By Madison's Lumber Reporter

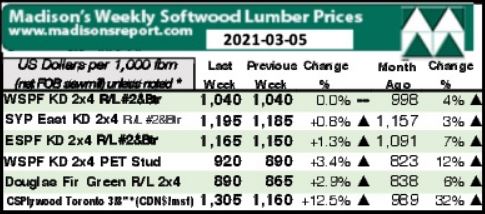

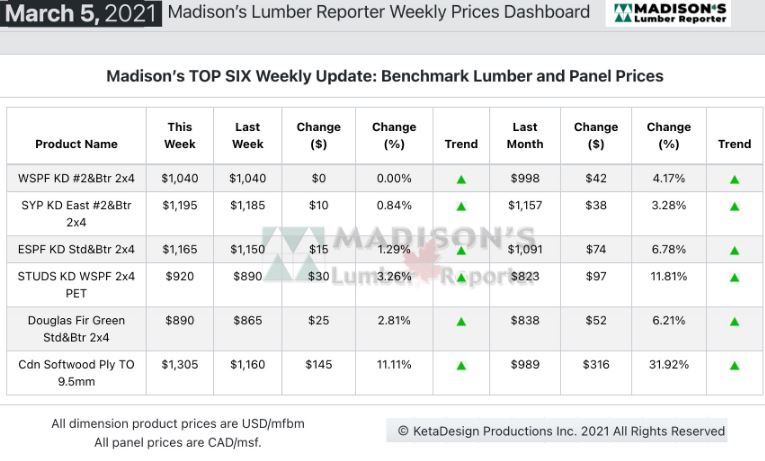

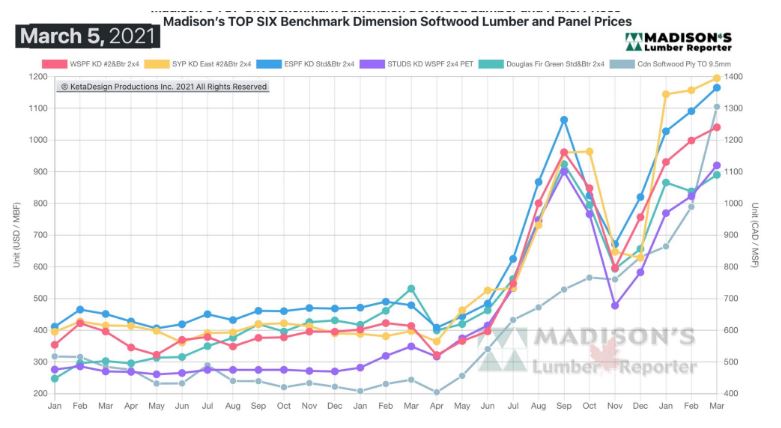

Prices of benchmark softwood lumber items, like

standard grade #2&Btr R/L stayed mostly flat

last week — particularly on the west side — as

customer demand flowed into other items. There

was quite a pop in #3/Utility grade and

#4/Economy prices across all species and sizes,

as well as a rise in Western and Eastern

Spruce-Pine-Fir straight-lengths — especially

for the 2×6 dimension. Delayed delivery times

continued to put a real crimp in supply; at this

point, operators don’t even know when, or if,

their rail cars are going to arrive. While the

urgency of booking orders seemed to have eased,

many speculate that this was just a temporary

easing. Expectations are that the “big buy” for

lumber in advance of spring is not yet over.

Those seeking a forward indicator need to look

no further than plywood. Prices of benchmark

plywood item Canadian Softwood Plywood Toronto

9.5 mm soared +C$145, or +11%, to C$1,303 msf

from C$1,160 the previous week. This item is now

+C$316, or +32%, higher than one month ago when

it was C$989 msf.

“As spring building season neared demand and prices showed no

signs of softening.” — Madison’s Lumber Reporter

For the week ending March 5, U.S. Western S-P-F sawmills maintained two

to four week order files. Availability of transportation equipment was a

constant bottleneck for suppliers, with complaints coming from all over

about delayed rail cars and limited trucks and drivers.

The upward trend was on display again for Canadian Western S-P-F

commodities, especially in 2×6 and wider. Prices of low grade also

climbed again, though producers noted a seeming plateau in demand for

those items. Producers sold into the week of March 29, but

transportation issues pushed delivery at least two weeks further out.

Log supply was in comparatively good shape after frigid weather froze

much of the interior region of B.C. Producers were in the process of

getting their decks ready for spring breakup.

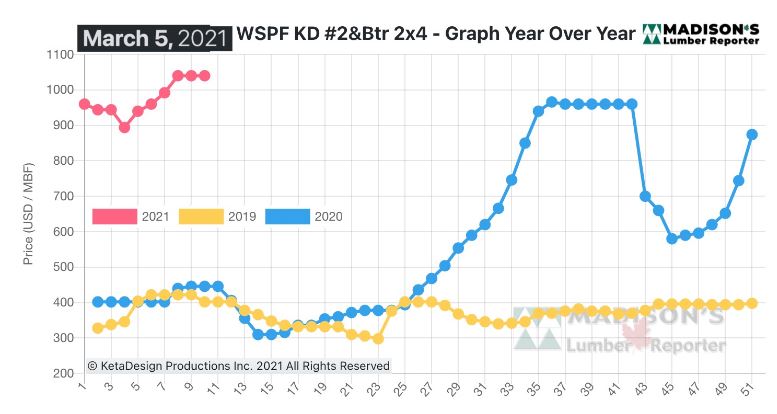

In an apparent plateau after reaching dizzying heights, in the

week ending March 5, 2021, the price of benchmark softwood lumber

commodity item Western S-P-F KD 2×4 #2&Btr was flat at US$1,040 mfbm.

That week’s price is +$42, or +4%, more than one month ago when it

was $998.

“Demand in Eastern Canada was strong again according to Eastern

S-P-F dealers. Buyers tried to push back against advancing prices

but there were too many folks who needed product with a desperation.

Sawmills boosted their asking prices into both the Great Lakes and

Toronto markets as their order files stretched into the first half

of April. Builders voiced their mounting concerns about supply

shortages and delays of virtually every manufactured product under

the sun.” — Madison’s Lumber Reporter

Compared to the price one-year-ago, of US$446 mfbm, last week benchmark

softwood lumber item Western S-P-F KD 2×4 #2&Btr was selling for

US$1,040 mfbm which is +594, or +133% more.

Related News:

-

U.S. & Canada softwood and panel markets - week

08 2021 (Mar

10

24,

2021)

-

U.S. & Canada softwood and panel markets - week

07 2021 (Mar

03,

2021)

-

U.S. & Canada softwood and panel markets - week

06 2021 (Feb

24,

2021)

-

U.S. & Canada softwood and panel markets - week

05 2021 (Feb

16,

2021)

-

U.S. & Canada softwood and panel markets - week

04 2021 (Feb

04,

2021)

-

U.S. & Canada softwood and panel markets - week

03 2021 (Jan

29,

2021)

-

U.S.&nb303& Canada softwood and panel markets - week

02 2021 (Jan

22,

2021)

-

U.S. & Canada softwood and panel markets - week

01 2021 (Jan

15,

2021)

-

U.S. & Canada softwood and panel markets - week

49 2020 (Dec

16,

2020)

-

U.S. & Canada softwood and panel markets - week

48 2020 (Dec

09,

2020)

-

U.S. & Canada softwood and panel markets - week

47 2020 (Dec

02,

2020)

-

U.S. & Canada softwood and panel markets - week

46 2020 (Nov

25,

2020)

-

U.S. & Canada softwood and panel markets - week

45 2020 (Nov

18,

2020)

-

U.S. & Canada softwood and panel markets - week

44 2020 (Nov

11,

2020)

-

U.S. & Canada softwood and panel markets - week

43 2020 (Nov

4,

2020)

-

U.S. & Canada softwood and panel markets - week

42 2020 (Oct

28,

2020)

-

U.S. & Canada softwood and panel markets - week

41 2020 (Oct

21,

2020)

-

U.S. & Canada softwood and panel markets - week

40 2020 (Oct

14,

2020)

-

U.S. & Canada softwood and panel markets - week

39, 2020 (Oct

07,

2020)

-

U.S. & Canada softwood and panel markets - week

38, 2020 (Sep

30,

2020)

-

U.S. & Canada softwood and panel markets - week

37, 2020 (Sep

23,

2020)

-

U.S. & Canada softwood and panel markets - week

36, 2020 (Sep

16,

2020)

-

U.S. & Canada softwood and panel markets - week

35, 2020 (Sep

09,

2020)

-

U.S. & Canada softwood and panel markets - week

34, 2020 (Sep

02,

2020)

-

U.S. & Canada softwood and panel markets - week

33, 2020 (Aug

26,

2020)

-

U.S. & Canada softwood and panel markets - week

32, 2020 (Aug

19,

2020)

-

U.S. & Canada softwood and panel markets - week

31, 2020 (Aug

12,

2020)

-

U.S. & Canada softwood and panel markets - week

30, 2020 (Aug

05,

2020)

-

U.S. & Canada softwood and panel markets - week 29, 2020 (Jul

29,

2020)

-

U.S. & Canada softwood and panel markets - week 28, 2020 (Jul

22,

2020)

-

U.S. & Canada softwood and panel markets - week 27, 2020 (Jul

17,

2020)

-

U.S. & Canada softwood and panel markets - week 26, 2020 (Jul

10,

2020)

-

U.S. & Canada softwood and panel markets - week 25, 2020 (Jul

02,

2020)

-

U.S. & Canada softwood and panel markets - week 24, 2020 (Jun

25,

2020)

-

U.S. & Canada softwood and panel markets - week 23, 2020 (Jun

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 22, 2020 (Jun

10,

2020)

-

U.S. &

Canada softwood and panel markets - week 21, 2020 (Jun

3,

2020)

-

U.S. &

Canada softwood and panel markets - week 20, 2020 (May 27,

2020)

-

U.S. &

Canada softwood and panel markets - week 19, 2020 (May 21,

2020)

-

U.S. &

Canada softwood and panel markets - week 18, 2020 (May 15,

2020)

-

U.S. &

Canada softwood and panel markets - week 17, 2020 (May 8,

2020)

-

U.S. &

Canada softwood and panel markets - week 16, 2020 (May 1,

2020)

-

U.S. &

Canada softwood and panel markets - week 15, 2020 (Apr

23,

2020)

-

U.S. &

Canada softwood and panel markets - week 14, 2020 (Apr

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 13, 2020 (Apr

08,

2020)

-

U.S. &

Canada softwood and panel markets - week 12, 2020 (Mar

31,

2020)

-

U.S. &

Canada softwood and panel markets - week 11, 2020 (Mar

24,

2020)

-

U.S. &

Canada softwood and panel markets - week 5, 2020 (Feb

11,

2020)

-

U.S. &

Canada softwood and panel markets - week 4, 2020 (Feb

4,

2020)

-

U.S. &

Canada softwood and panel markets - week 3, 2020 (January

27,

2020)

-

U.S. &

Canada softwood and panel markets - week 2, 2020 (January

20,

2020)

-

U.S. &

Canada softwood and panel markets - week 1, 2020 (January

13,

2020)

-

U.S. &

Canada softwood and panel markets - week 50, 2019 (December

17,

2019)

-

U.S. &

Canada softwood and panel markets - week 49, 2019 (December

10,

2019)

-

U.S. &

Canada softwood and panel markets - week 48, 2019 (December

3,

2019)

-

U.S. &

Canada softwood and panel markets - week 47, 2019 (November

26,

2019)

-

U.S. &

Canada softwood and panel markets - week 46, 2019 (November

19,

2019)

-

U.S. &

Canada softwood and panel markets - week 45, 2019 (November

12,

2019)

-

U.S. &

Canada softwood and panel markets - week 44, 2019 (November

5,

2019)

-

U.S. &

Canada softwood and panel markets - week 43, 2019 ( October

29,

2019)

-

U.S. &

Canada softwood and panel markets - week 42, 2019 ( October

22,

2019)

-

U.S. &

Canada softwood and panel markets - week 41, 2019 ( October

15,

2019)

-

U.S. &

Canada softwood and panel markets - week 40, 2019 ( October

8,

2019)

-

U.S. &

Canada softwood and panel markets - week 39, 2019 ( October

1,

2019)

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|