago Mercantile Exchange corrected down to roughly cash levels.

Western S-P-F producers in Canada described tangibly quieter demand,

especially on Monday and Tuesday. Buyers were extremely cautious

following confusing Futures board activity early in the week, but there

were still plenty of folks in need of wood, and certainly more than

enough to keep demand well ahead of supply.

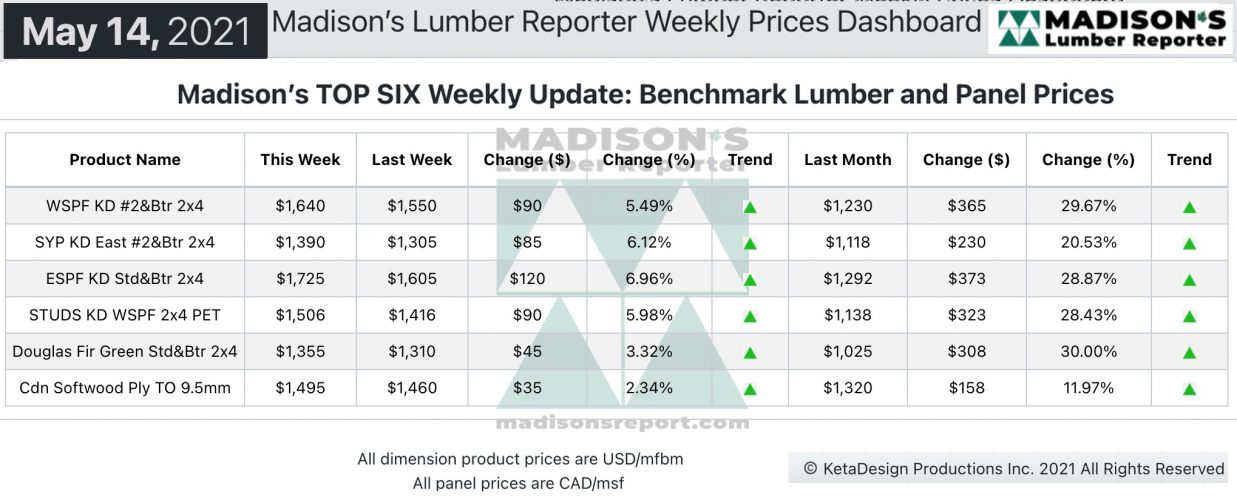

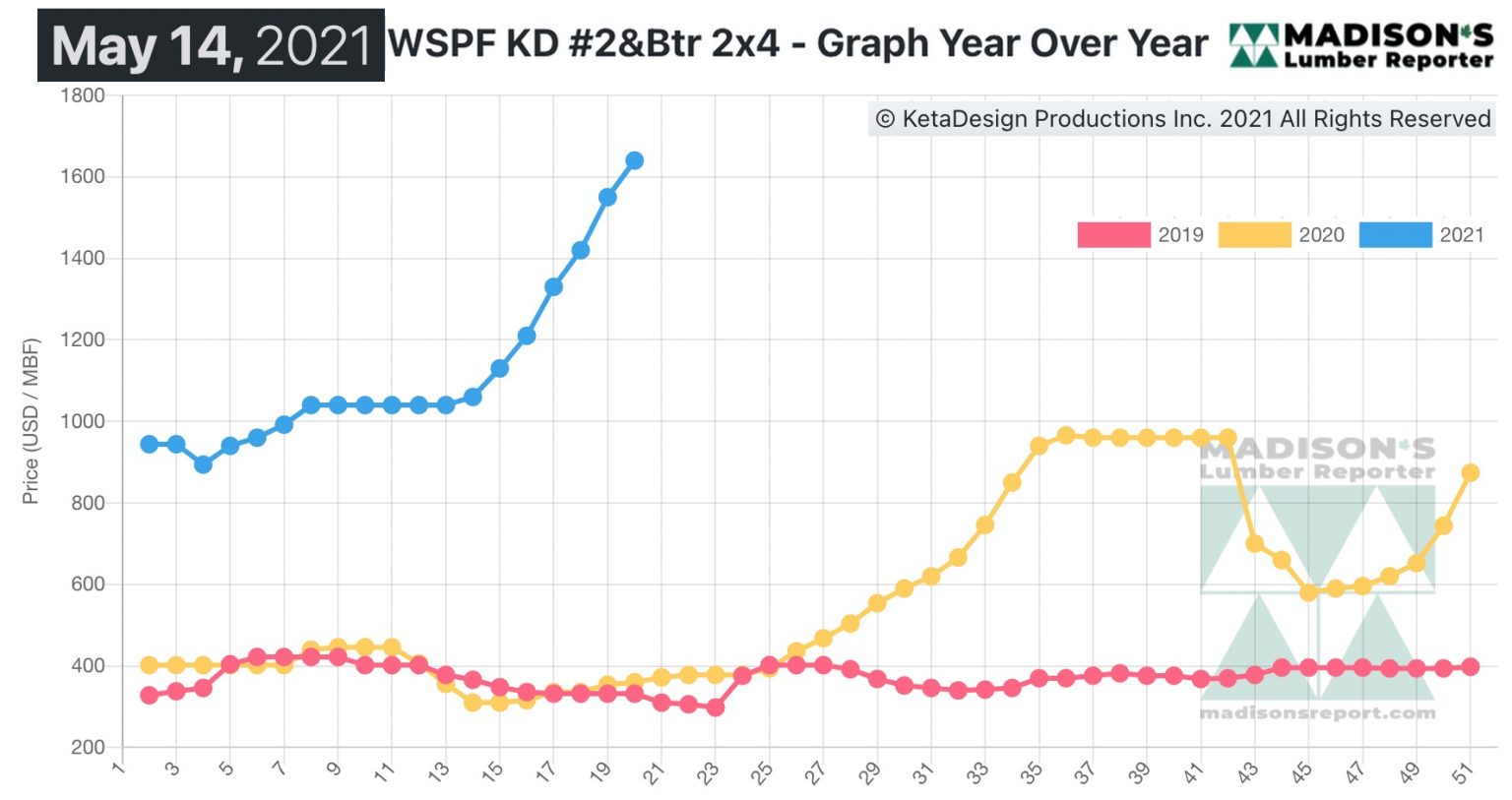

Continued price increases were outright rejected by customers, but

there were enough who absolutely needed to buy that prices pushed up

further, albeit on rather low sales volumes. In the week ending May

14, 2021 the wholesaler price of benchmark softwood lumber commodity

item Western S-P-F KD 2×4 #2&Btr was US$1,650 mfbm. This is up by

+$90, or +5%, from the previous week when it was $1,550.

That week’s price is up by +$418, or +33%, from one month ago when

it was $1,230.

Compared to the price one-year-ago, when it was US$360 mfbm, for the

week ending May 14, 2021, the price of Western S-P-F KD 2×4 was up by

+$1,280, or +356%.

Related News:

-

U.S. & Canada softwood and panel markets - week

18 2021 (May

19,

2021)

-

U.S. & Canada softwood and panel markets - week

17 2021 (May

12,

2021)

-

U.S. & Canada softwood and panel markets - week

16 2021 (May

5,

2021)

-

U.S. & Canada softwood and panel markets - week

15 2021 (Apr

28,

2021)

-

U.S. & Canada softwood and panel markets - week

14 2021 (Apr

21,

2021)

-

U.S. & Canada softwood and panel markets - week

13 2021 (Apr

15,

2021)

-

U.S. & Canada softwood and panel markets - week

12 2021 (Apr

8,

2021)

-

U.S. & Canada softwood and panel markets - week

11 2021 (Apr

1,

2021)

-

U.S. & Canada softwood and panel markets - week

10 2021 (Mar

25,

2021)

-

U.S. & Canada softwood and panel markets - week

09 2021 (Mar

17,

2021)

-

U.S. & Canada softwood and panel markets - week

08 2021 (Mar

10,

2021)

-

U.S. & Canada softwood and panel markets - week

07 2021 (Mar

03,

2021)

-

U.S. & Canada softwood and panel markets - week

06 2021 (Feb

24,

2021)

-

U.S. & Canada softwood and panel markets - week

05 2021 (Feb

16,

2021)

-

U.S. & Canada softwood and panel markets - week

04 2021 (Feb

04,

2021)

-

U.S. & Canada softwood and panel markets - week

03 2021 (Jan

29,

2021)

-

U.S.&nb303& Canada softwood and panel markets - week

02 2021 (Jan

22,

2021)

-

U.S. & Canada softwood and panel markets - week

01 2021 (Jan

15,

2021)

-

U.S. & Canada softwood and panel markets - week

49 2020 (Dec

16,

2020)

-

U.S. & Canada softwood and panel markets - week

48 2020 (Dec

09,

2020)

-

U.S. & Canada softwood and panel markets - week

47 2020 (Dec

02,

2020)

-

U.S. & Canada softwood and panel markets - week

46 2020 (Nov

25,

2020)

-

U.S. & Canada softwood and panel markets - week

45 2020 (Nov

18,

2020)

-

U.S. & Canada softwood and panel markets - week

44 2020 (Nov

11,

2020)

-

U.S. & Canada softwood and panel markets - week

43 2020 (Nov

4,

2020)

-

U.S. & Canada softwood and panel markets - week

42 2020 (Oct

28,

2020)

-

U.S. & Canada softwood and panel markets - week

41 2020 (Oct

21,

2020)

-

U.S. & Canada softwood and panel markets - week

40 2020 (Oct

14,

2020)

-

U.S. & Canada softwood and panel markets - week

39, 2020 (Oct

07,

2020)

-

U.S. & Canada softwood and panel markets - week

38, 2020 (Sep

30,

2020)

-

U.S. & Canada softwood and panel markets - week

37, 2020 (Sep

23,

2020)

-

U.S. & Canada softwood and panel markets - week

36, 2020 (Sep

16,

2020)

-

U.S. & Canada softwood and panel markets - week

35, 2020 (Sep

09,

2020)

-

U.S. & Canada softwood and panel markets - week

34, 2020 (Sep

02,

2020)

-

U.S. & Canada softwood and panel markets - week

33, 2020 (Aug

26,

2020)

-

U.S. & Canada softwood and panel markets - week

32, 2020 (Aug

19,

2020)

-

U.S. & Canada softwood and panel markets - week

31, 2020 (Aug

12,

2020)

-

U.S. & Canada softwood and panel markets - week

30, 2020 (Aug

05,

2020)

-

U.S. & Canada softwood and panel markets - week 29, 2020 (Jul

29,

2020)

-

U.S. & Canada softwood and panel markets - week 28, 2020 (Jul

22,

2020)

-

U.S. & Canada softwood and panel markets - week 27, 2020 (Jul

17,

2020)

-

U.S. & Canada softwood and panel markets - week 26, 2020 (Jul

10,

2020)

-

U.S. & Canada softwood and panel markets - week 25, 2020 (Jul

02,

2020)

-

U.S. & Canada softwood and panel markets - week 24, 2020 (Jun

25,

2020)

-

U.S. & Canada softwood and panel markets - week 23, 2020 (Jun

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 22, 2020 (Jun

10,

2020)

-

U.S. &

Canada softwood and panel markets - week 21, 2020 (Jun

3,

2020)

-

U.S. &

Canada softwood and panel markets - week 20, 2020 (May 27,

2020)

-

U.S. &

Canada softwood and panel markets - week 19, 2020 (May 21,

2020)

-

U.S. &

Canada softwood and panel markets - week 18, 2020 (May 15,

2020)

-

U.S. &

Canada softwood and panel markets - week 17, 2020 (May 8,

2020)

-

U.S. &

Canada softwood and panel markets - week 16, 2020 (May 1,

2020)

-

U.S. &

Canada softwood and panel markets - week 15, 2020 (Apr

23,

2020)

-

U.S. &

Canada softwood and panel markets - week 14, 2020 (Apr

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 13, 2020 (Apr

08,

2020)

-

U.S. &

Canada softwood and panel markets - week 12, 2020 (Mar

31,

2020)

-

U.S. &

Canada softwood and panel markets - week 11, 2020 (Mar

24,

2020)

-

U.S. &

Canada softwood and panel markets - week 5, 2020 (Feb

11,

2020)

-

U.S. &

Canada softwood and panel markets - week 4, 2020 (Feb

4,

2020)

-

U.S. &

Canada softwood and panel markets - week 3, 2020 (January

27,

2020)

-

U.S. &

Canada softwood and panel markets - week 2, 2020 (January

20,

2020)

-

U.S. &

Canada softwood and panel markets - week 1, 2020 (January

13,

2020)

-

U.S. &

Canada softwood and panel markets - week 50, 2019 (December

17,

2019)

-

U.S. &

Canada softwood and panel markets - week 49, 2019 (December

10,

2019)

-

U.S. &

Canada softwood and panel markets - week 48, 2019 (December

3,

2019)

-

U.S. &

Canada softwood and panel markets - week 47, 2019 (November

26,

2019)

-

U.S. &

Canada softwood and panel markets - week 46, 2019 (November

19,

2019)

-

U.S. &

Canada softwood and panel markets - week 45, 2019 (November

12,

2019)

-

U.S. &

Canada softwood and panel markets - week 44, 2019 (November

5,

2019)

-

U.S. &

Canada softwood and panel markets - week 43, 2019 ( October

29,

2019)

-

U.S. &

Canada softwood and panel markets - week 42, 2019 ( October

22,

2019)

-

U.S. &

Canada softwood and panel markets - week 41, 2019 ( October

15,

2019)

-

U.S. &

Canada softwood and panel markets - week 40, 2019 ( October

8,

2019)

-

U.S. &

Canada softwood and panel markets - week 39, 2019 ( October

1,

2019)

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|