|

Lumber and panel market weekly report ----

Week

46, 2021 |

|

By Madison's Lumber Reporter

The extent of damage to transportation

infrastructure and supply chain in southern

British Columbia following the massive flooding

in November is now known. After closing down two

times the Port of Vancouver is now fully

re-open, as both railways are running again. The

Canadian Pacific and Canadian National railways

are sharing the one repaired rail line from

Kamloops to Vancouver, so wood from the

important fibre basket of the B.C. Interior is

once again moving. However, enormous backlogs

are built up, both at sawmills and at the Port

of Vancouver (the third largest by volume in

North America).

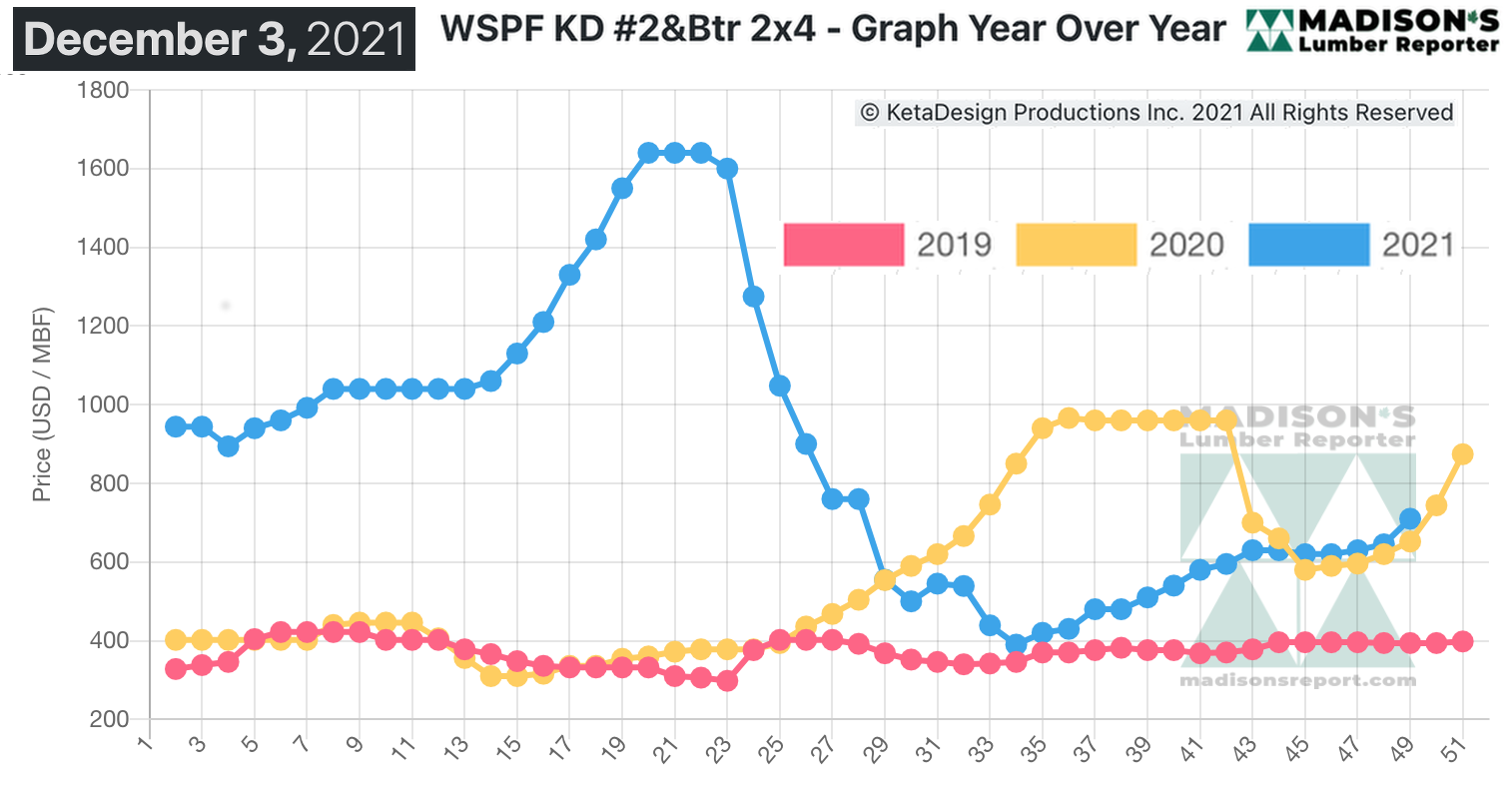

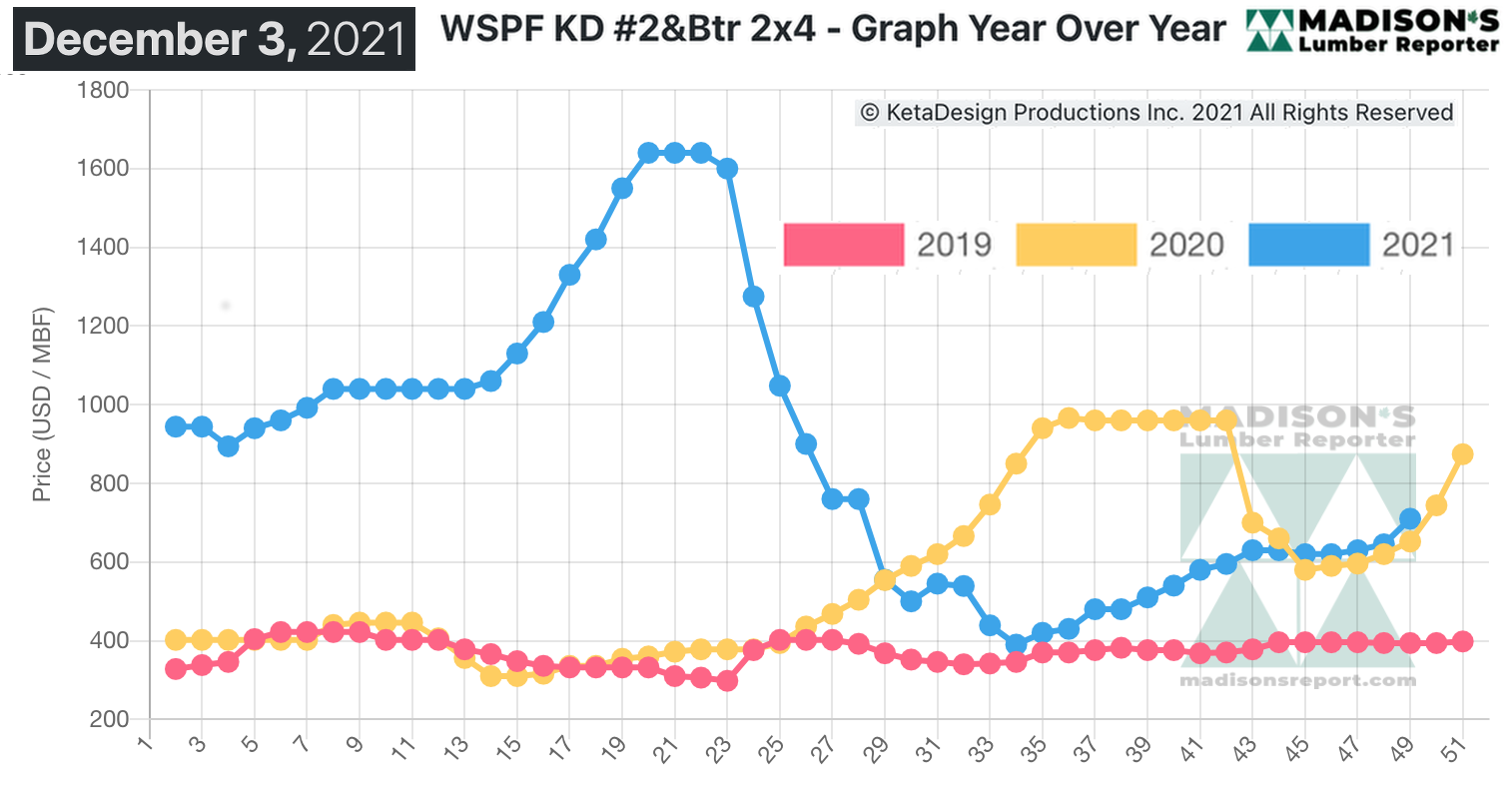

Since lumber customers were keeping very lean

inventories in the hopes that prices would go

down toward the end of the year, which was

historically the usual seasonal trend, the

supply-demand balance is firmly in favour of

producers and prices are rising steadily. It is

quite interesting that the current trend line is

almost exactly matching the same time last year.

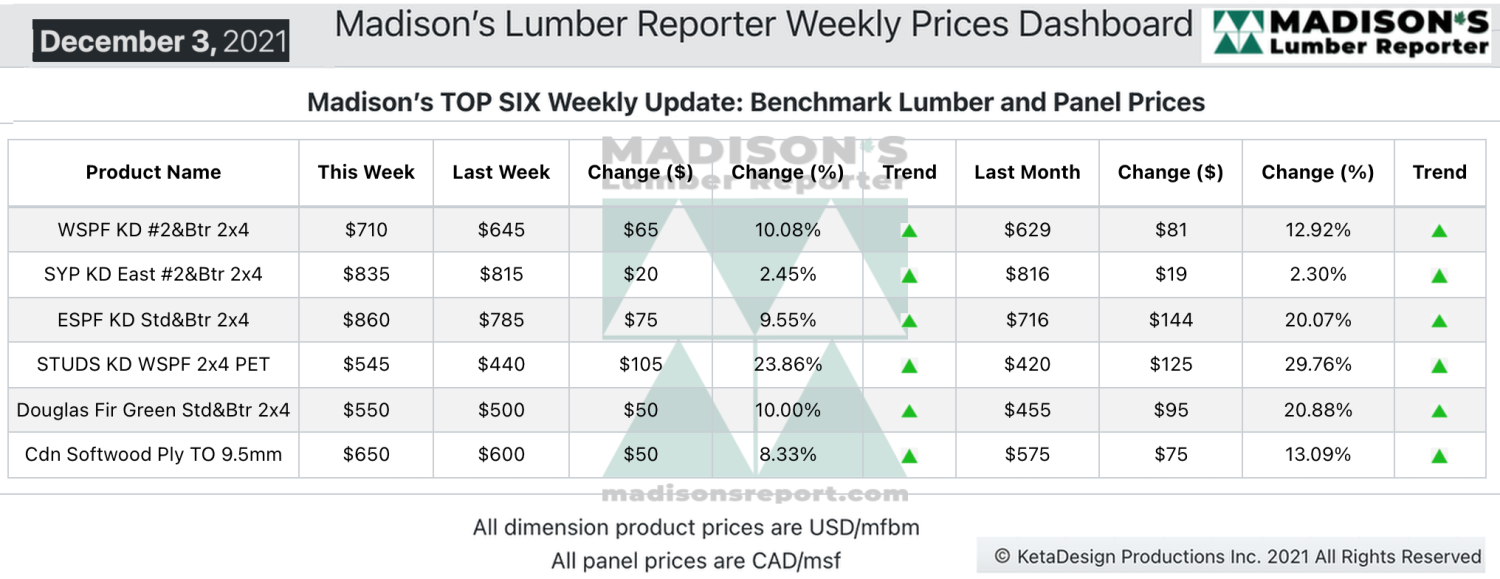

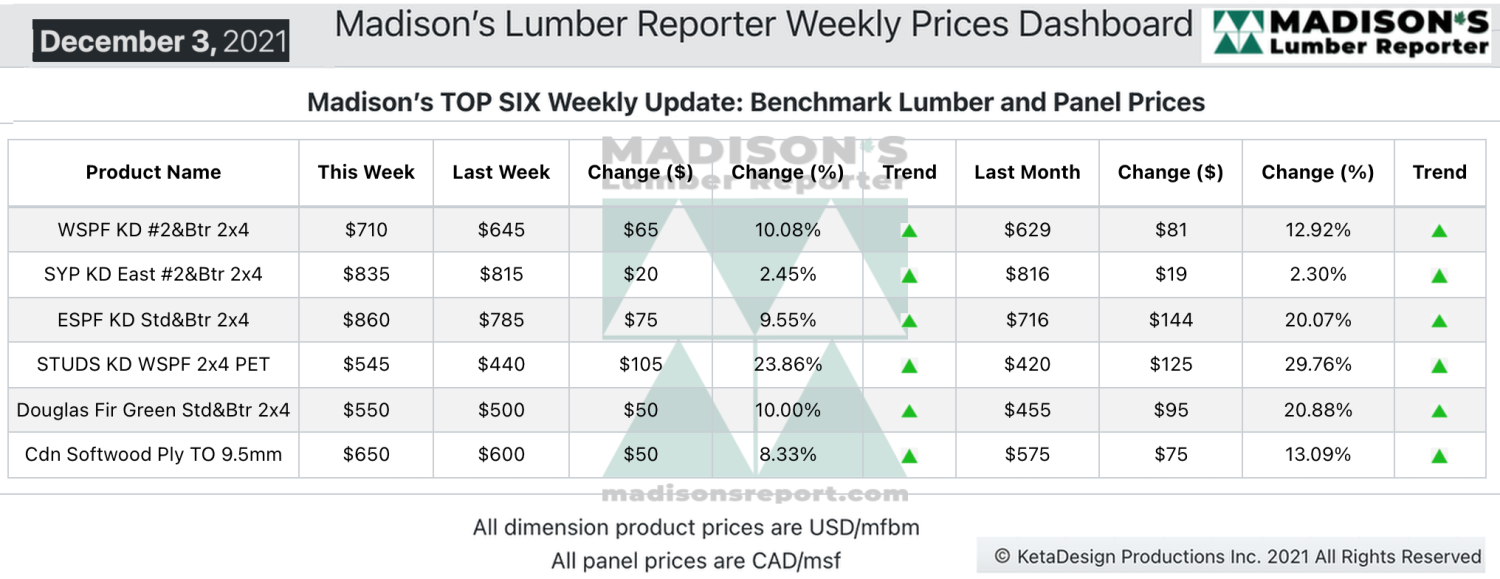

As shocked customers searched hungrily for any

wood they could find, in the week ending

December 3, 2021 the price of benchmark lumber

item Western S-P-F 2×4 #2&Btr KD (RL) jumped

dramatically, up by +$65 or +10% to US$710 mfbm,

from $645 the previous week, said lumber

industry price guide newsletter Madison’s Lumber

Reporter. That week’s price is up by +$81, or

+13%, from one month ago when it was $629.

Prices advanced on nearly every commodity while

supply chains and transportation networks

languished.

“Price volatility was the watchword, with most

buyers abandoning any sense of caution as they

frantically tried to find coverage.” — Madison’s

Lumber Reporter

Peppy demand persisted this week for Western S-P-F lumber and studs in

the United States. Sawmill lists were thin to begin the week and

offerings only got slimmer as Friday approached.

Western S-P-F producers in Canada reported potent demand this week.

Several developments convinced players that the strong market will

persist into 2022, including limited supply, light field inventories,

severe transportation disruptions, positive lumber futures, and the

trade dispute between Canada and the U.S. As buyers scurried about in

effort to cover their needs, producers pushed their order files into the

last week of December on most items and jacked asking prices up.

“WSPF studs experienced unyielding demand this week as buyers were

either desperately scrabbling to find coverage or paralyzed by the

sudden surge in prices – shortly after which they joined the former

camp. Stud sawmills boosted their prices.” — Madison’s Lumber Reporter

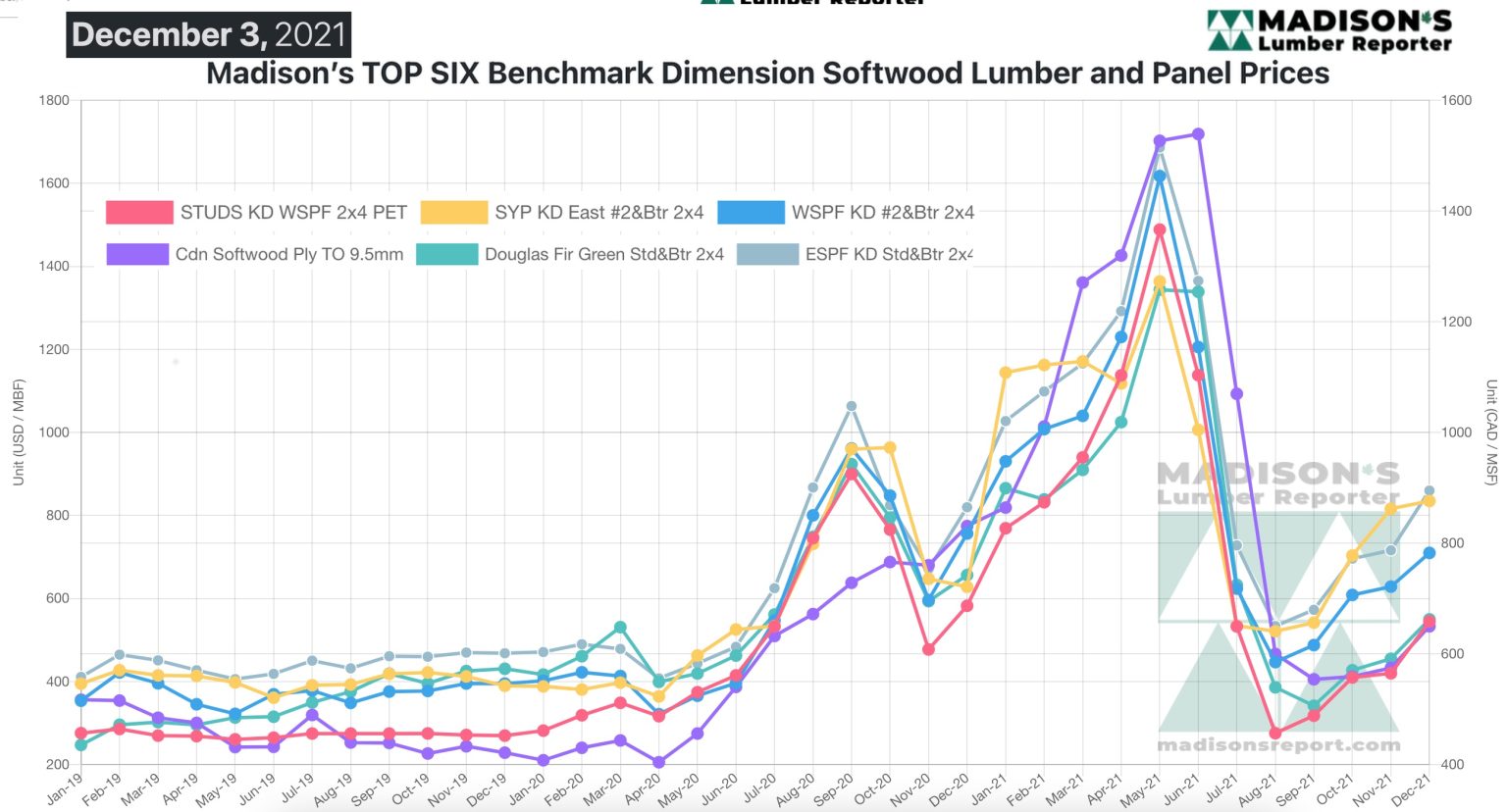

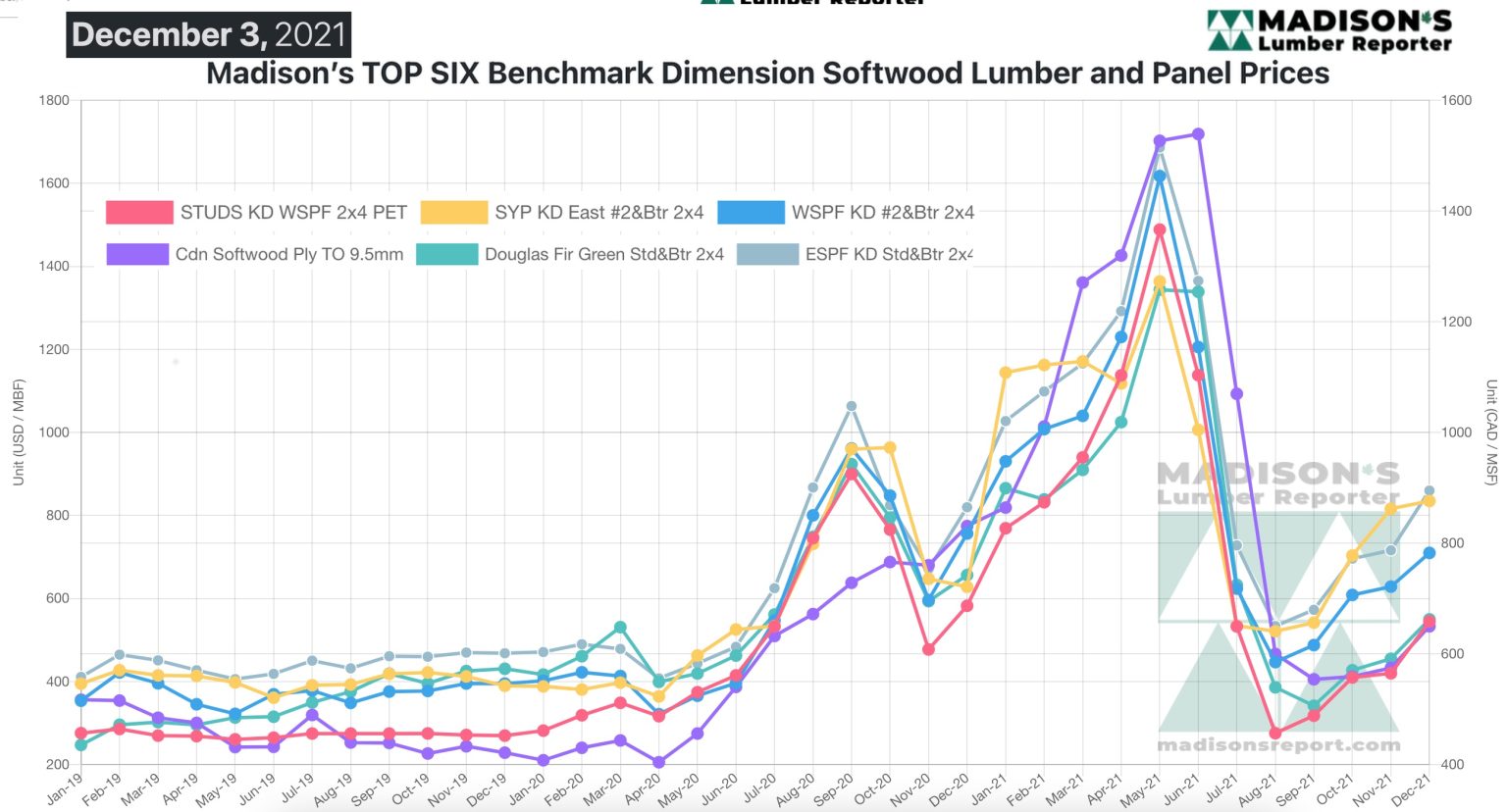

Madison’s Benchmark Top-Six Softwood Lumber and Panel

Prices: Monthly Averages

Compared to the same week last year, when it was US$652 mfbm, for the

week ending December 3, 2021 the price of Western S-P-F 2×4 #2&Btr KD (RL)

was up by +$58, or +9%.

Compared to two years’ ago when it was $394, that week’s price was up by

+$316, or +80%.

-

U.S. & Canada softwood and panel markets - week

45 2021 (Dec

08,

2021)

-

U.S. & Canada softwood and panel markets - week

44 2021 (Dec

01,

2021)

-

U.S. & Canada softwood and panel markets - week

43 2021 (Nov24,

2021)

-

U.S. & Canada softwood and panel markets - week

42 2021 (Nov17,

2021)

-

U.S. & Canada softwood and panel markets - week

41 2021 (Nov10,

2021)

-

U.S. & Canada softwood and panel markets - week

40 2021 (Nov

03,

2021)

-

U.S. & Canada softwood and panel markets - week

39 2021 (Oct

27,

2021)

-

U.S. & Canada softwood and panel markets - week

38 2021 (Oct

20,

2021)

-

U.S. & Canada softwood and panel markets - week

37 2021 (Oct

13,

2021)

-

U.S. & Canada softwood and panel markets - week

36 2021 (Oct

06,

2021)

-

U.S. & Canada softwood and panel markets - week

35 2021 (Sep

29,

2021)

-

U.S. & Canada softwood and panel markets - week

34 2021 (Sep

22,

2021)

-

U.S. & Canada softwood and panel markets - week

33 2021 (Sep

8,

2021)

-

U.S. & Canada softwood and panel markets - week

32 2021 (Sep

1,

2021)

-

U.S. & Canada softwood and panel markets - week

31 2021 (Aug

25,

2021)

-

U.S. & Canada softwood and panel markets - week

30 2021 (Aug

18,

2021)

-

U.S. & Canada softwood and panel markets - week

29 2021 (Aug

11,

2021)

-

U.S. & Canada softwood and panel markets - week

28 2021 (Aug

04,

2021)

-

U.S. & Canada softwood and panel markets - week

27 2021 (Jul

28,

2021)

-

U.S. & Canada softwood and panel markets - week

26 2021 (Jul

21,

2021)

-

U.S. & Canada softwood and panel markets - week

25 2021 (Jul

14,

2021)

-

U.S. & Canada softwood and panel markets - week

24 2021 (Jul

07,

2021)

-

U.S. & Canada softwood and panel markets - week

23 2021 (Jun

30,

2021)

-

U.S. & Canada softwood and panel markets - week

22 2021 (Jun

23,

2021)

-

U.S. & Canada softwood and panel markets - week

21 2021 (Jun

10,

2021)

-

U.S. & Canada softwood and panel markets - week

20 2021 (Jun

03,

2021)

-

U.S. & Canada softwood and panel markets - week

19 2021 (May

26,

2021)

-

U.S. & Canada softwood and panel markets - week

18 2021 (May

19,

2021)

-

U.S. & Canada softwood and panel markets - week

17 2021 (May

12,

2021)

-

U.S. & Canada softwood and panel markets - week

16 2021 (May

5,

2021)

-

U.S. & Canada softwood and panel markets - week

15 2021 (Apr

28,

2021)

-

U.S. & Canada softwood and panel markets - week

14 2021 (Apr

21,

2021)

-

U.S. & Canada softwood and panel markets - week

13 2021 (Apr

15,

2021)

-

U.S. & Canada softwood and panel markets - week

12 2021 (Apr

8,

2021)

-

U.S. & Canada softwood and panel markets - week

11 2021 (Apr

1,

2021)

-

U.S. & Canada softwood and panel markets - week

10 2021 (Mar

25,

2021)

-

U.S. & Canada softwood and panel markets - week

09 2021 (Mar

17,

2021)

-

U.S. & Canada softwood and panel markets - week

08 2021 (Mar

10,

2021)

-

U.S. & Canada softwood and panel markets - week

07 2021 (Mar

03,

2021)

-

U.S. & Canada softwood and panel markets - week

06 2021 (Feb

24,

2021)

-

U.S. & Canada softwood and panel markets - week

05 2021 (Feb

16,

2021)

-

U.S. & Canada softwood and panel markets - week

04 2021 (Feb

04,

2021)

-

U.S. & Canada softwood and panel markets - week

03 2021 (Jan

29,

2021)

-

U.S.&nb303& Canada softwood and panel markets - week

02 2021 (Jan

22,

2021)

-

U.S. & Canada softwood and panel markets - week

01 2021 (Jan

15,

2021)

-

U.S. & Canada softwood and panel markets - week

49 2020 (Dec

16,

2020)

-

U.S. & Canada softwood and panel markets - week

48 2020 (Dec

09,

2020)

-

U.S. & Canada softwood and panel markets - week

47 2020 (Dec

02,

2020)

-

U.S. & Canada softwood and panel markets - week

46 2020 (Nov

25,

2020)

-

U.S. & Canada softwood and panel markets - week

45 2020 (Nov

18,

2020)

-

U.S. & Canada softwood and panel markets - week

44 2020 (Nov

11,

2020)

-

U.S. & Canada softwood and panel markets - week

43 2020 (Nov

4,

2020)

-

U.S. & Canada softwood and panel markets - week

42 2020 (Oct

28,

2020)

-

U.S. & Canada softwood and panel markets - week

41 2020 (Oct

21,

2020)

-

U.S. & Canada softwood and panel markets - week

40 2020 (Oct

14,

2020)

-

U.S. & Canada softwood and panel markets - week

39, 2020 (Oct

07,

2020)

-

U.S. & Canada softwood and panel markets - week

38, 2020 (Sep

30,

2020)

-

U.S. & Canada softwood and panel markets - week

37, 2020 (Sep

23,

2020)

-

U.S. & Canada softwood and panel markets - week

36, 2020 (Sep

16,

2020)

-

U.S. & Canada softwood and panel markets - week

35, 2020 (Sep

09,

2020)

-

U.S. & Canada softwood and panel markets - week

34, 2020 (Sep

02,

2020)

-

U.S. & Canada softwood and panel markets - week

33, 2020 (Aug

26,

2020)

-

U.S. & Canada softwood and panel markets - week

32, 2020 (Aug

19,

2020)

-

U.S. & Canada softwood and panel markets - week

31, 2020 (Aug

12,

2020)

-

U.S. & Canada softwood and panel markets - week

30, 2020 (Aug

05,

2020)

-

U.S. & Canada softwood and panel markets - week 29, 2020 (Jul

29,

2020)

-

U.S. & Canada softwood and panel markets - week 28, 2020 (Jul

22,

2020)

-

U.S. & Canada softwood and panel markets - week 27, 2020 (Jul

17,

2020)

-

U.S. & Canada softwood and panel markets - week 26, 2020 (Jul

10,

2020)

-

U.S. & Canada softwood and panel markets - week 25, 2020 (Jul

02,

2020)

-

U.S. & Canada softwood and panel markets - week 24, 2020 (Jun

25,

2020)

-

U.S. & Canada softwood and panel markets - week 23, 2020 (Jun

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 22, 2020 (Jun

10,

2020)

-

U.S. &

Canada softwood and panel markets - week 21, 2020 (Jun

3,

2020)

-

U.S. &

Canada softwood and panel markets - week 20, 2020 (May 27,

2020)

-

U.S. &

Canada softwood and panel markets - week 19, 2020 (May 21,

2020)

-

U.S. &

Canada softwood and panel markets - week 18, 2020 (May 15,

2020)

-

U.S. &

Canada softwood and panel markets - week 17, 2020 (May 8,

2020)

-

U.S. &

Canada softwood and panel markets - week 16, 2020 (May 1,

2020)

-

U.S. &

Canada softwood and panel markets - week 15, 2020 (Apr

23,

2020)

-

U.S. &

Canada softwood and panel markets - week 14, 2020 (Apr

17,

2020)

-

U.S. &

Canada softwood and panel markets - week 13, 2020 (Apr

08,

2020)

-

U.S. &

Canada softwood and panel markets - week 12, 2020 (Mar

31,

2020)

-

U.S. &

Canada softwood and panel markets - week 11, 2020 (Mar

24,

2020)

-

U.S. &

Canada softwood and panel markets - week 5, 2020 (Feb

11,

2020)

-

U.S. &

Canada softwood and panel markets - week 4, 2020 (Feb

4,

2020)

-

U.S. &

Canada softwood and panel markets - week 3, 2020 (January

27,

2020)

-

U.S. &

Canada softwood and panel markets - week 2, 2020 (January

20,

2020)

-

U.S. &

Canada softwood and panel markets - week 1, 2020 (January

13,

2020)

-

U.S. &

Canada softwood and panel markets - week 50, 2019 (December

17,

2019)

-

U.S. &

Canada softwood and panel markets - week 49, 2019 (December

10,

2019)

-

U.S. &

Canada softwood and panel markets - week 48, 2019 (December

3,

2019)

-

U.S. &

Canada softwood and panel markets - week 47, 2019 (November

26,

2019)

-

U.S. &

Canada softwood and panel markets - week 46, 2019 (November

19,

2019)

-

U.S. &

Canada softwood and panel markets - week 45, 2019 (November

12,

2019)

-

U.S. &

Canada softwood and panel markets - week 44, 2019 (November

5,

2019)

-

U.S. &

Canada softwood and panel markets - week 43, 2019 ( October

29,

2019)

-

U.S. &

Canada softwood and panel markets - week 42, 2019 ( October

22,

2019)

-

U.S. &

Canada softwood and panel markets - week 41, 2019 ( October

15,

2019)

-

U.S. &

Canada softwood and panel markets - week 40, 2019 ( October

8,

2019)

-

U.S. &

Canada softwood and panel markets - week 39, 2019 ( October

1,

2019)

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|

|

|