As April waned, the usual spring buying of construction framing softwood

lumber had not yet materialized. Suppliers had plenty of inventory on hand

for customers who continued to only order wood for immediate needs. As such,

supply remained quite ahead of demand. Even as the days got progressively

longer and the weather improved, there did not seem to be a boom in home

building, as has been historically normal. As such, the recent and ongoing

production curtailments – especially in British Columbia – helped keep

sawmill order files to within two or three weeks.

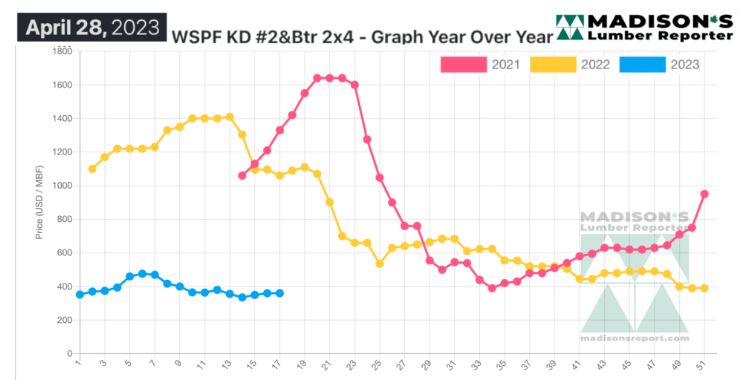

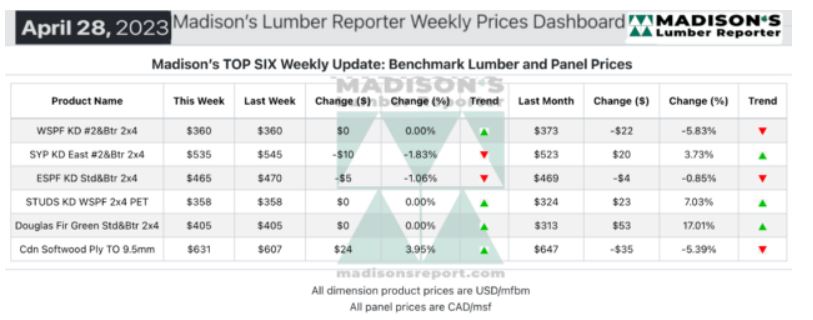

In the week ending April 28, 2023, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$360 mfbm, which is

flat from the previous week. This is down by $13, or 3.0 per cent, from one

month ago when it was $373.

Good takeaway of low-grade commodities persisted as industrial customers

remained active. A growing contingent of suppliers felt the market was

undervalued and poised to go on a run.

“The interminable wait for spring activity to arrive persisted this week.

Buyers remained cautious while suppliers chomped at the bit.” — Madison’s

Lumber Reporter

Demand for Western S-P-F in the United States was so-so, to hear traders

tell it. Business was heavily region- and product-dependent, with

bread-and-butter dimension and stud items garnering the lion’s share of

demand. Experienced players wondered whether sawmills might consider cutting

the odd shift to pull material out of what many referred to as an

oversupplied market. Downstream buyers were content with replenishing

through the distribution network and still showed no urgency to cover more

than immediate needs.

According to Canadian purveyors, the Western S-P-F market continued to

struggle to reach typical spring price levels. Prices stabilized further,

with nearly all dimension commodities remaining at or on either side of the

previous week’s numbers. Notable exceptions were found in straight length

2x10s, several of which came back down to earth in triple-digit tumbles.

Secondary suppliers noted that the market seemed oversupplied still, even if

availability was largely hit-and-miss depending on the source and item.

Spring had sprung for the most part, but weather continued to be an issue in

some key consuming regions. Buyers were fond of leaning on LTL and mixed

load business through the distribution network when they needed coverage.

“Sales of Eastern S-P-F started the week on shaky ground before finding

firmer footing. Demand was fair to middling, with most sales activity going

to secondary suppliers who offered flexible tallies and quick shipment. One

veteran trader noted that every deal was a unique challenge as orders did

not come easy. While prices of studs and low grade firmed up in both the

Great Lakes and Toronto markets, R/L #2&Btr dimension was comparatively

listless. A better tone emerged around midweek when buyers sensed a change

in the wind and started to secure more coverage. Sawmill order files were no

further than two weeks out.” — Madison’s Lumber Reporter

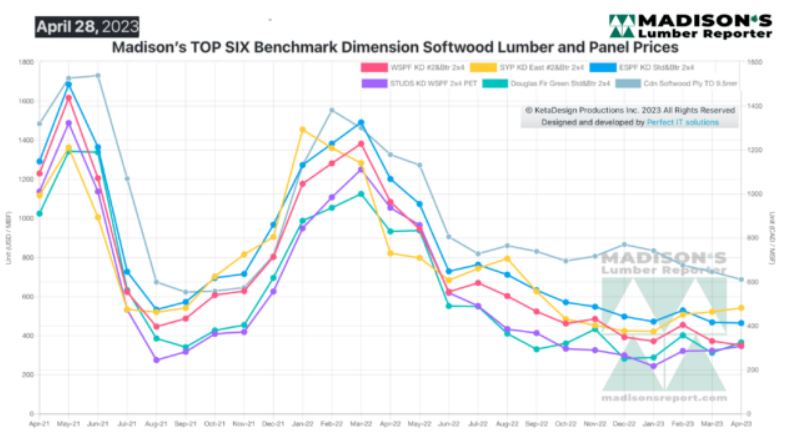

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly

Averages

Compared to the same week last year, when it was US$1,060 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending April 28,

2023, this price was down by $700, or 66 per cent. Compared to two years ago

when it was $1,330, that week’s price is down by $970, or 73 per cent.

More Reports: