May dawned to witness no particular increase in lumber demand. Supply

remained good as sawmills had plenty of inventory on hand. Customer

inquiries did improve, as is normal for the time of year, but was still

along the levels of the past winter. Players wondered when ever would the

spring construction season materialize for 2023.

In response to the weak market conditions, another producer announced a

round of curtailments at manufacturing facilities, again in British

Columbia. This to prevent lumber commodity prices from falling even further,

as they are currently dangerously at or below cost-of-production.

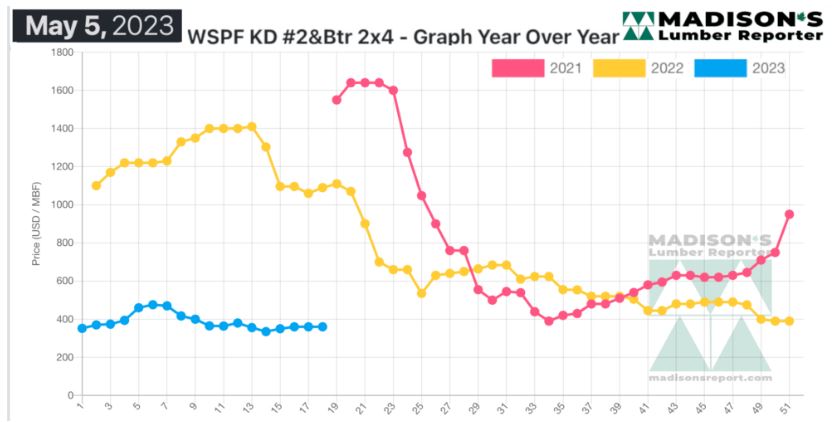

In the week ending May 05, 2023, the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$360 mfbm, which is flat from the previous week. That

week’s price is up by $9, or two per cent, from one month ago when it was

$351.

Substantial discounts for material beyond a two-week timeline were not

considered as producers waited to see if they could firm up their numbers

over the course of May.

“

The overall pace of business remained lacklustre considering the time of

year, yet traders remained optimistic about more sales to come.” — Madison’s

Lumber Reporter

Real springtime sales activity remained elusive again according to Western

S-P-F traders in the United States. There was apparently still too much

supply chasing too little demand. Some players contrastingly reported

sneaky-good business in their respective regions, with a fair bit of

day-to-day truck orders coming in. While demand levels seemed boring, by

day’s end the number of overall deals stacked up to decent numbers. A

prevailing sentiment was that 2×4 #2&Btr R/L was undervalued no matter the

source. Meanwhile, #3/Utility 2×4 was much more difficult to buy and easier

to sell. Traders saw studs as the most liquid items. Sawmill order files

were in the realm of two weeks.

Caution continued to reign in the Western S-P-F lumber market to hear

Canadian suppliers tell it. Players were optimistic overall, but the pace of

business remained well below typical springtime levels. Buyers still

subsisted on hand-to-mouth deals. Even as they kept to short-covering,

customers reported increased jobsite activity and retail traffic. Western

Canadian sawmills adjusted their asking prices on bread-and-butter items

within a narrow range, trying to find tradable levels that stuck.

Transportation continued to flow smoothly and on time for the most part,

further reducing urgency on the part of buyers.

“

Sellers of green Douglas-fir lumber and studs in the United States

reported another grind of a week. Inquiry was out there, but securing actual

orders was a challenge according to suppliers. Wholesalers and distributers

were busier than sawmills as buyers continued to favour highly-specified

mixes and LTL orders that could be shipped in 10 days or less. Meanwhile,

producers worked to build up their meagre log decks as soggy forestland

dried out, anticipating improved demand in the back half of May. Sawmill

order files were largely into the second or third week of May.” — Madison’s

Lumber Reporter

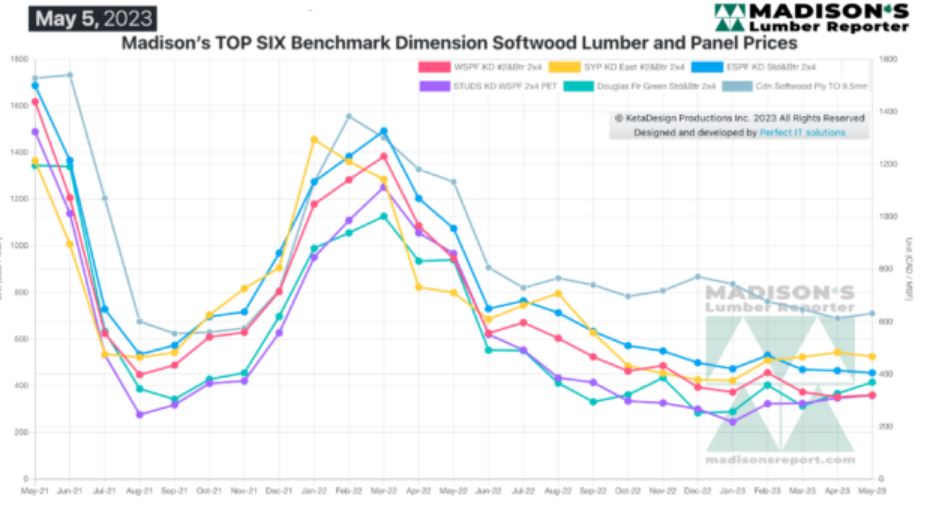

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly

Averages

Compared to the same week last year, when it was US$1,060 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending May 05, 2023

was down by $700, or 66 per cent. Compared to two years ago when it was

$1,210, that week’s price is down by $850, or 70 per cent.

More Reports: