By Madison's Lumber Reporter

After staying flat over the Canadian Victoria

Day long weekend and U.S. Memorial Day holiday,

lumber prices wavered slightly before falling

dramatically in the past two weeks. Now that

price quotes are approaching something

reasonably close to what sticker-shocked

customers might want to pay, sales volumes are

improving. Have suppliers and buyers found the

sweet spot where lumber prices will settle until

the weather turns winter-like and construction

stops for the year? We won’t know until after

the dual Canada Day/Independence Day long

weekend at the beginning of July. In terms of

the condition for customers, U.S. Census Bureau

and the Department of Housing and Urban

Development data released this week of new house

prices shows new homes for sale are experiencing

the same supply squeeze as lumber has been. The

median sales price rose to a record US$374,400

in May. About 76 per cent of homes sold last

month were either under construction or yet to

be built. This is a phenomenal ratio, suggesting

more of a bullish environment for home builders

still to come.

Sales of new U.S. single-family homes fell to a

one-year low in May as the median price of newly

built houses soared amid expensive raw

materials, including framing lumber. New home

sales comprise 10 per cent of the housing market

and are considered a leading housing market

indicator as they are recorded when contracts

are signed. There were 330,000 new homes on the

market last month, up from 315,000 in April. At

May’s sales pace it would take 5.1 months to

clear the supply of houses on the market, up

from 4.6 months in April.

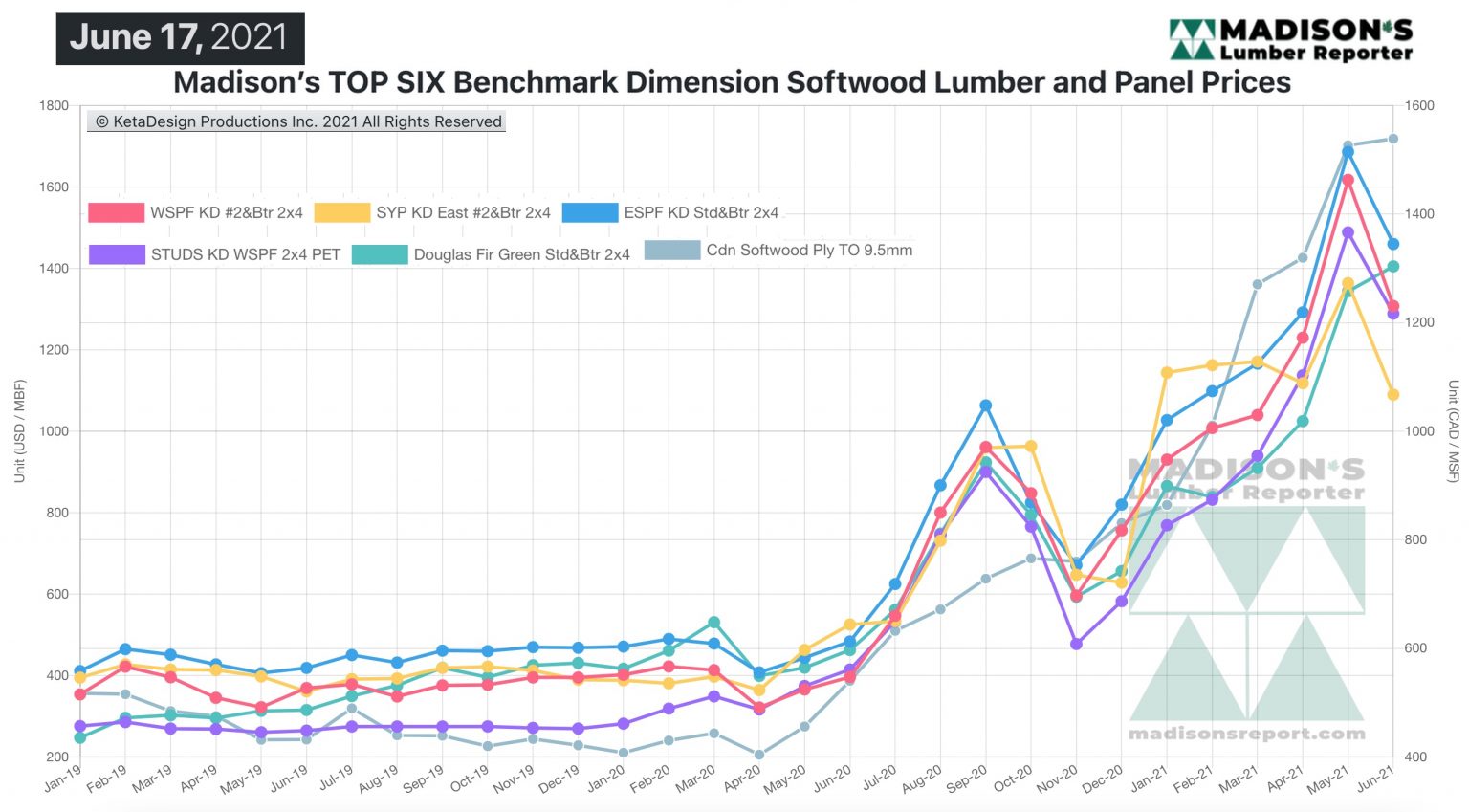

“Douglas-fir and sheet goods’ prices

continued to hold on comparatively while the rest of the market cratered

further.” — Madison’s Lumber Reporter

Western S-P-F sawmills in the U.S. had little to no order file to speak

of as buyers continued to wait and watch for the most part. There was

still a steady stream of takeaway as many buyers found their preferred

price and jumped in – largely dependent on the state of their individual

inventories – and price reports varied wildly due to the sheer number of

counter-offers being entertained by different producers. A large

contingent of customers continued to lean on whatever inventory they had

on the ground as they waited to pounce at the elusive bottom to buy.

Canadian Western S-P-F producers continued their struggle to find

takeaway of serious volumes as buyers smelled blood and were often

content to wait and see how deep corrections would go before stepping in

to close purchases. Demand was still there, but was accompanied by

considerable counter-offers on top of – or, more appropriately, below –

asking prices from sawmills. Levels were all over the place as some

producers tried to hold the line while others slashed their numbers with

aplomb to entice buyers.

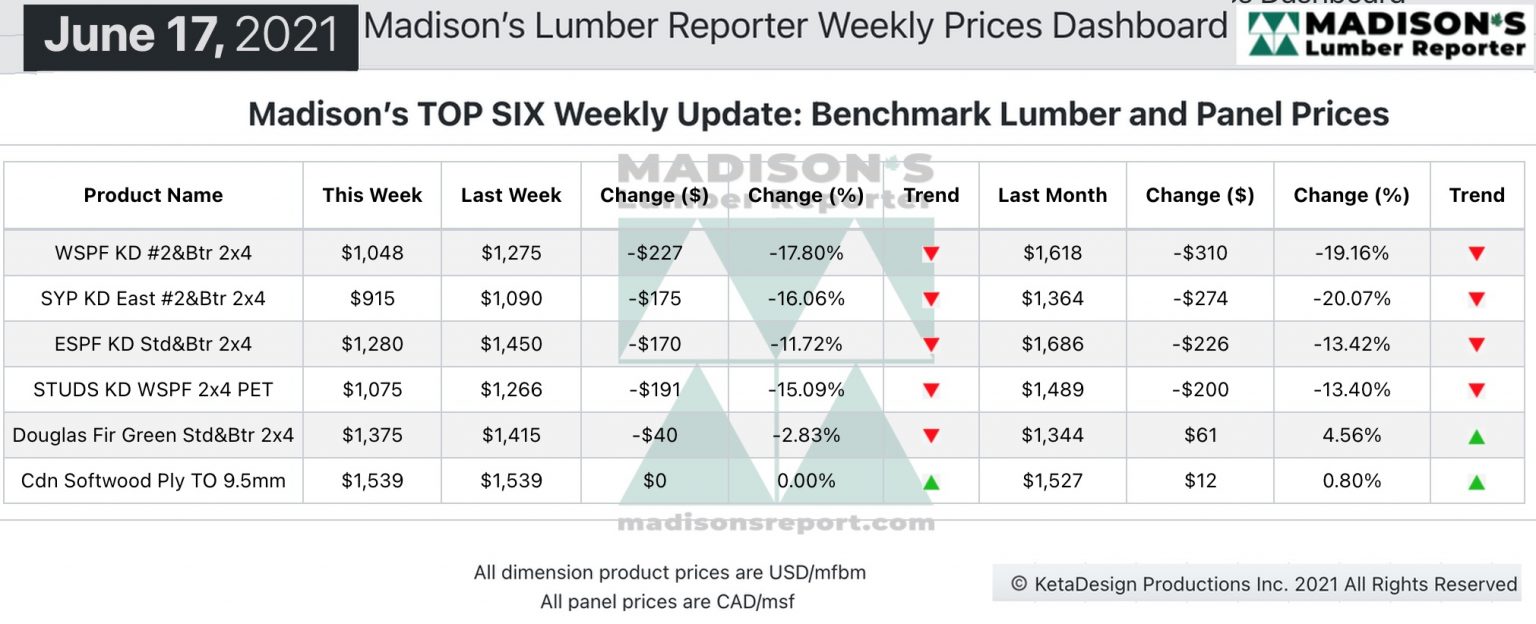

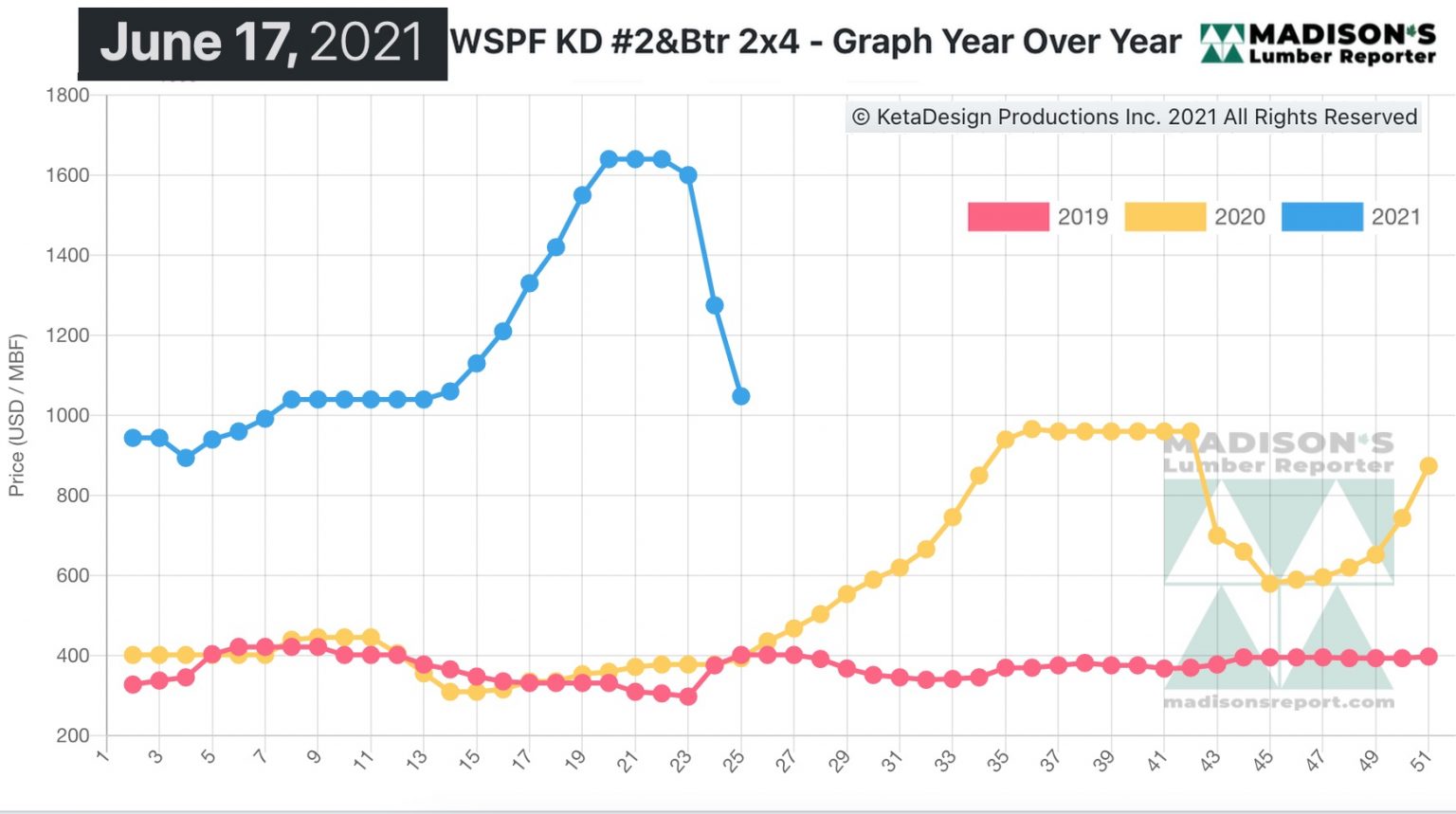

Extended customer reluctance during much of June finally resulted in

real price decreases, thus for the week ending June 17, 2021 the

wholesaler price of benchmark softwood lumber commodity item Western

S-P-F KD 2×4 #2&Btr continued dramatic drops, down by -$227, or

-18%, to US$1,048, from $1,275 mfbm the previous week.

That week’s price is down by -$570, or -35%, from one month ago when

it was $1,618.

“Demand in Eastern Canada was slow to start the week as buyers

remained circumspect and confident that prices would slide more

before they needed to jump in. From Tuesday-on mills persistently

established lower numbers and accepted counters to keep product

moving.” — Madison’s Lumber Reporter

Compared to the price one-year-ago, when it was US$378 mfbm, for the

week ending June 10, 2021, the price of Western S-P-F KD 2×4 was up by

+$897, or +237%.

Related News:

-

U.S. & Canada softwood and panel markets - week

22 2021 (Jun

23,

2021)

-

U.S. & Canada softwood and panel markets - week

21 2021 (Jun

10,

2021)

-

U.S. & Canada softwood and panel markets - week

20 2021 (Jun

03,

2021)

-

U.S. & Canada softwood and panel markets - week

19 2021 (May

26,

2021)

-

U.S. & Canada softwood and panel markets - week

18 2021 (May

19,

2021)

-

U.S. & Canada softwood and panel markets - week

17 2021 (May

12,

2021)

-

U.S. & Canada softwood and panel markets - week

16 2021 (May

5,

2021)

-

U.S. & Canada softwood and panel markets - week

15 2021 (Apr

28,

2021)

-

U.S. & Canada softwood and panel markets - week

14 2021 (Apr

21,

2021)

-

U.S. & Canada softwood and panel markets - week

13 2021 (Apr

15,

2021)

-

U.S. & Canada softwood and panel markets - week

12 2021 (Apr

8,

2021)

-

U.S. & Canada softwood and panel markets - week

11 2021 (Apr

1,

2021)

-

U.S. & Canada softwood and panel markets - week

10 2021 (Mar

25,

2021)

-

U.S. & Canada softwood and panel markets - week

09 2021 (Mar

17,

2021)

-

U.S. & Canada softwood and panel markets - week

08 2021 (Mar

10,

2021)

-

U.S. & Canada softwood and panel markets - week

07 2021 (Mar

03,

2021)

-

U.S. & Canada softwood and panel markets - week

06 2021 (Feb

24,

2021)

-

U.S. & Canada softwood and panel markets - week

05 2021 (Feb

16,

2021)

-

U.S. & Canada softwood and panel markets - week

04 2021 (Feb

04,

2021)

-

U.S. & Canada softwood and panel markets - week

03 2021 (Jan

29,

2021)

-

U.S.&nb303& Canada softwood and panel markets - week

02 2021 (Jan

22,

2021)

-

U.S. & Canada softwood and panel markets - week

01 2021 (Jan

15,

2021)

-

U.S. & Canada softwood and panel markets - week

49 2020 (Dec

16,

2020)

-

U.S. & Canada softwood and panel markets - week

48 2020 (Dec

09,

2020)

-

U.S. & Canada softwood and panel markets - week

47 2020 (Dec

02,

2020)

-

U.S. & Canada softwood and panel markets - week

46 2020 (Nov

25,

2020)

-

U.S. & Canada softwood and panel markets - week

45 2020 (Nov

18,

2020)

-

U.S. & Canada softwood and panel markets - week

44 2020 (Nov

11,

2020)

-

U.S. & Canada softwood and panel markets - week

43 2020 (Nov

4,

2020)

-

U.S. & Canada softwood and panel markets - week

42 2020 (Oct

28,

2020)

-

U.S. & Canada softwood and panel markets - week

41 2020 (Oct

21,

2020)

-

U.S. & Canada softwood and panel markets - week

40 2020 (Oct

14,

2020)

-

U.S. & Canada softwood and panel markets - week

39, 2020 (Oct

07,

2020)

-

U.S. & Canada softwood and panel markets - week

38, 2020 (Sep

30,

2020)

-

U.S. & Canada softwood and panel markets - week

37, 2020 (Sep

23,

2020)

-

U.S. & Canada softwood and panel markets - week

36, 2020 (Sep

16,

2020)

-

U.S. & Canada softwood and panel markets - week

35, 2020 (Sep

09,

2020)

-

U.S. & Canada softwood and panel markets - week

34, 2020 (Sep

02,

2020)

-

U.S. & Canada softwood and panel markets - week

33, 2020 (Aug

26,

2020)

-

U.S. & Canada softwood and panel markets - week

32, 2020 (Aug

19,

2020)

-

U.S. & Canada softwood and panel markets - week

31, 2020 (Aug

12,

2020)

-

U.S. & Canada softwood and panel markets - week

30, 2020 (Aug

05,

2020)

-

U.S. & Canada softwood and panel markets - week 29, 2020 (Jul

29,

2020)

-

U.S. & Canada softwood and panel markets - week 28, 2020 (Jul

22,

2020)

-

U.S. & Canada softwood and panel markets - week 27, 2020 (Jul

17,

2020)

-

U.S. & Canada softwood and panel markets - week 26, 2020 (Jul

10,

2020)

-

U.S. & Canada softwood and panel markets - week 25, 2020 (Jul

02,

2020)

-

U.S. & Canada softwood and panel markets - week 24, 2020 (Jun

25,

2020)

-

U.S. & Canada softwood and panel markets - week 23, 2020 (Jun

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 22, 2020 (Jun

10,

2020)

-

U.S. &

Canada softwood and panel markets - week 21, 2020 (Jun

3,

2020)

-

U.S. &

Canada softwood and panel markets - week 20, 2020 (May 27,

2020)

-

U.S. &

Canada softwood and panel markets - week 19, 2020 (May 21,

2020)

-

U.S. &

Canada softwood and panel markets - week 18, 2020 (May 15,

2020)

-

U.S. &

Canada softwood and panel markets - week 17, 2020 (May 8,

2020)

-

U.S. &

Canada softwood and panel markets - week 16, 2020 (May 1,

2020)

-

U.S. &

Canada softwood and panel markets - week 15, 2020 (Apr

23,

2020)

-

U.S. &

Canada softwood and panel markets - week 14, 2020 (Apr

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 13, 2020 (Apr

08,

2020)

-

U.S. &

Canada softwood and panel markets - week 12, 2020 (Mar

31,

2020)

-

U.S. &

Canada softwood and panel markets - week 11, 2020 (Mar

24,

2020)

-

U.S. &

Canada softwood and panel markets - week 5, 2020 (Feb

11,

2020)

-

U.S. &

Canada softwood and panel markets - week 4, 2020 (Feb

4,

2020)

-

U.S. &

Canada softwood and panel markets - week 3, 2020 (January

27,

2020)

-

U.S. &

Canada softwood and panel markets - week 2, 2020 (January

20,

2020)

-

U.S. &

Canada softwood and panel markets - week 1, 2020 (January

13,

2020)

-

U.S. &

Canada softwood and panel markets - week 50, 2019 (December

17,

2019)

-

U.S. &

Canada softwood and panel markets - week 49, 2019 (December

10,

2019)

-

U.S. &

Canada softwood and panel markets - week 48, 2019 (December

3,

2019)

-

U.S. &

Canada softwood and panel markets - week 47, 2019 (November

26,

2019)

-

U.S. &

Canada softwood and panel markets - week 46, 2019 (November

19,

2019)

-

U.S. &

Canada softwood and panel markets - week 45, 2019 (November

12,

2019)

-

U.S. &

Canada softwood and panel markets - week 44, 2019 (November

5,

2019)

-

U.S. &

Canada softwood and panel markets - week 43, 2019 ( October

29,

2019)

-

U.S. &

Canada softwood and panel markets - week 42, 2019 ( October

22,

2019)

-

U.S. &

Canada softwood and panel markets - week 41, 2019 ( October

15,

2019)

-

U.S. &

Canada softwood and panel markets - week 40, 2019 ( October

8,

2019)

-

U.S. &

Canada softwood and panel markets - week 39, 2019 ( October

1,

2019)

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|