Following the Easter long weekend, demand for lumber increased somewhat

however supply remained abundant. Sales to retailers increased noticeably,

as weather across the continent became more seasonably mild. Prices of most

softwood lumber and panel commodity items remained relatively even; some

were up and some were down a little bit. Sales volumes remained lower than

historically normal for the time of year. Expectations for the usual spring

building season remained — once again — in the future. It seemed like the

recent influx of European wood imports was starting to slow down.

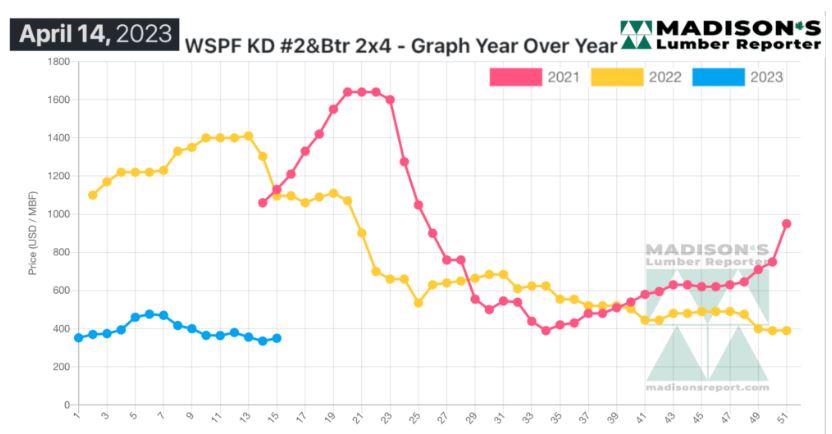

In the week ending April 14, the price of benchmark softwood lumber item

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$350 mfbm, which is up by

$15 or 4.0 per cent, from the previous week when it was US$335 mfbm. This is

down by $23, or 6.0 per cent, from one month ago when it was $373.

Sales of panels continued to flounder compared to lumber and studs,

though Oriented Strand Board seemed to gain some traction. Meanwhile, real

spring construction and resultant demand for building materials remained

elusive.

“Many buyers considered Easter weekend the latest important litmus test, and

after seeing steady numbers from the sawmills, decided to secure more

coverage.” — Madison’s Lumber Reporter

Sales across the entire North American solid wood commodities market

continued to sputter to life, and US Western S-P-F was no exception.

Availability appeared abundant as buyers stuck to their hand-to-mouth

purchases, but mounting reports of tightening supply at the sawmill level

belied the notion of a vastly oversupplied market. Retailers were busier

than in recent weeks, noting that the counteroffers accepted by mills have

recently slimmed down to $5 to $10 at most. The influx of European spruce

seemed to be waning lately, but there was still plenty available at lower

price points than domestic wood. Producers maintained two- to three-week

order files.

Western S-P-F lumber prices firmed up for the most part as players returned

to their desks after the Easter holiday long weekend. While Monday was

quiet, sales gained momentum from Tuesday-on. Players continued to report a

broad perception of oversupply from the view of buyers, however. While sales

volumes showed a promising direction, demand had yet to equalize with supply

and reach a pace typically associated with the spring season. Secondary

suppliers continued to field good takeaway from buyers looking for

last-minute coverage. Two-week order files at sawmills were the norm.

“

Buyers of Kiln-Dried Douglas-fir commodities continued to play it

cautious, sticking to short-term coverage of their most immediate

inventory-needs. Apparently, some sawmills were having trouble restocking on

fibre as log sellers boosted their asking prices, and kept shopping around

until they found someone willing to go higher on purchase price. For their

part, producers upped their asking prices on narrows a jot and held the line

on less-popular wides for the time being. At sawmills, dimension lead times

were still into the week of April 24th.” — Madison’s Lumber Reporter

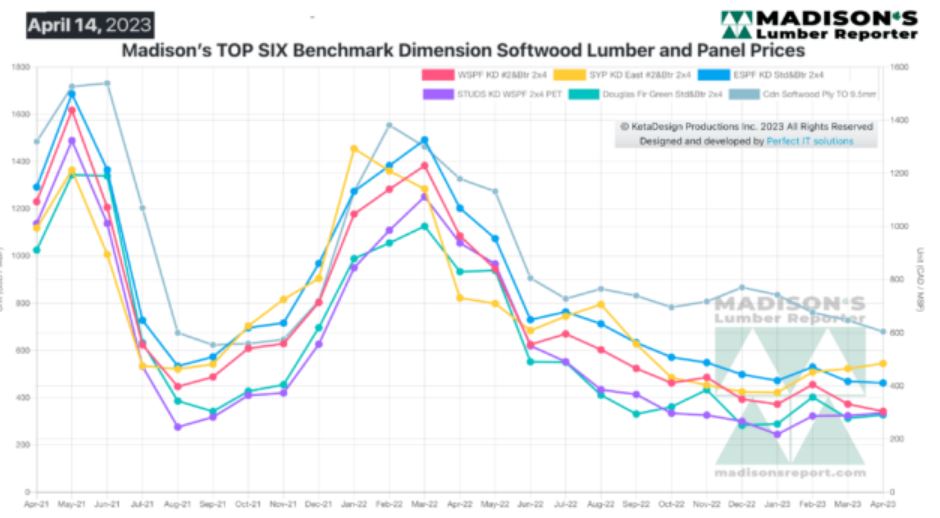

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly

Averages

Compared to the same week last year, when it was US$1,096 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending April 14,

2023 this price was down by $746, or 68 per cent. Compared to two years ago

when it was $1,130, that week’s price is down by $780, or 69 per cent.

More Reports: