What is normally considered a “litmus test” of sorts for the construction

framing dimension softwood lumber market, the week leading up to the Easter

holiday demonstrated still weak demand. Indications, though, were for

increasing sales volumes to come, as sawmills were better able to deflect

counter-offers than in recent weeks.

Another bought of harsh winter weather, especially in eastern Canada, kept

home building activity low. Several regions across the continent did

experience actual spring, thus demand for wood did start increasing. As the

calendar moves closer to May, the usual spring building season will truly

arrive.

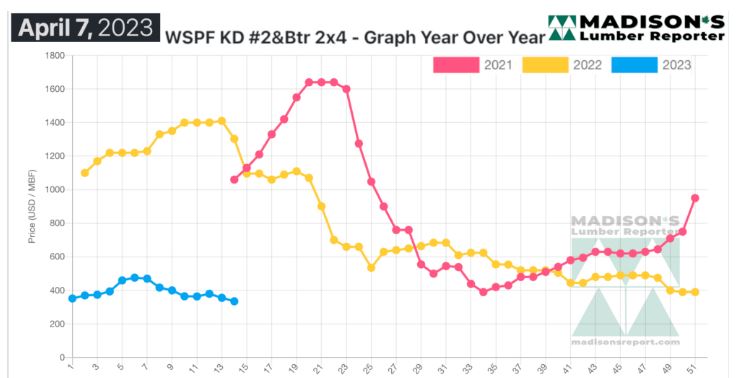

In the week ending April 7, the price of Western Spruce-Pine-Fir 2×4 #2&Btr

KD (RL) was US$335 mfbm, which is down by $21, or 6.0 per cent, from the

previous week when it was $356. That week’s price is down by $38, or 10 per

cent, from one month ago when it was $373.

Excess overall supply of Southern Yellow Pine and European wood continued to

give buyers myriad options to cover their positions.

“Solid wood commodity traders reported a so-so pace to sales activity in

virtually every category during the holiday-shortened week.” — Madison’s

Lumber Reporter

Sales of Western S-P-F commodities started the week on a so-so note and

dwindled slowly from there. According to traders in the U.S., buyers were

content with their inventories and took the opportunity of a

holiday-shortened week to retreat to the sidelines. Producers maintained

late-April order files and kept their asking prices at or slightly on either

side of the previous week’s levels. Another spate of cold weather enveloped

much of the U.S. Midwest, dampening demand from that region. Players noted

that sellers of European wood were changing their strategies, with that

source of supply anticipated to dry up.

Suppliers of Western S-P-F lumber in Western Canada reported pokey demand.

Buyers stayed cautious and were only too happy to play it quiet in advance

of the Easter holiday weekend. Modest business persisted through the

distribution network, but those sales volumes remained subpar by any

standard. Buyers continued to avoid any speculative purchasing. For their

part, producers were increasingly disinterested in counter-offers even as

they showed plentiful availability. While the outlook was cold and wet in

the West over the holiday weekend, players looked toward warmer weather in

the long-term forecast.

“Southern Yellow Pine trading slowed down as the Easter holiday

approached and buyers took the opportunity to step back and digest

previously-ordered material. Producers remained confident, keeping their

numbers firm or slightly above last week’s levels and extending order files

into late-April on most items. Industrial customers stayed more active than

other buyers, and studs were again a steady seller.” — Madison’s Lumber

Reporter

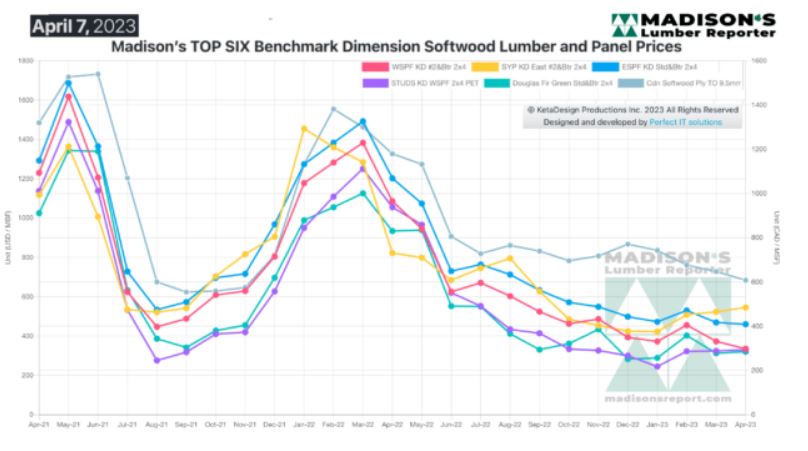

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly

Averages

Compared to the same week last year, when it was US$1,096 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending April 7, was

down by $761, or 21 per cent. Compared to two years ago when it was $1,110,

that week’s price is down by $565, or 51 per cent.

More Reports: