|

Lumber and panel market weekly report ----

Week

45, 2021 |

|

By Madison's Lumber Reporter

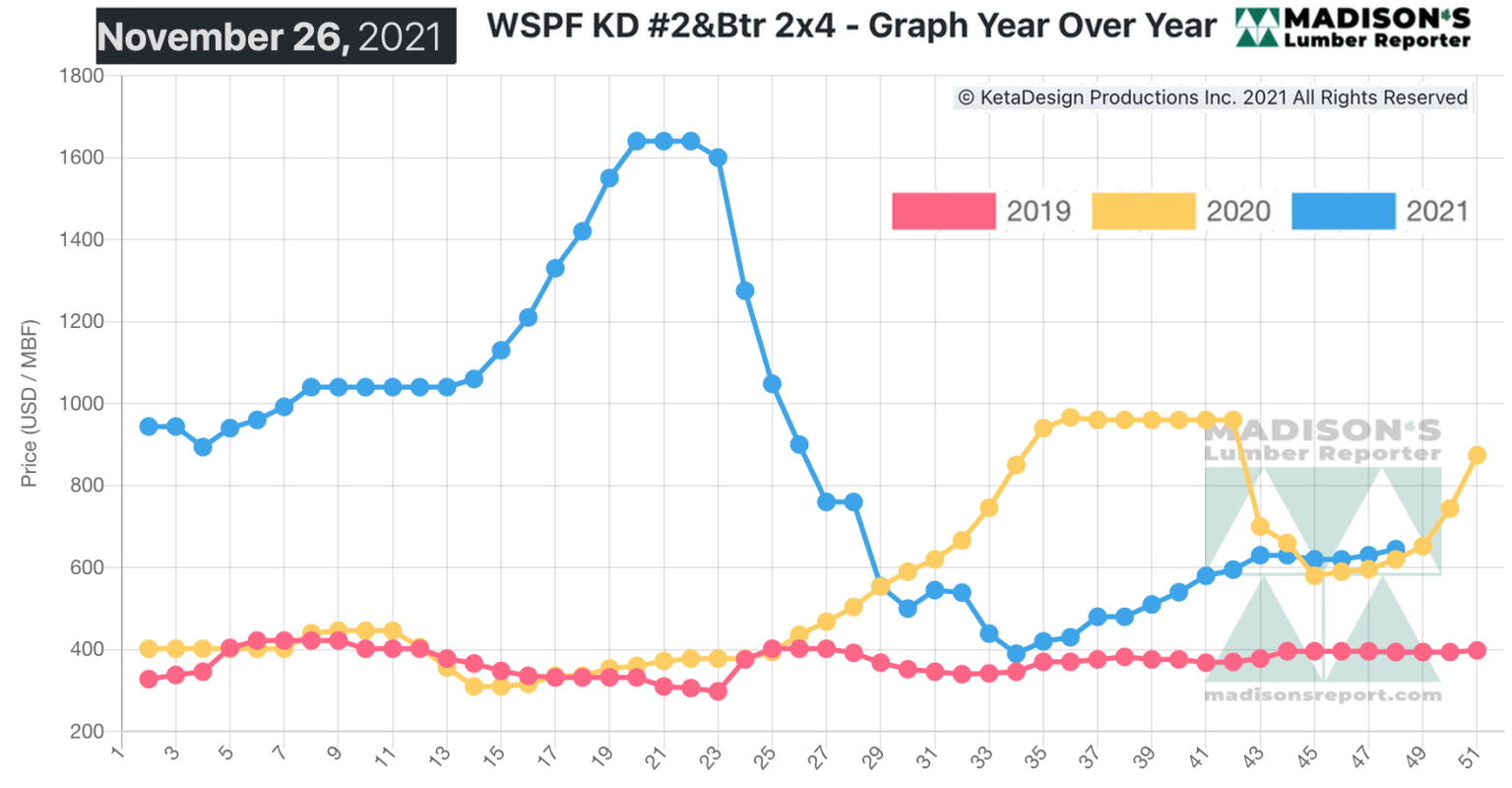

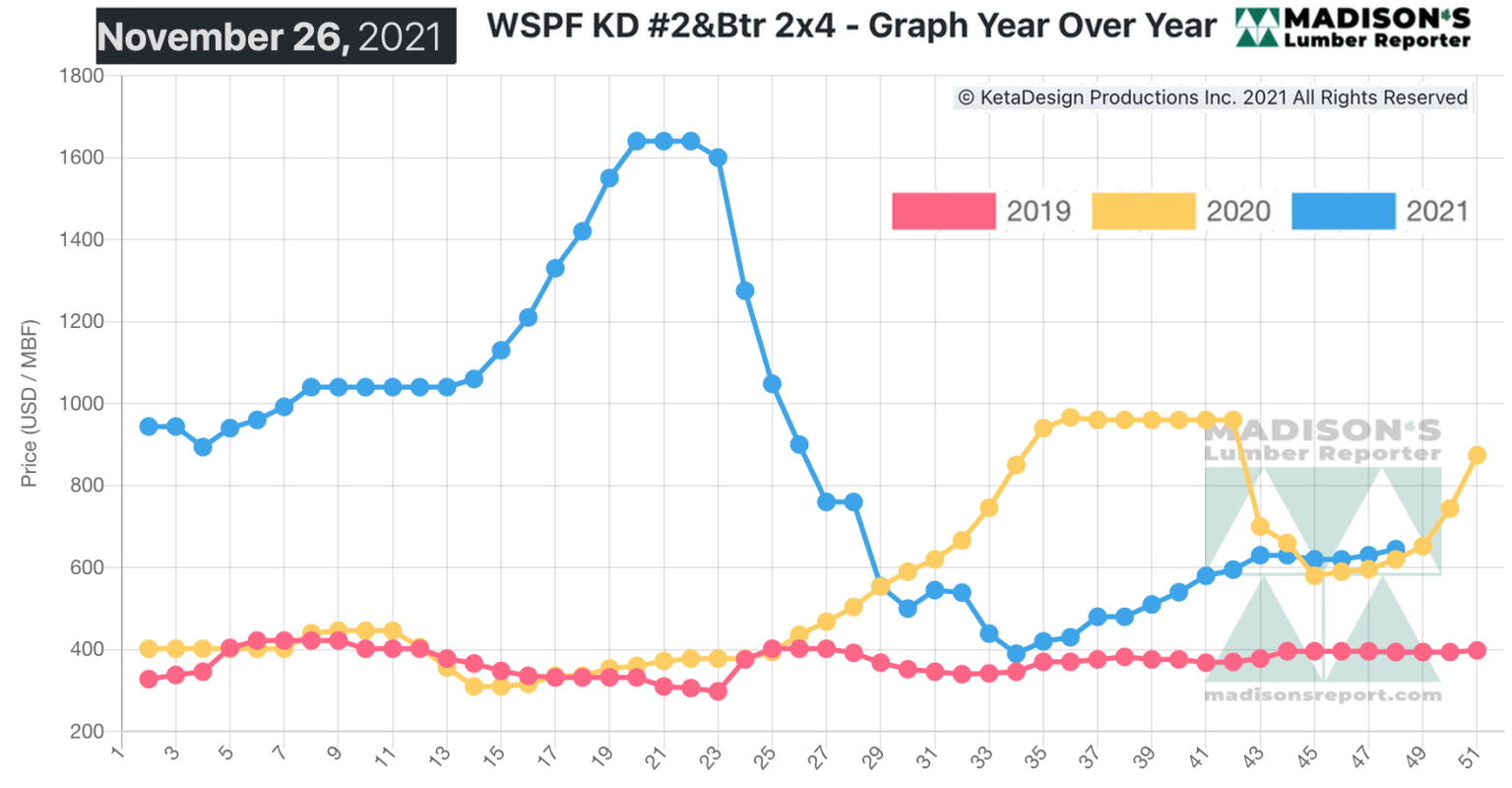

As explained last week, the North America

construction framing dimension softwood lumber

market has changed forever. Following the

massive flooding and infrastructure damage to

transportation routes in southern British

Columbia, which will take many months to repair,

for the week ending Nov. 26, 2021 industry

players had not yet been able to determine what

impact this supply impediment would have on

lumber prices. However, it was known hat the

supply-demand balance is now decidedly in the

favour of producers. This is because most

players were not stocking inventory, generally

in the hopes that prices would go down. Now that

there are huge logistical challenges in moving

wood out of the important fibre basket in B.C.,

those who still need lumber before the end of

this year are scrambling to find whatever

material they can.

This is, of course, sending prices higher.

Normally at this time of year players have

ordered — and indeed received — any lumber

building materials they need for the end of the

year and prices are starting to go down. That

was not the case last year, and does not seem to

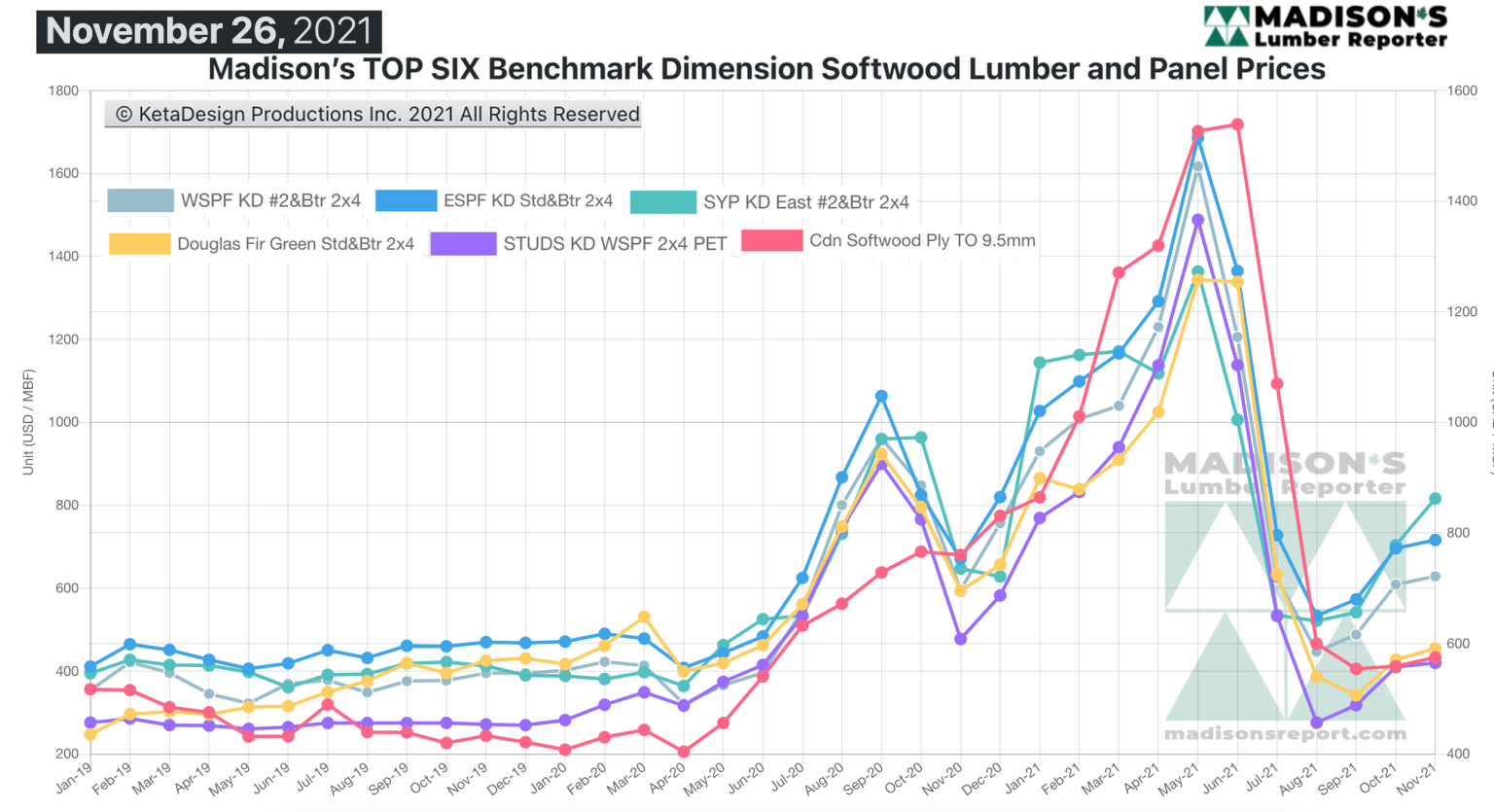

be the case this year. Please see graphs

attached for more details.

At time of writing the two Canadian railways

were back to running through southern B.C., and

the Port of Vancouver was re-opened. However

there is a significant backlog of goods waiting

to move, which would take quite a while to work

through at the best of times, not to mention

right at the busy holiday season.

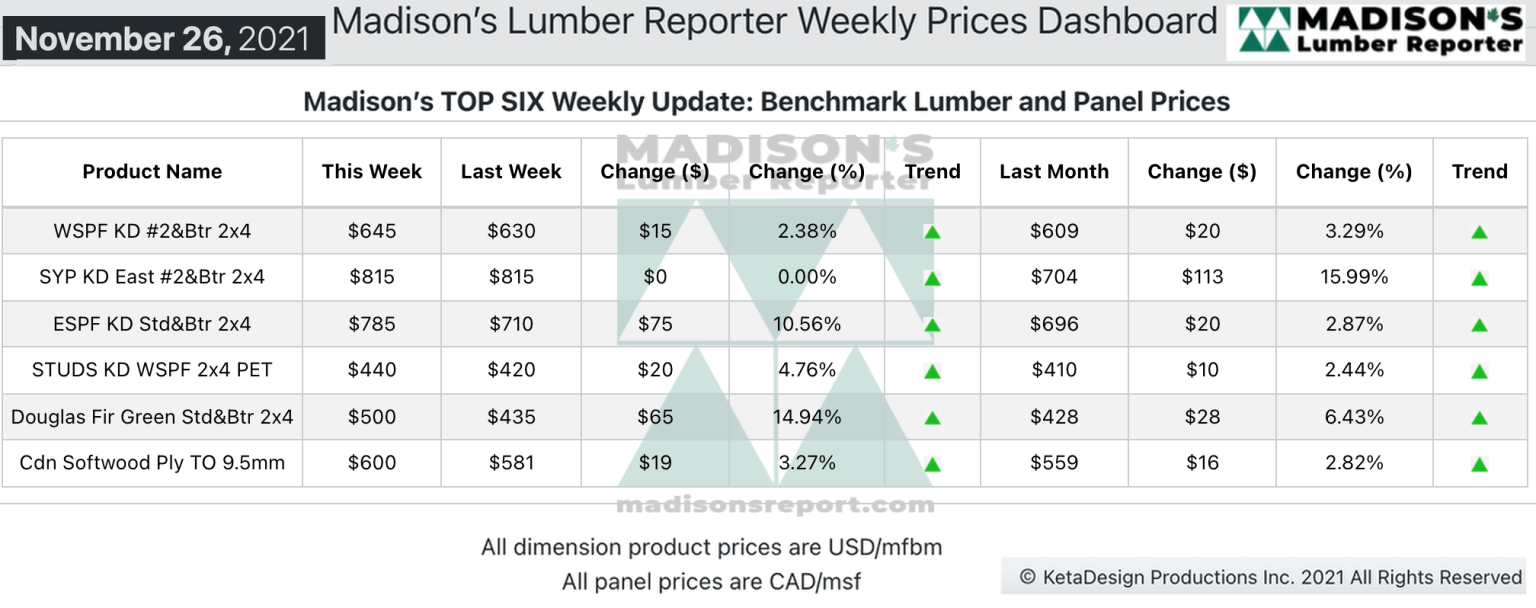

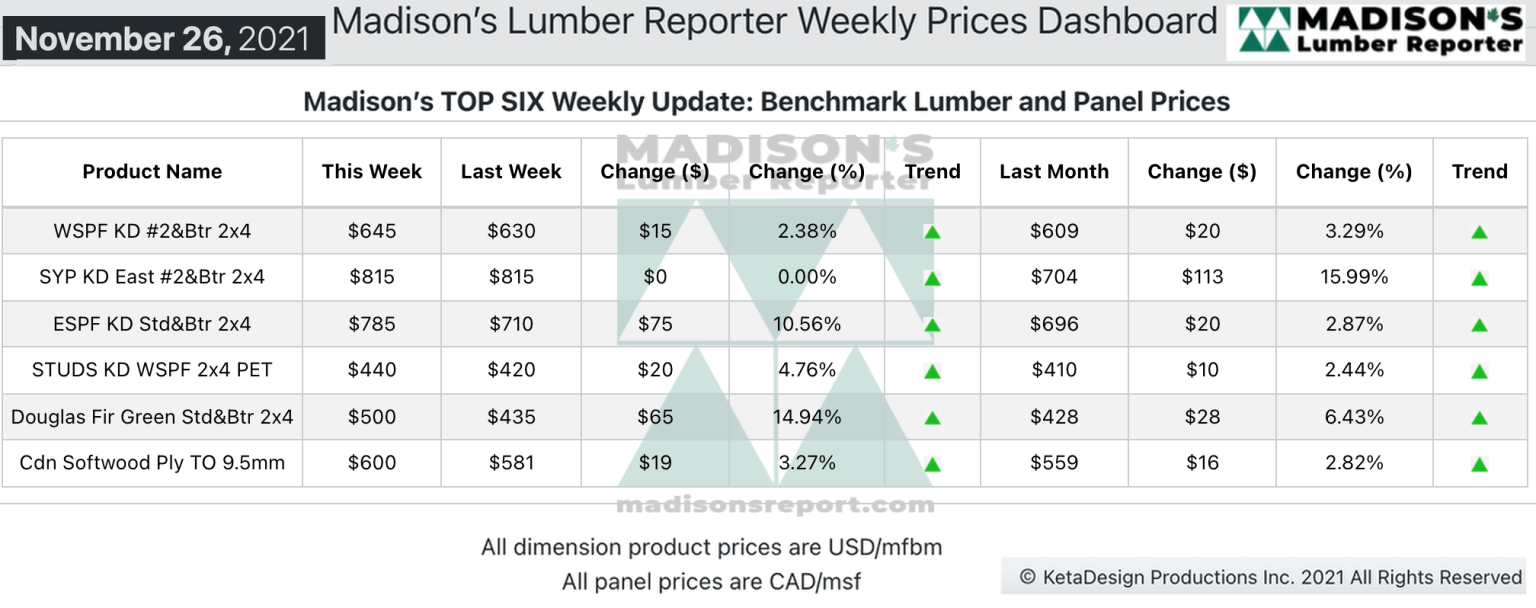

Boosting higher compared to the previous week,

and rising to match the same week one year ago,

for the week of November 26, 2021 the price of

WSPF 2×4 #2&Btr KD (RL) was US$645 mfbm. This is

up by +$15, or +2%, from the previous week when

it was $630.

Southern Yellow Pine demand was consistent as

frustrated buyers had trouble sourcing dimension

items.

“Myriad supply and logistical issues

caused strong demand for most solid wood

commodities.” — Madison’s Lumber Reporter

Traders of Western S-P-F lumber and studs in the United States related

strong demand amid multiple logistical and supply issues, according to

both primary and secondary suppliers. Buyers who had dithered for even

one moment lost the sale. Sawmill order files were extended into

mid-December for the most part. The stage was set for a solid finish to

2021 and an even better start to 2022.

Heightened demand for Western S-P-F dimension lumber continued to drive

the overall lumber market. Sawmill order files were into the second week

of December on most items. The US Department of Commerce’s final

decision on its second Administrative Review of softwood lumber duties

for the year of 2019 doubled the combined rate from 8.99 per cent to

17.9 per cent for most Canadian operators.

“The larger Southern Yellow Pine sawmills were difficult to get a

hold of while smaller producers who actually answered their phones had

correspondingly limited supply. Order files ranged between December 6th

and 20th, sawmill- and item-dependent.” — Madison’s Lumber Reporter

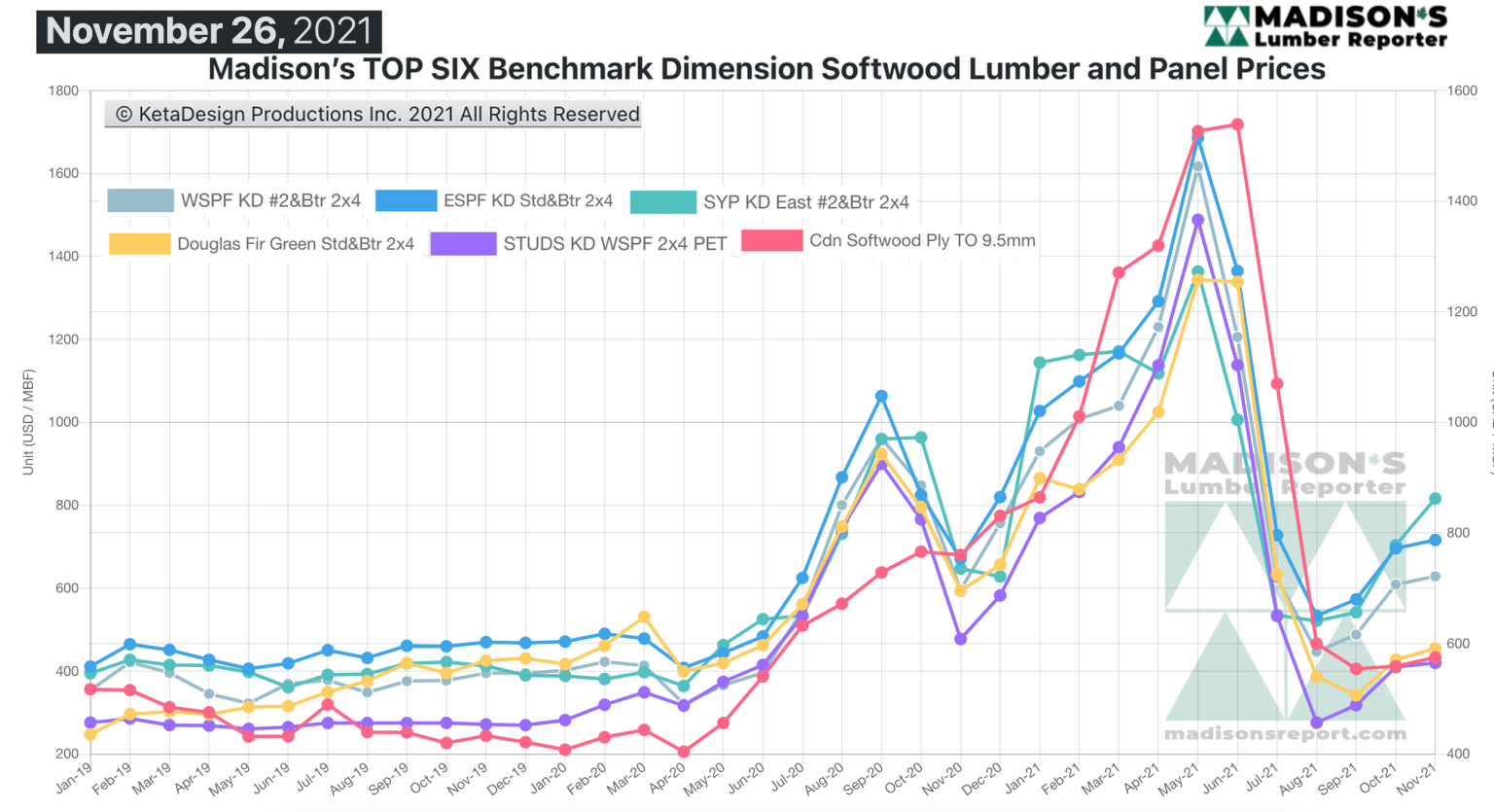

Madison’s Benchmark Top-Six Softwood Lumber and Panel

Prices: Monthly Averages

For the week of November 26, 2021 the price of WSPF 2×4 #2&Btr KD (RL)

was up by +$16, or +3%, from one month ago when it was US$629 mfbm. When

compared to the same week last year, when it was $620, that week’s price

is up by +$25, or +4%.

Compared to two years’ ago when it was $394, that week’s price is up by

+$251, or +39%.

-

U.S. & Canada softwood and panel markets - week

44 2021 (Dec

01,

2021)

-

U.S. & Canada softwood and panel markets - week

43 2021 (Nov24,

2021)

-

U.S. & Canada softwood and panel markets - week

42 2021 (Nov17,

2021)

-

U.S. & Canada softwood and panel markets - week

41 2021 (Nov10,

2021)

-

U.S. & Canada softwood and panel markets - week

40 2021 (Nov

03,

2021)

-

U.S. & Canada softwood and panel markets - week

39 2021 (Oct

27,

2021)

-

U.S. & Canada softwood and panel markets - week

38 2021 (Oct

20,

2021)

-

U.S. & Canada softwood and panel markets - week

37 2021 (Oct

13,

2021)

-

U.S. & Canada softwood and panel markets - week

36 2021 (Oct

06,

2021)

-

U.S. & Canada softwood and panel markets - week

35 2021 (Sep

29,

2021)

-

U.S. & Canada softwood and panel markets - week

34 2021 (Sep

22,

2021)

-

U.S. & Canada softwood and panel markets - week

33 2021 (Sep

8,

2021)

-

U.S. & Canada softwood and panel markets - week

32 2021 (Sep

1,

2021)

-

U.S. & Canada softwood and panel markets - week

31 2021 (Aug

25,

2021)

-

U.S. & Canada softwood and panel markets - week

30 2021 (Aug

18,

2021)

-

U.S. & Canada softwood and panel markets - week

29 2021 (Aug

11,

2021)

-

U.S. & Canada softwood and panel markets - week

28 2021 (Aug

04,

2021)

-

U.S. & Canada softwood and panel markets - week

27 2021 (Jul

28,

2021)

-

U.S. & Canada softwood and panel markets - week

26 2021 (Jul

21,

2021)

-

U.S. & Canada softwood and panel markets - week

25 2021 (Jul

14,

2021)

-

U.S. & Canada softwood and panel markets - week

24 2021 (Jul

07,

2021)

-

U.S. & Canada softwood and panel markets - week

23 2021 (Jun

30,

2021)

-

U.S. & Canada softwood and panel markets - week

22 2021 (Jun

23,

2021)

-

U.S. & Canada softwood and panel markets - week

21 2021 (Jun

10,

2021)

-

U.S. & Canada softwood and panel markets - week

20 2021 (Jun

03,

2021)

-

U.S. & Canada softwood and panel markets - week

19 2021 (May

26,

2021)

-

U.S. & Canada softwood and panel markets - week

18 2021 (May

19,

2021)

-

U.S. & Canada softwood and panel markets - week

17 2021 (May

12,

2021)

-

U.S. & Canada softwood and panel markets - week

16 2021 (May

5,

2021)

-

U.S. & Canada softwood and panel markets - week

15 2021 (Apr

28,

2021)

-

U.S. & Canada softwood and panel markets - week

14 2021 (Apr

21,

2021)

-

U.S. & Canada softwood and panel markets - week

13 2021 (Apr

15,

2021)

-

U.S. & Canada softwood and panel markets - week

12 2021 (Apr

8,

2021)

-

U.S. & Canada softwood and panel markets - week

11 2021 (Apr

1,

2021)

-

U.S. & Canada softwood and panel markets - week

10 2021 (Mar

25,

2021)

-

U.S. & Canada softwood and panel markets - week

09 2021 (Mar

17,

2021)

-

U.S. & Canada softwood and panel markets - week

08 2021 (Mar

10,

2021)

-

U.S. & Canada softwood and panel markets - week

07 2021 (Mar

03,

2021)

-

U.S. & Canada softwood and panel markets - week

06 2021 (Feb

24,

2021)

-

U.S. & Canada softwood and panel markets - week

05 2021 (Feb

16,

2021)

-

U.S. & Canada softwood and panel markets - week

04 2021 (Feb

04,

2021)

-

U.S. & Canada softwood and panel markets - week

03 2021 (Jan

29,

2021)

-

U.S.&nb303& Canada softwood and panel markets - week

02 2021 (Jan

22,

2021)

-

U.S. & Canada softwood and panel markets - week

01 2021 (Jan

15,

2021)

-

U.S. & Canada softwood and panel markets - week

49 2020 (Dec

16,

2020)

-

U.S. & Canada softwood and panel markets - week

48 2020 (Dec

09,

2020)

-

U.S. & Canada softwood and panel markets - week

47 2020 (Dec

02,

2020)

-

U.S. & Canada softwood and panel markets - week

46 2020 (Nov

25,

2020)

-

U.S. & Canada softwood and panel markets - week

45 2020 (Nov

18,

2020)

-

U.S. & Canada softwood and panel markets - week

44 2020 (Nov

11,

2020)

-

U.S. & Canada softwood and panel markets - week

43 2020 (Nov

4,

2020)

-

U.S. & Canada softwood and panel markets - week

42 2020 (Oct

28,

2020)

-

U.S. & Canada softwood and panel markets - week

41 2020 (Oct

21,

2020)

-

U.S. & Canada softwood and panel markets - week

40 2020 (Oct

14,

2020)

-

U.S. & Canada softwood and panel markets - week

39, 2020 (Oct

07,

2020)

-

U.S. & Canada softwood and panel markets - week

38, 2020 (Sep

30,

2020)

-

U.S. & Canada softwood and panel markets - week

37, 2020 (Sep

23,

2020)

-

U.S. & Canada softwood and panel markets - week

36, 2020 (Sep

16,

2020)

-

U.S. & Canada softwood and panel markets - week

35, 2020 (Sep

09,

2020)

-

U.S. & Canada softwood and panel markets - week

34, 2020 (Sep

02,

2020)

-

U.S. & Canada softwood and panel markets - week

33, 2020 (Aug

26,

2020)

-

U.S. & Canada softwood and panel markets - week

32, 2020 (Aug

19,

2020)

-

U.S. & Canada softwood and panel markets - week

31, 2020 (Aug

12,

2020)

-

U.S. & Canada softwood and panel markets - week

30, 2020 (Aug

05,

2020)

-

U.S. & Canada softwood and panel markets - week 29, 2020 (Jul

29,

2020)

-

U.S. & Canada softwood and panel markets - week 28, 2020 (Jul

22,

2020)

-

U.S. & Canada softwood and panel markets - week 27, 2020 (Jul

17,

2020)

-

U.S. & Canada softwood and panel markets - week 26, 2020 (Jul

10,

2020)

-

U.S. & Canada softwood and panel markets - week 25, 2020 (Jul

02,

2020)

-

U.S. & Canada softwood and panel markets - week 24, 2020 (Jun

25,

2020)

-

U.S. & Canada softwood and panel markets - week 23, 2020 (Jun

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 22, 2020 (Jun

10,

2020)

-

U.S. &

Canada softwood and panel markets - week 21, 2020 (Jun

3,

2020)

-

U.S. &

Canada softwood and panel markets - week 20, 2020 (May 27,

2020)

-

U.S. &

Canada softwood and panel markets - week 19, 2020 (May 21,

2020)

-

U.S. &

Canada softwood and panel markets - week 18, 2020 (May 15,

2020)

-

U.S. &

Canada softwood and panel markets - week 17, 2020 (May 8,

2020)

-

U.S. &

Canada softwood and panel markets - week 16, 2020 (May 1,

2020)

-

U.S. &

Canada softwood and panel markets - week 15, 2020 (Apr

23,

2020)

-

U.S. &

Canada softwood and panel markets - week 14, 2020 (Apr

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 13, 2020 (Apr

08,

2020)

-

U.S. &

Canada softwood and panel markets - week 12, 2020 (Mar

31,

2020)

-

U.S. &

Canada softwood and panel markets - week 11, 2020 (Mar

24,

2020)

-

U.S. &

Canada softwood and panel markets - week 5, 2020 (Feb

11,

2020)

-

U.S. &

Canada softwood and panel markets - week 4, 2020 (Feb

4,

2020)

-

U.S. &

Canada softwood and panel markets - week 3, 2020 (January

27,

2020)

-

U.S. &

Canada softwood and panel markets - week 2, 2020 (January

20,

2020)

-

U.S. &

Canada softwood and panel markets - week 1, 2020 (January

13,

2020)

-

U.S. &

Canada softwood and panel markets - week 50, 2019 (December

17,

2019)

-

U.S. &

Canada softwood and panel markets - week 49, 2019 (December

10,

2019)

-

U.S. &

Canada softwood and panel markets - week 48, 2019 (December

3,

2019)

-

U.S. &

Canada softwood and panel markets - week 47, 2019 (November

26,

2019)

-

U.S. &

Canada softwood and panel markets - week 46, 2019 (November

19,

2019)

-

U.S. &

Canada softwood and panel markets - week 45, 2019 (November

12,

2019)

-

U.S. &

Canada softwood and panel markets - week 44, 2019 (November

5,

2019)

-

U.S. &

Canada softwood and panel markets - week 43, 2019 ( October

29,

2019)

-

U.S. &

Canada softwood and panel markets - week 42, 2019 ( October

22,

2019)

-

U.S. &

Canada softwood and panel markets - week 41, 2019 ( October

15,

2019)

-

U.S. &

Canada softwood and panel markets - week 40, 2019 ( October

8,

2019)

-

U.S. &

Canada softwood and panel markets - week 39, 2019 ( October

1,

2019)

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|

|

|