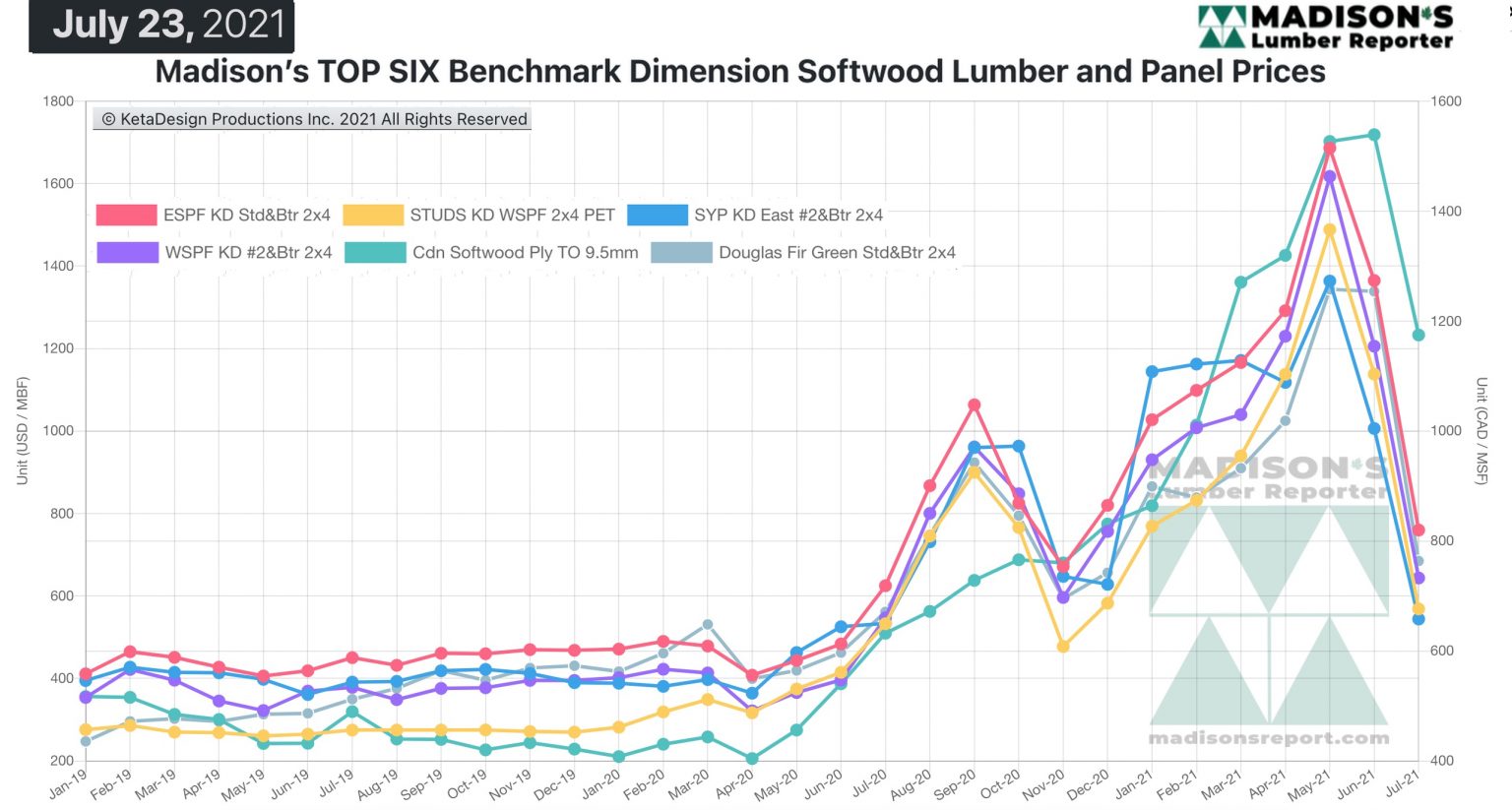

By Madison's Lumber Reporter The latest

construction framing dimension softwood lumber

and panel price movement downward has been

enough to motivate previously reluctant

customers to start making purchases again. Other

circumstances, like wildfires and extreme heat

in the usual timber supply areas, are adding

uncertainty to how the rest of 2021 summer is

going to go.

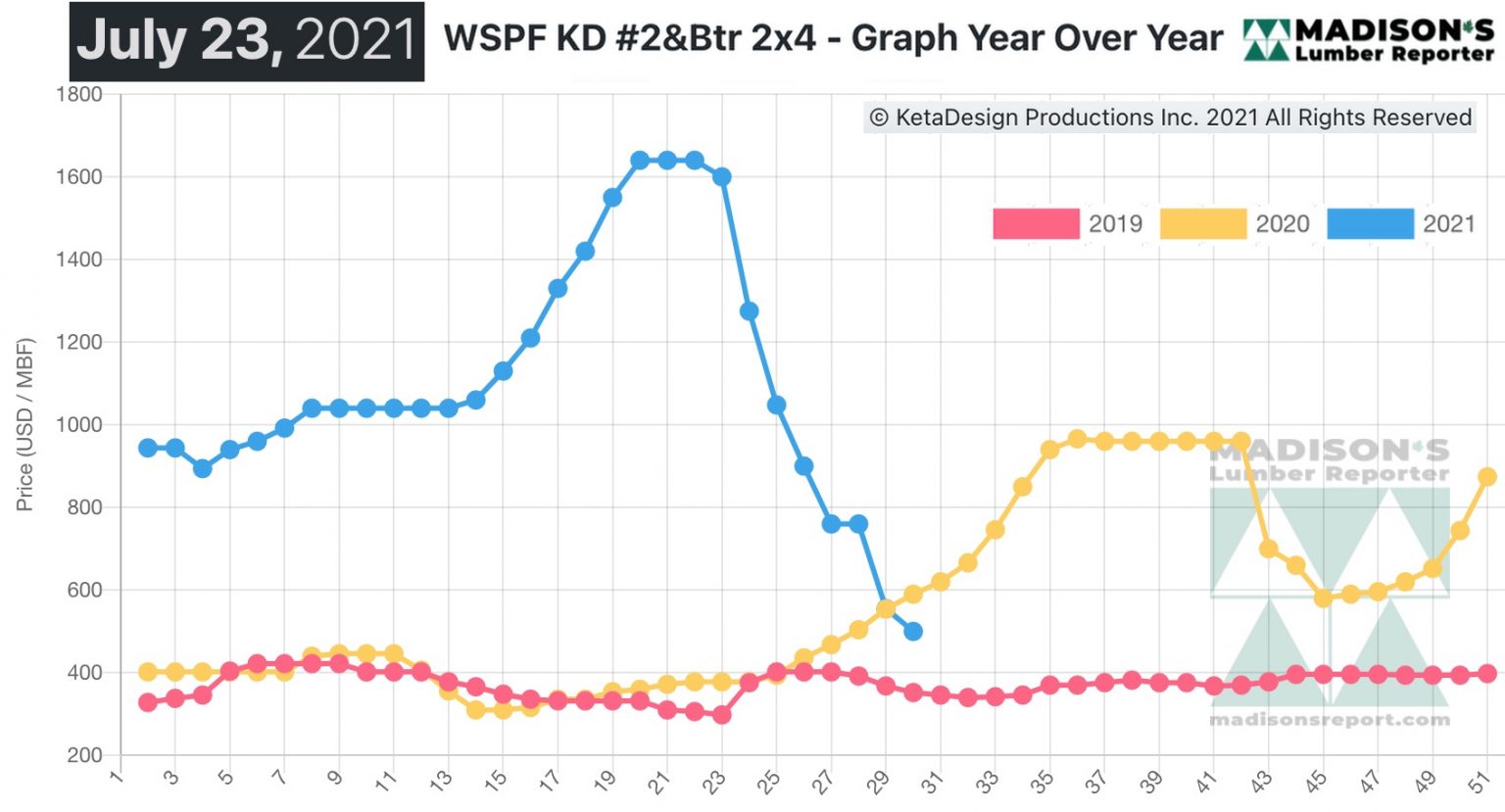

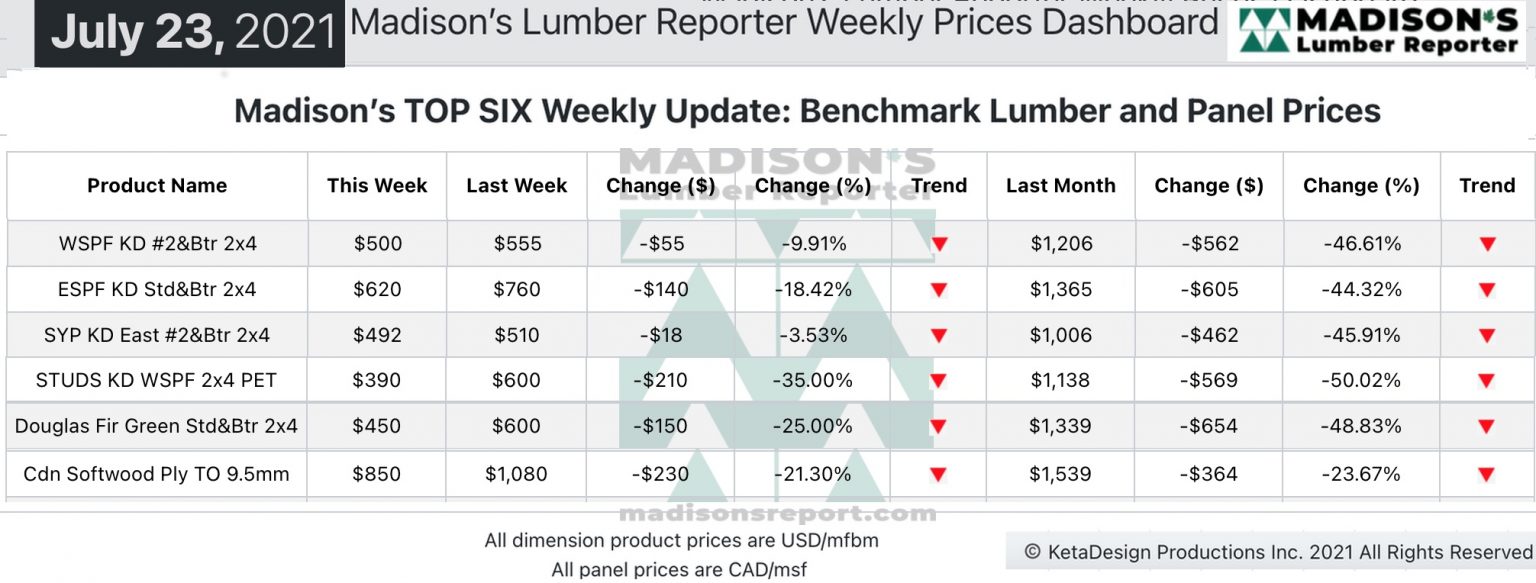

After touching exactly the price of one year

ago, in the week ending July 23, 2021 the

wholesaler price of benchmark softwood lumber

commodity item Western S-P-F KD 2×4 #2&Btr fell

yet more. That week’s price of US$500 mfbm is

down by -$55, or (-10%), from the previous week

when it was $555, and is down by -$706, or

(-59%), from one month ago when it was $1,206.

Encouraging U.S. single-family construction activity kept momentum going

for lumber sales, even as sales volumes were dropping. It seemed like

the market could turn on a dime. The appetite for wood remains strong,

it’s just that customers have collectively balked at those unprecedented

high prices of two months ago. Are price levels approaching the bottom,

prompting many to pull the trigger and make the purchases they have been

holding off on, preferring to wait is prices will drop further? Only the

next week or two will tell.

“Wildfires and logistical snags got many buyers off the fence this

week; prices continued to peel off.” — Madison’s Lumber Reporter

Demand for Western S-P-F in the United States stumbled out of the

gate before gaining strength through the rest of that week.

Production and supply dominated the conversation. Curtailment

announcements in Canada caused secondary suppliers to pull the

trigger, and downstream buyers followed suit to restock their

depleted inventories. Buyers were mostly focussed on standard grade

dimension, as demand for studs and low grade remained weak.

Canadian purveyors of Western S-P-F commodities spent another week

trying to find a tradable bottom. Prices remained variable by wide

margins as primary and secondary suppliers competed for limited

demand. Sawmills continued to receive deep counter offers from

buyers but were less receptive than in recent weeks, even as volumes

of prompt material piled up. Producers had enough logs to last

between two weeks and two months, depending on the mill. Wildfire

activity and danger in Western Canada was horrific again.

“Eastern Canadian sawmills were more consistent with their

pricing to start the week. They still sought out business from day

to day but were firmer and less amenable to counter offers than

buyers had gotten used to in recent weeks and months. As the week

progressed more buyers seemed to find their preferred levels, so

covered some short-term needs.” — Madison’s Lumber Reporter

When compared to the same week last year, when it was $590, that week’s

price of benchmark softwood lumber commodity item Western S-P-F KD 2×4

#2&Btr is down by -$90, or (-15%).

Compared to two years’ ago when it was $352, the is up by $148, or

(42%).

Related News:

-

U.S. & Canada softwood and panel markets - week

27 2021 (Jul

28,

2021)

-

U.S. & Canada softwood and panel markets - week

26 2021 (Jul

21,

2021)

-

U.S. & Canada softwood and panel markets - week

25 2021 (Jul

14,

2021)

-

U.S. & Canada softwood and panel markets - week

24 2021 (Jul

07,

2021)

-

U.S. & Canada softwood and panel markets - week

23 2021 (Jun

30,

2021)

-

U.S. & Canada softwood and panel markets - week

22 2021 (Jun

23,

2021)

-

U.S. & Canada softwood and panel markets - week

21 2021 (Jun

10,

2021)

-

U.S. & Canada softwood and panel markets - week

20 2021 (Jun

03,

2021)

-

U.S. & Canada softwood and panel markets - week

19 2021 (May

26,

2021)

-

U.S. & Canada softwood and panel markets - week

18 2021 (May

19,

2021)

-

U.S. & Canada softwood and panel markets - week

17 2021 (May

12,

2021)

-

U.S. & Canada softwood and panel markets - week

16 2021 (May

5,

2021)

-

U.S. & Canada softwood and panel markets - week

15 2021 (Apr

28,

2021)

-

U.S. & Canada softwood and panel markets - week

14 2021 (Apr

21,

2021)

-

U.S. & Canada softwood and panel markets - week

13 2021 (Apr

15,

2021)

-

U.S. & Canada softwood and panel markets - week

12 2021 (Apr

8,

2021)

-

U.S. & Canada softwood and panel markets - week

11 2021 (Apr

1,

2021)

-

U.S. & Canada softwood and panel markets - week

10 2021 (Mar

25,

2021)

-

U.S. & Canada softwood and panel markets - week

09 2021 (Mar

17,

2021)

-

U.S. & Canada softwood and panel markets - week

08 2021 (Mar

10,

2021)

-

U.S. & Canada softwood and panel markets - week

07 2021 (Mar

03,

2021)

-

U.S. & Canada softwood and panel markets - week

06 2021 (Feb

24,

2021)

-

U.S. & Canada softwood and panel markets - week

05 2021 (Feb

16,

2021)

-

U.S. & Canada softwood and panel markets - week

04 2021 (Feb

04,

2021)

-

U.S. & Canada softwood and panel markets - week

03 2021 (Jan

29,

2021)

-

U.S.&nb303& Canada softwood and panel markets - week

02 2021 (Jan

22,

2021)

-

U.S. & Canada softwood and panel markets - week

01 2021 (Jan

15,

2021)

-

U.S. & Canada softwood and panel markets - week

49 2020 (Dec

16,

2020)

-

U.S. & Canada softwood and panel markets - week

48 2020 (Dec

09,

2020)

-

U.S. & Canada softwood and panel markets - week

47 2020 (Dec

02,

2020)

-

U.S. & Canada softwood and panel markets - week

46 2020 (Nov

25,

2020)

-

U.S. & Canada softwood and panel markets - week

45 2020 (Nov

18,

2020)

-

U.S. & Canada softwood and panel markets - week

44 2020 (Nov

11,

2020)

-

U.S. & Canada softwood and panel markets - week

43 2020 (Nov

4,

2020)

-

U.S. & Canada softwood and panel markets - week

42 2020 (Oct

28,

2020)

-

U.S. & Canada softwood and panel markets - week

41 2020 (Oct

21,

2020)

-

U.S. & Canada softwood and panel markets - week

40 2020 (Oct

14,

2020)

-

U.S. & Canada softwood and panel markets - week

39, 2020 (Oct

07,

2020)

