Lumber prices dropped yet again at the end of March, as demand remained soft

and customers skeptical. While sawmills were able to book order files out

two weeks or longer, most buying remained just-in-time. Almost no one was

stocking inventory, which is a bit odd given the time of year. Usually by

the end of March the weather is quite improved and all eyes look toward the

oncoming spring building season. This year, the seemingly relentless rounds

of storms and snow across the continent has delayed that burst of spring

lumber buying. Add to that a sense of economic uncertainty, specifically in

regard to home building and housing construction, and the result is low

volumes of lumber sales. The Easter long weekend will reveal much ….

particularly regarding where lumber prices will be as construction finally

ramps up this year.

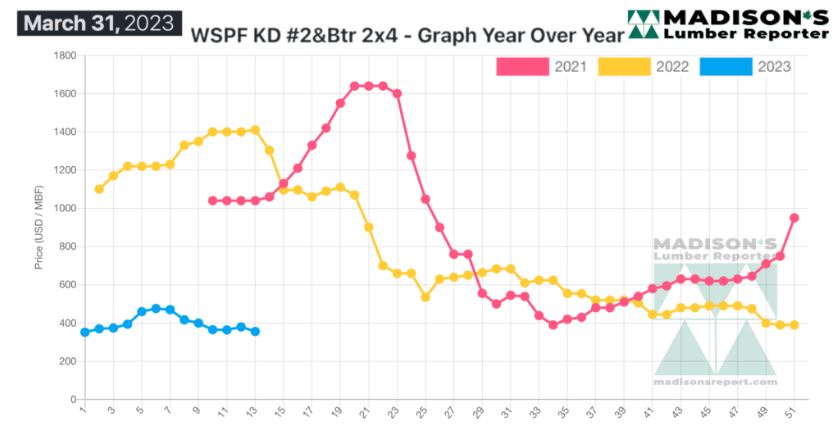

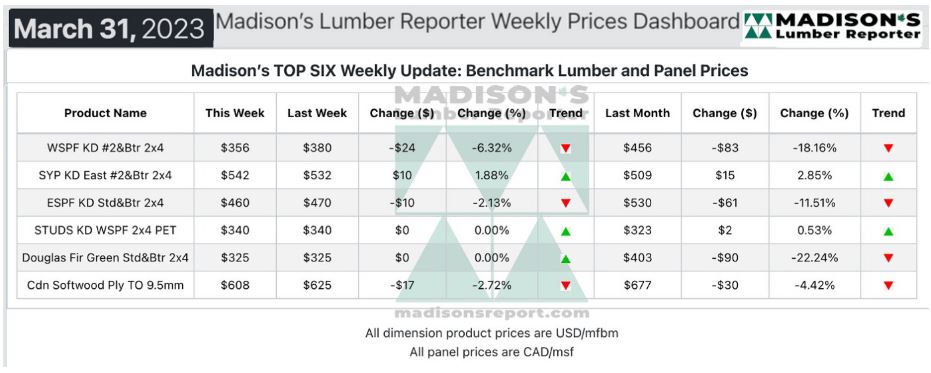

In the week ending March 31, the price of benchmark softwood lumber item

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$356 mfbm, which is down by

$24 or 6.0 per cent, from the previous week when it was US$380 mfbm. This is

down by $17, or 5.0 per cent, from one month ago when it was $373.

U.S. sawmills with extended production schedules held their prices flat,

while those in weaker positions made it known they were open to all but the

most egregious counteroffers.

“Despite pockets of promising sales in both lumber and panels this week, the

tone remained frustrating and uninspired.” — Madison’s Lumber Reporter

Sales volumes of Western S-P-F in the U.S. hung in there, but suppliers were

frustrated with the lack of improvement as March came to a close. The

vaunted spring building rush was held back by enduring cold weather and a

benighted economic outlook. Faltering lumber futures also caused to buyers

to hesitate with their purchase decisions. Steady demand for 2×4 and 2×6

contrasted starkly with weak inquiry into wides.

While customers stuck to short-covering, Western Canadian lumber suppliers

waited with bated breath for the dam to burst on spring buying. Inquiry and

takeaway of 2×4 and 2×6 R/L #2&Btr was better than of wides, which

experienced weaker demand and some significant downward price pressure.

Wholesalers and distributers reported steady sales volumes thanks to growing

demand from several key construction markets where spring weather has

arrived. Sawmill order files were into the week of April 10th.

“Eastern Canadian lumber suppliers were busy as a revolving door of

buyers kept orders flowing. That steady downstream activity boosted the

confidence of wholesalers and distributers, who consistently replenished

their inventories with a variety of items. For their part, producers kept

asking prices flat or slightly down from the previous week’s levels. The

ample availability shown by both primary and secondary suppliers early in

the week dried up noticeably by Wednesday as buyers appeared to lose the

upper hand of shopping around at their leisure. Thanks to that strong

takeaway in the early going, sawmill order files now stretched into the

second or third week of April.” — Madison’s Lumber Reporter

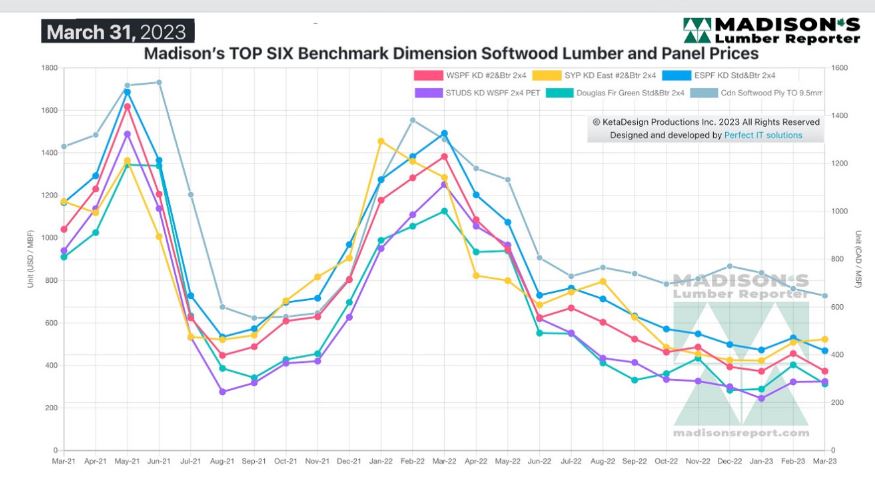

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly

Averages

Compared to the same week last year, when it was US$1,410 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending March 31,

this price was down by $1,054, or 75 per cent. Compared to two years ago

when it was $1,040, that week’s price is down by $684, or 66 per cent.

More Reports: