|

Lumber and panel market weekly report ----

Week

47, 2021 |

|

By Madison's Lumber Reporter

A huge disruption to transportation for most of

November from the critical lumber producing

basket of the British Columbia interior,

euphemistically referred to as “sawmill

country”, caused a supply crunch for wood

products which the market is currently still

working out. Of all construction framing lumber

in the U.S. at any time, approximately 14% comes

from B.C., so such a big drop so suddenly is

having a great impact on lumber prices.

Meanwhile, U.S. home construction activity is

very strong for this time of year. Total housing

starts in the US for November 2021 soared by

almost +12% from October, to a seasonally

adjusted annual rate of 1.679 million units.

This is an +8.3% improvement from the same month

one year ago, when it was 1.551 million.

Since players had not been stocking lumber

inventory in hopes that prices would go down,

they were caught short toward the end of they

year so needed to buy at volumes when normally

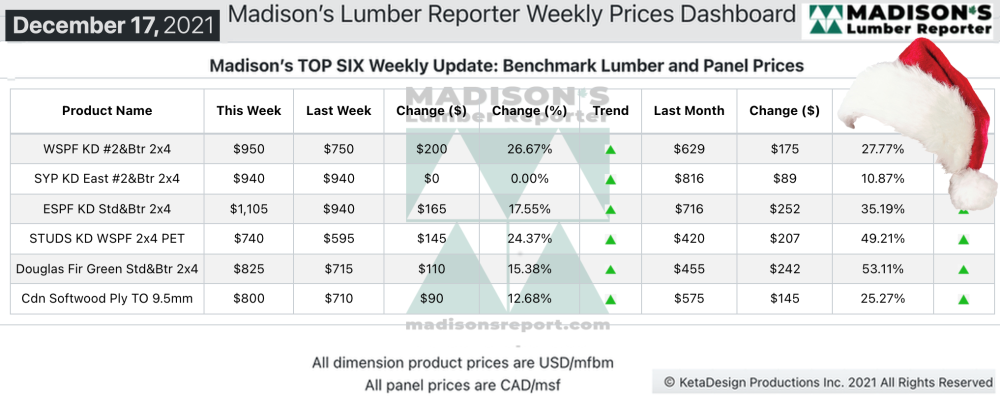

construction activity is very low. For the week

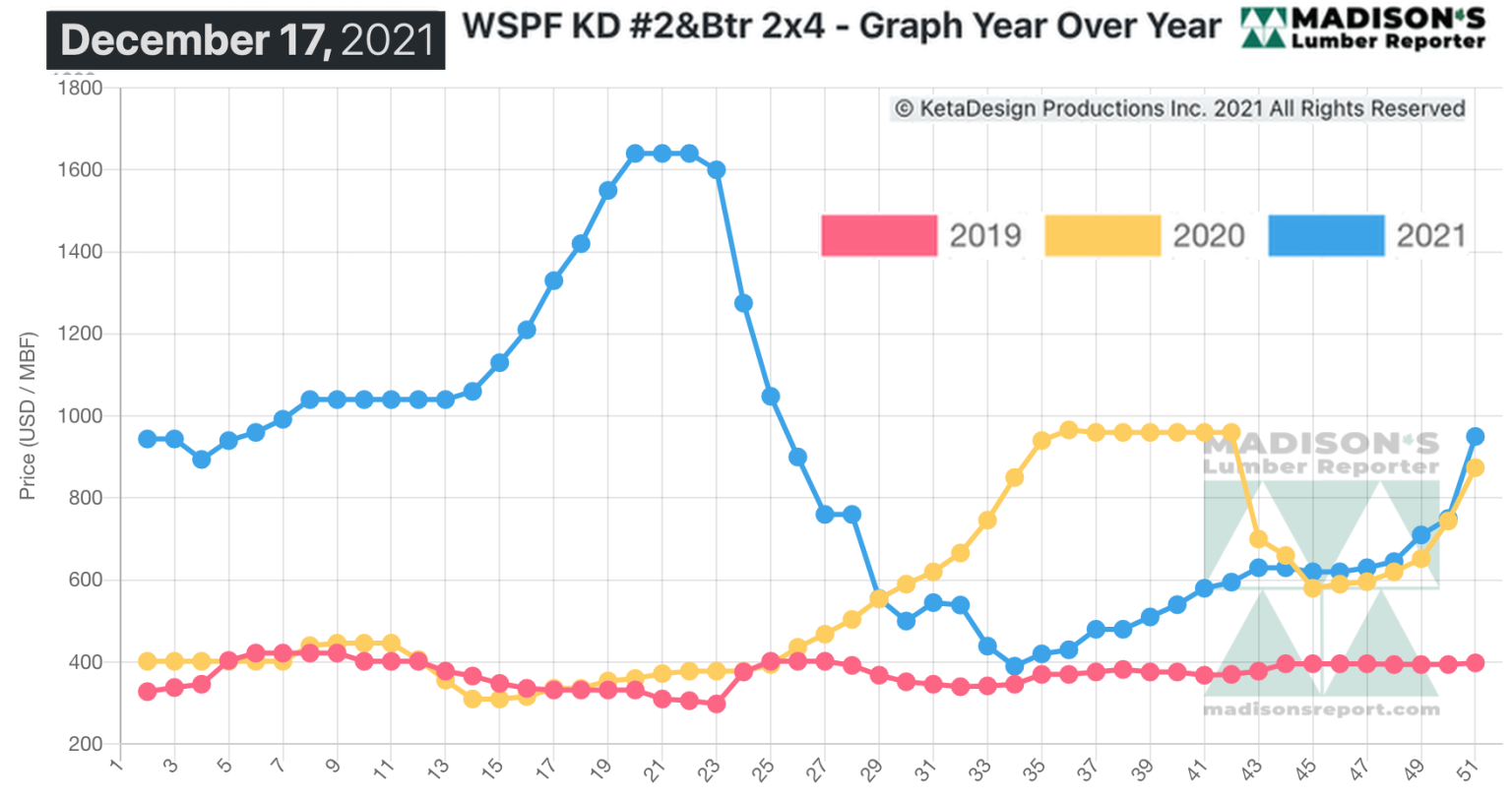

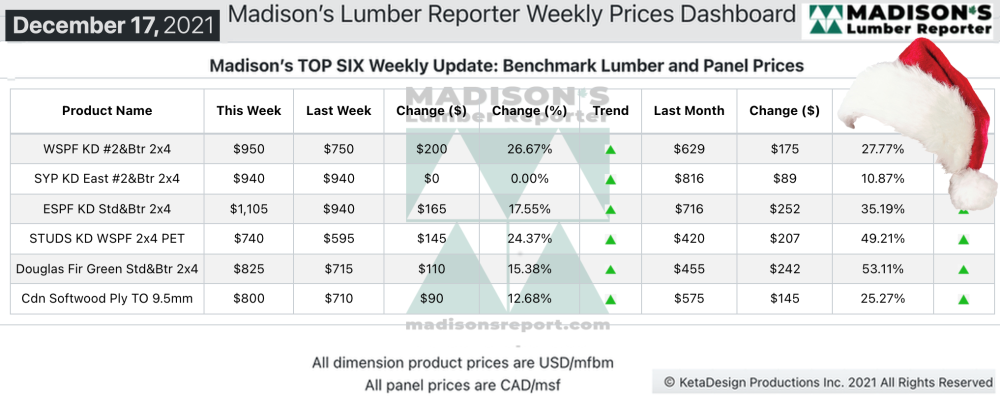

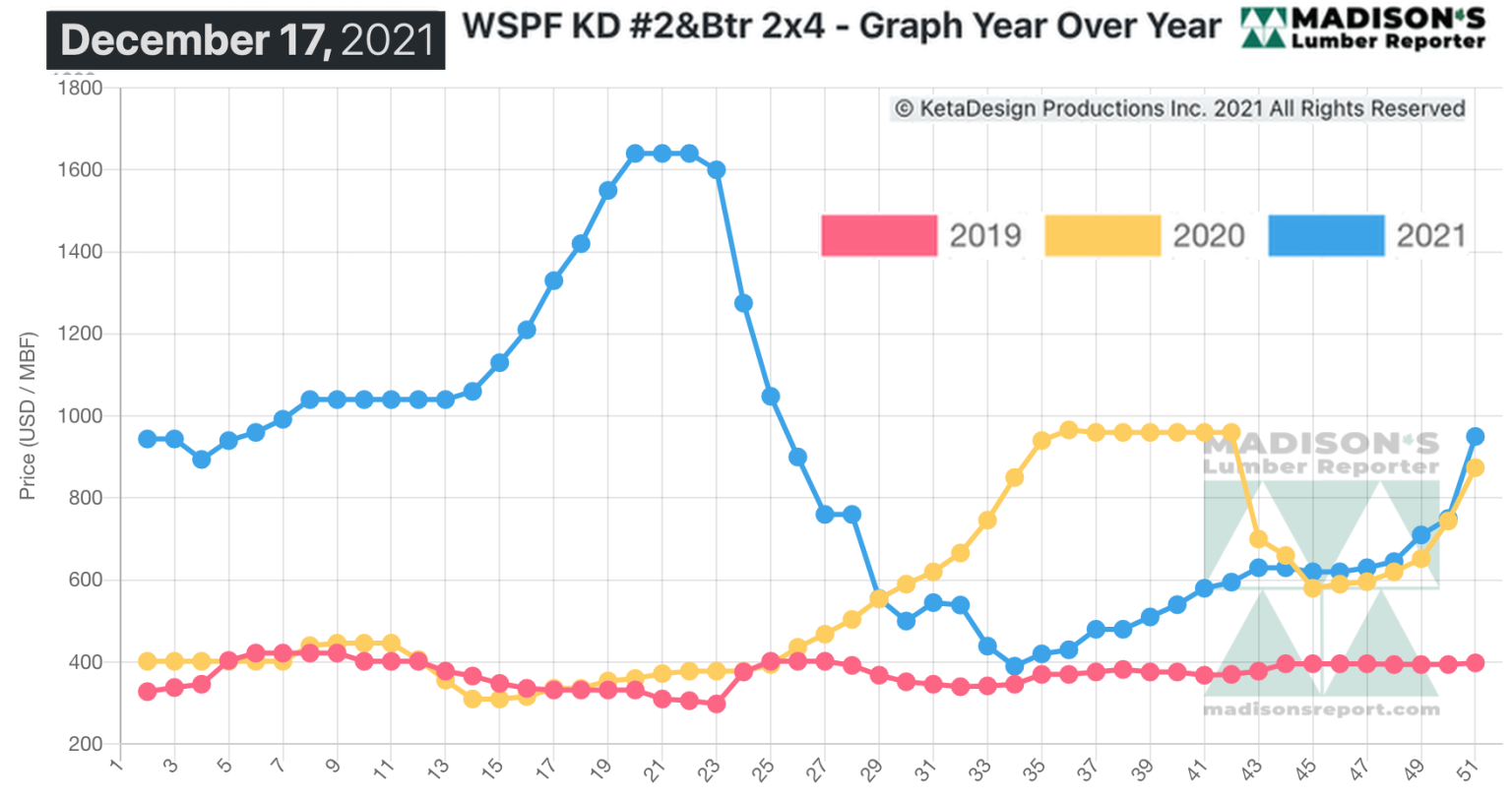

ending December 317 2021 the price of benchmark

lumber item Western S-P-F 2×4 #2&Btr KD (RL)

skyrocketed, up by a mind-boggling +$200 or +27%

to US$950 mfbm, from $750 the previous week,

said lumber industry price guide newsletter

Madison’s Lumber Reporter. That week’s price is

up by +$321, or +51%, from one month ago when it

was $629.

Prices jumped significantly again and those who

didn’t have inventory coverage were running out

of time as most sawmills planned to start their

two-week holiday shutdowns sooner rather than

later.

“ Solid wood commodity prices experienced

another surge as 2021 came to a close, with

studs and standard grade dimension leading the

way.” — Madison’s Lumber Reporter

Western S-P-F buyers in the United States were either sitting back after

covering their early- to mid-January needs, or desperately scrambling to

do so. January 17th order files were widely reported by both lumber and

studs manufacturers. Production volumes remained low and the only

perceivable pressure on prices was further upward.

Canadian purveyors of Western S-P-F lumber garnered consistent demand,

with order files stretching into the back half of January on many items.

Suppliers weren’t surprised to see inquiry wane as Friday approached,

since many buyers had covered their immediate needs over the past

fortnight and decided to shift into holiday-mode for the balance of the

year.

“Demand ebbed in the Eastern S-P-F market as the week wore on and

buyers got quieter, mainly due to replacement costs marching inexorably

upward. Sawmill availability remained tight and field inventories were

still lean despite steady sales volumes through the first half of

December.” — Madison’s Lumber Reporter

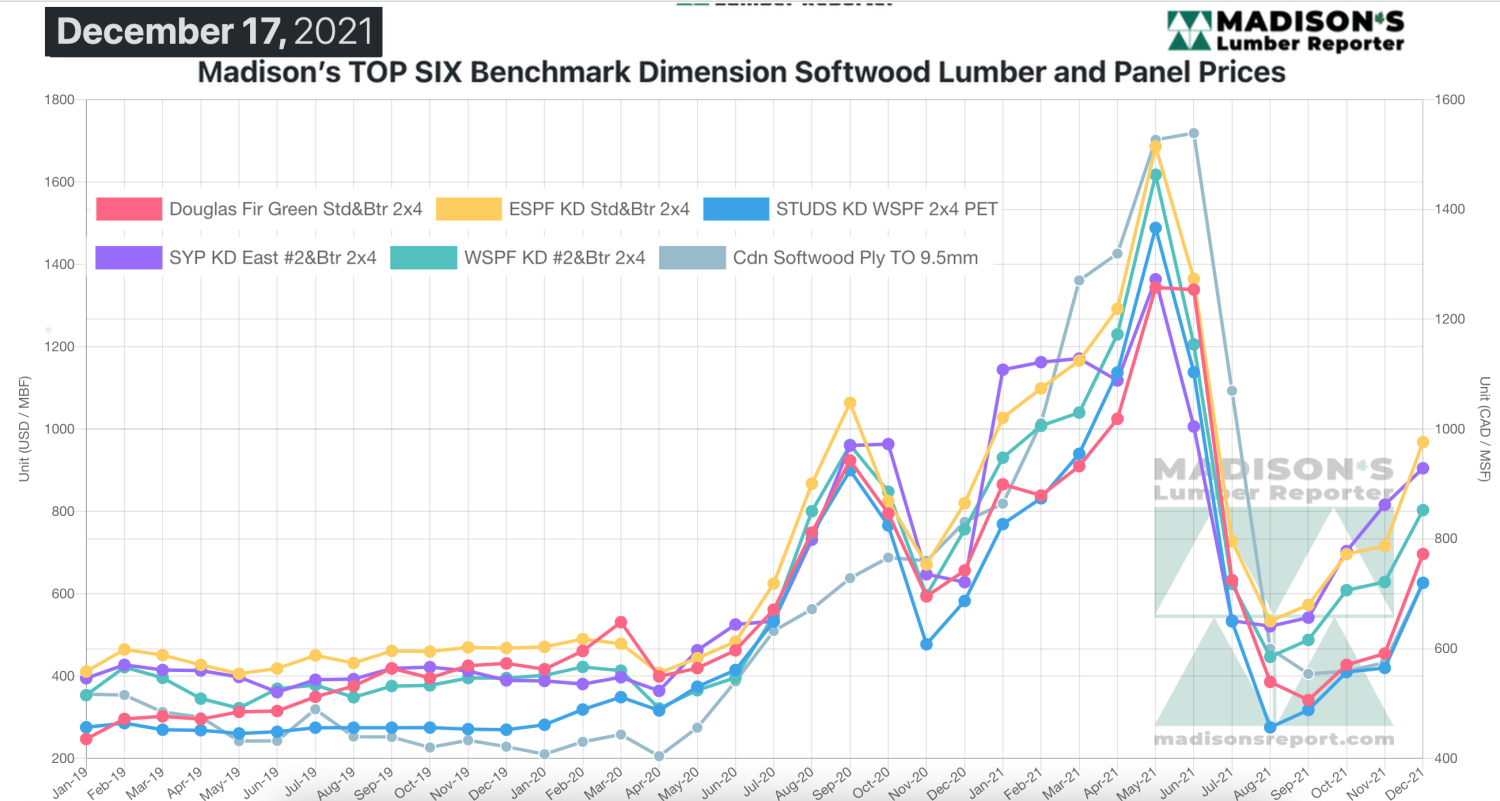

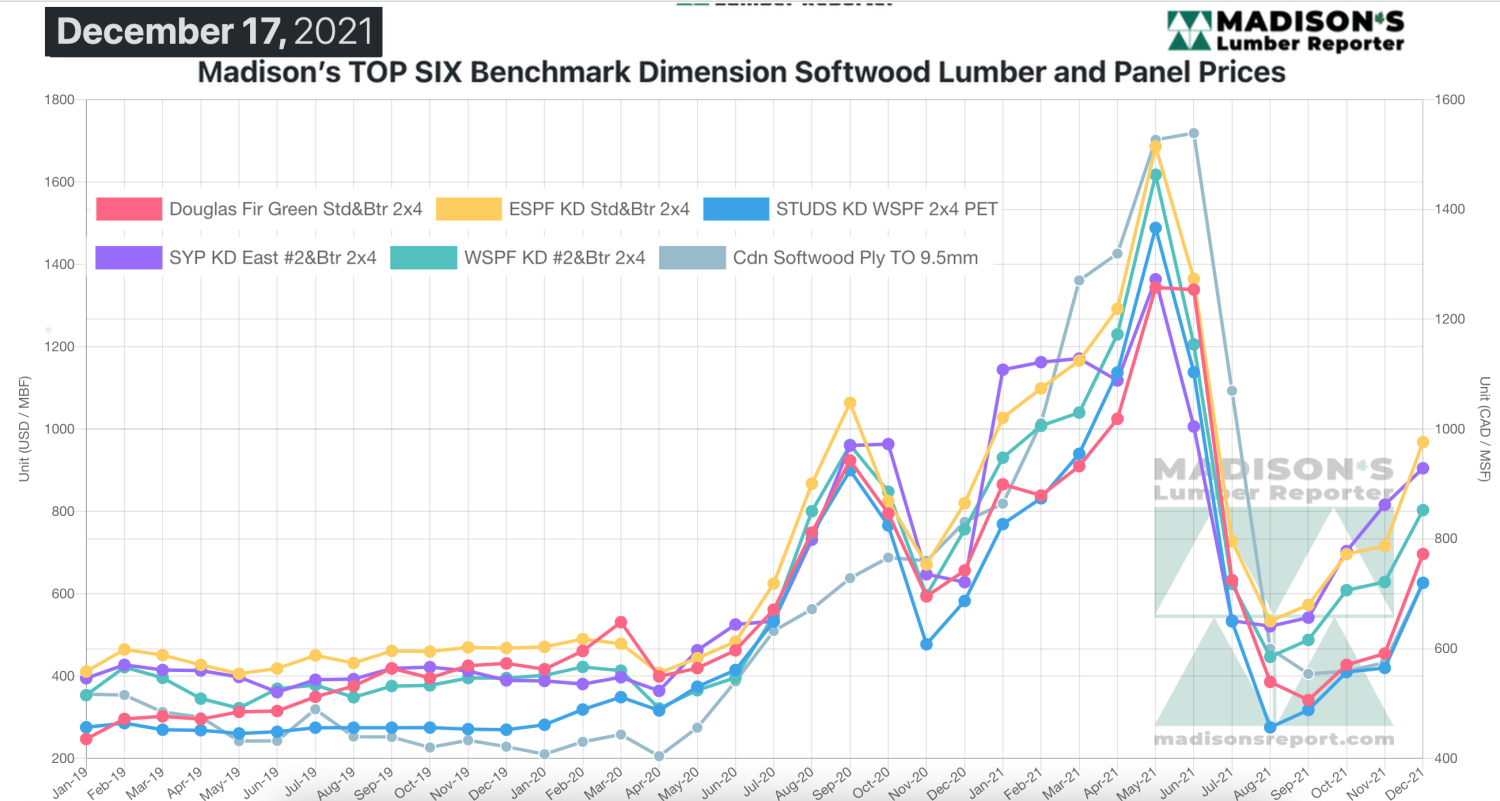

Madison’s Benchmark Top-Six Softwood Lumber and Panel

Prices: Monthly Averages

Compared to the same week last year, when it was US$874 mfbm, for the

week ending December 17, 2021 the price of Western S-P-F 2×4 #2&Btr KD (RL)

was up by +$76, or +9%.

Compared to two years’ ago when it was $398, that week’s price was up by

+$552, or +139%.

-

U.S. & Canada softwood and panel markets - week

46 2021 (Dec

15,

2021)

-

U.S. & Canada softwood and panel markets - week

45 2021 (Dec

08,

2021)

-

U.S. & Canada softwood and panel markets - week

44 2021 (Dec

01,

2021)

-

U.S. & Canada softwood and panel markets - week

43 2021 (Nov24,

2021)

-

U.S. & Canada softwood and panel markets - week

42 2021 (Nov17,

2021)

-

U.S. & Canada softwood and panel markets - week

41 2021 (Nov10,

2021)

-

U.S. & Canada softwood and panel markets - week

40 2021 (Nov

03,

2021)

-

U.S. & Canada softwood and panel markets - week

39 2021 (Oct

27,

2021)

-

U.S. & Canada softwood and panel markets - week

38 2021 (Oct

20,

2021)

-

U.S. & Canada softwood and panel markets - week

37 2021 (Oct

13,

2021)

-

U.S. & Canada softwood and panel markets - week

36 2021 (Oct

06,

2021)

-

U.S. & Canada softwood and panel markets - week

35 2021 (Sep

29,

2021)

-

U.S. & Canada softwood and panel markets - week

34 2021 (Sep

22,

2021)

-

U.S. & Canada softwood and panel markets - week

33 2021 (Sep

8,

2021)

-

U.S. & Canada softwood and panel markets - week

32 2021 (Sep

1,

2021)

-

U.S. & Canada softwood and panel markets - week

31 2021 (Aug

25,

2021)

-

U.S. & Canada softwood and panel markets - week

30 2021 (Aug

18,

2021)

-

U.S. & Canada softwood and panel markets - week

29 2021 (Aug

11,

2021)

-

U.S. & Canada softwood and panel markets - week

28 2021 (Aug

04,

2021)

-

U.S. & Canada softwood and panel markets - week

27 2021 (Jul

28,

2021)

-

U.S. & Canada softwood and panel markets - week

26 2021 (Jul

21,

2021)

-

U.S. & Canada softwood and panel markets - week

25 2021 (Jul

14,

2021)

-

U.S. & Canada softwood and panel markets - week

24 2021 (Jul

07,

2021)

-

U.S. & Canada softwood and panel markets - week

23 2021 (Jun

30,

2021)

-

U.S. & Canada softwood and panel markets - week

22 2021 (Jun

23,

2021)

-

U.S. & Canada softwood and panel markets - week

21 2021 (Jun

10,

2021)

-

U.S. & Canada softwood and panel markets - week

20 2021 (Jun

03,

2021)

-

U.S. & Canada softwood and panel markets - week

19 2021 (May

26,

2021)

-

U.S. & Canada softwood and panel markets - week

18 2021 (May

19,

2021)

-

U.S. & Canada softwood and panel markets - week

17 2021 (May

12,

2021)

-

U.S. & Canada softwood and panel markets - week

16 2021 (May

5,

2021)

-

U.S. & Canada softwood and panel markets - week

15 2021 (Apr

28,

2021)

-

U.S. & Canada softwood and panel markets - week

14 2021 (Apr

21,

2021)

-

U.S. & Canada softwood and panel markets - week

13 2021 (Apr

15,

2021)

-

U.S. & Canada softwood and panel markets - week

12 2021 (Apr

8,

2021)

-

U.S. & Canada softwood and panel markets - week

11 2021 (Apr

1,

2021)

-

U.S. & Canada softwood and panel markets - week

10 2021 (Mar

25,

2021)

-

U.S. & Canada softwood and panel markets - week

09 2021 (Mar

17,

2021)

-

U.S. & Canada softwood and panel markets - week

08 2021 (Mar

10,

2021)

-

U.S. & Canada softwood and panel markets - week

07 2021 (Mar

03,

2021)

-

U.S. & Canada softwood and panel markets - week

06 2021 (Feb

24,

2021)

-

U.S. & Canada softwood and panel markets - week

05 2021 (Feb

16,

2021)

-

U.S. & Canada softwood and panel markets - week

04 2021 (Feb

04,

2021)

-

U.S. & Canada softwood and panel markets - week

03 2021 (Jan

29,

2021)

-

U.S.&nb303& Canada softwood and panel markets - week

02 2021 (Jan

22,

2021)

-

U.S. & Canada softwood and panel markets - week

01 2021 (Jan

15,

2021)

-

U.S. & Canada softwood and panel markets - week

49 2020 (Dec

16,

2020)

-

U.S. & Canada softwood and panel markets - week

48 2020 (Dec

09,

2020)

-

U.S. & Canada softwood and panel markets - week

47 2020 (Dec

02,

2020)

-

U.S. & Canada softwood and panel markets - week

46 2020 (Nov

25,

2020)

-

U.S. & Canada softwood and panel markets - week

45 2020 (Nov

18,

2020)

-

U.S. & Canada softwood and panel markets - week

44 2020 (Nov

11,

2020)

-

U.S. & Canada softwood and panel markets - week

43 2020 (Nov

4,

2020)

-

U.S. & Canada softwood and panel markets - week

42 2020 (Oct

28,

2020)

-

U.S. & Canada softwood and panel markets - week

41 2020 (Oct

21,

2020)

-

U.S. & Canada softwood and panel markets - week

40 2020 (Oct

14,

2020)

-

U.S. & Canada softwood and panel markets - week

39, 2020 (Oct

07,

2020)

-

U.S. & Canada softwood and panel markets - week

38, 2020 (Sep

30,

2020)

-

U.S. & Canada softwood and panel markets - week

37, 2020 (Sep

23,

2020)

-

U.S. & Canada softwood and panel markets - week

36, 2020 (Sep

16,

2020)

-

U.S. & Canada softwood and panel markets - week

35, 2020 (Sep

09,

2020)

-

U.S. & Canada softwood and panel markets - week

34, 2020 (Sep

02,

2020)

-

U.S. & Canada softwood and panel markets - week

33, 2020 (Aug

26,

2020)

-

U.S. & Canada softwood and panel markets - week

32, 2020 (Aug

19,

2020)

-

U.S. & Canada softwood and panel markets - week

31, 2020 (Aug

12,

2020)

-

U.S. & Canada softwood and panel markets - week

30, 2020 (Aug

05,

2020)

-

U.S. & Canada softwood and panel markets - week 29, 2020 (Jul

29,

2020)

-

U.S. & Canada softwood and panel markets - week 28, 2020 (Jul

22,

2020)

-

U.S. & Canada softwood and panel markets - week 27, 2020 (Jul

17,

2020)

-

U.S. & Canada softwood and panel markets - week 26, 2020 (Jul

10,

2020)

-

U.S. & Canada softwood and panel markets - week 25, 2020 (Jul

02,

2020)

-

U.S. & Canada softwood and panel markets - week 24, 2020 (Jun

25,

2020)

-

U.S. & Canada softwood and panel markets - week 23, 2020 (Jun

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 22, 2020 (Jun

10,

2020)

-

U.S. &

Canada softwood and panel markets - week 21, 2020 (Jun

3,

2020)

-

U.S. &

Canada softwood and panel markets - week 20, 2020 (May 27,

2020)

-

U.S. &

Canada softwood and panel markets - week 19, 2020 (May 21,

2020)

-

U.S. &

Canada softwood and panel markets - week 18, 2020 (May 15,

2020)

-

U.S. &

Canada softwood and panel markets - week 17, 2020 (May 8,

2020)

-

U.S. &

Canada softwood and panel markets - week 16, 2020 (May 1,

2020)

-

U.S. &

Canada softwood and panel markets - week 15, 2020 (Apr

23,

2020)

-

U.S. &

Canada softwood and panel markets - week 14, 2020 (Apr

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 13, 2020 (Apr

08,

2020)

-

U.S. &

Canada softwood and panel markets - week 12, 2020 (Mar

31,

2020)

-

U.S. &

Canada softwood and panel markets - week 11, 2020 (Mar

24,

2020)

-

U.S. &

Canada softwood and panel markets - week 5, 2020 (Feb

11,

2020)

-

U.S. &

Canada softwood and panel markets - week 4, 2020 (Feb

4,

2020)

-

U.S. &

Canada softwood and panel markets - week 3, 2020 (January

27,

2020)

-

U.S. &

Canada softwood and panel markets - week 2, 2020 (January

20,

2020)

-

U.S. &

Canada softwood and panel markets - week 1, 2020 (January

13,

2020)

-

U.S. &

Canada softwood and panel markets - week 50, 2019 (December

17,

2019)

-

U.S. &

Canada softwood and panel markets - week 49, 2019 (December

10,

2019)

-

U.S. &

Canada softwood and panel markets - week 48, 2019 (December

3,

2019)

-

U.S. &

Canada softwood and panel markets - week 47, 2019 (November

26,

2019)

-

U.S. &

Canada softwood and panel markets - week 46, 2019 (November

19,

2019)

-

U.S. &

Canada softwood and panel markets - week 45, 2019 (November

12,

2019)

-

U.S. &

Canada softwood and panel markets - week 44, 2019 (November

5,

2019)

-

U.S. &

Canada softwood and panel markets - week 43, 2019 ( October

29,

2019)

-

U.S. &

Canada softwood and panel markets - week 42, 2019 ( October

22,

2019)

-

U.S. &

Canada softwood and panel markets - week 41, 2019 ( October

15,

2019)

-

U.S. &

Canada softwood and panel markets - week 40, 2019 ( October

8,

2019)

-

U.S. &

Canada softwood and panel markets - week 39, 2019 ( October

1,

2019)

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|

|

|