-

U.S. & Canada softwood and panel markets - week

38, 2020 (Sep

30,

2020)

-

U.S. & Canada softwood and panel markets - week

37, 2020 (Sep

23,

2020)

-

U.S. & Canada softwood and panel markets - week

36, 2020 (Sep

16,

2020)

-

U.S. & Canada softwood and panel markets - week

35, 2020 (Sep

09,

2020)

-

U.S. & Canada softwood and panel markets - week

34, 2020 (Sep

02,

2020)

-

U.S. & Canada softwood and panel markets - week

33, 2020 (Aug

26,

2020)

-

U.S. & Canada softwood and panel markets - week

32, 2020 (Aug

19,

2020)

-

U.S. & Canada softwood and panel markets - week

31, 2020 (Aug

12,

2020)

-

U.S. & Canada softwood and panel markets - week

30, 2020 (Aug

05,

2020)

-

U.S. & Canada softwood and panel markets - week 29, 2020 (Jul

29,

2020)

-

U.S. & Canada softwood and panel markets - week 28, 2020 (Jul

22,

2020)

-

U.S. & Canada softwood and panel markets - week 27, 2020 (Jul

17,

2020)

-

U.S. & Canada softwood and panel markets - week 26, 2020 (Jul

10,

2020)

-

U.S. & Canada softwood and panel markets - week 25, 2020 (Jul

02,

2020)

-

U.S. & Canada softwood and panel markets - week 24, 2020 (Jun

25,

2020)

-

U.S. & Canada softwood and panel markets - week 23, 2020 (Jun

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 22, 2020 (Jun

10,

2020)

-

U.S. &

Canada softwood and panel markets - week 21, 2020 (Jun

3,

2020)

-

U.S. &

Canada softwood and panel markets - week 20, 2020 (May 27,

2020)

-

U.S. &

Canada softwood and panel markets - week 19, 2020 (May 21,

2020)

-

U.S. &

Canada softwood and panel markets - week 18, 2020 (May 15,

2020)

-

U.S. &

Canada softwood and panel markets - week 17, 2020 (May 8,

2020)

-

U.S. &

Canada softwood and panel markets - week 16, 2020 (May 1,

2020)

-

U.S. &

Canada softwood and panel markets - week 15, 2020 (Apr

23,

2020)

-

U.S. &

Canada softwood and panel markets - week 14, 2020 (Apr

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 13, 2020 (Apr

08,

2020)

-

U.S. &

Canada softwood and panel markets - week 12, 2020 (Mar

31,

2020)

-

U.S. &

Canada softwood and panel markets - week 11, 2020 (Mar

24,

2020)

-

U.S. &

Canada softwood and panel markets - week 5, 2020 (Feb

11,

2020)

-

U.S. &

Canada softwood and panel markets - week 4, 2020 (Feb

4,

2020)

-

U.S. &

Canada softwood and panel markets - week 3, 2020 (January

27,

2020)

-

U.S. &

Canada softwood and panel markets - week 2, 2020 (January

20,

2020)

-

U.S. &

Canada softwood and panel markets - week 1, 2020 (January

13,

2020)

-

U.S. &

Canada softwood and panel markets - week 50, 2019 (December

17,

2019)

-

U.S. &

Canada softwood and panel markets - week 49, 2019 (December

10,

2019)

-

U.S. &

Canada softwood and panel markets - week 48, 2019 (December

3,

2019)

-

U.S. &

Canada softwood and panel markets - week 47, 2019 (November

26,

2019)

-

U.S. &

Canada softwood and panel markets - week 46, 2019 (November

19,

2019)

-

U.S. &

Canada softwood and panel markets - week 45, 2019 (November

12,

2019)

-

U.S. &

Canada softwood and panel markets - week 44, 2019 (November

5,

2019)

-

U.S. &

Canada softwood and panel markets - week 43, 2019 ( October

29,

2019)

-

U.S. &

Canada softwood and panel markets - week 42, 2019 ( October

22,

2019)

-

U.S. &

Canada softwood and panel markets - week 41, 2019 ( October

15,

2019)

-

U.S. &

Canada softwood and panel markets - week 40, 2019 ( October

8,

2019)

-

U.S. &

Canada softwood and panel markets - week 39, 2019 ( October

1,

2019)

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|