In The Third Week Of October 2025 Occurred The Final Push To Book Orders For

All Expected Needs Toward Year-End.

Sales volumes remained small, yet constrained supply served to keep prices

stable. Most players agreed the writing is on the wall for the beginning of

the real slowdown of construction as true winter weather approaches.

Due to ongoing curtailments and downtime, Western SPF producers were able to

push their sawmill order files out to two or three weeks. Customers

continued searching for prompt wood. Sentiment was still generally cautious

if not downright pessimistic.

Only specialty items and some panel products’ prices increased.

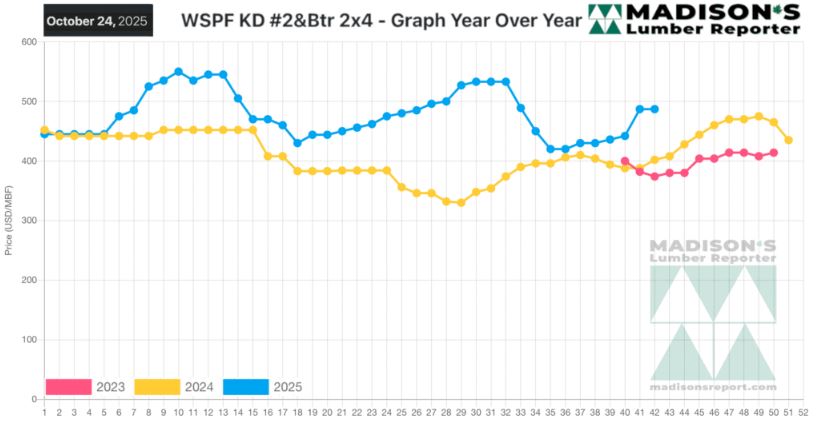

However, in comparison to the same week last year and in 2023, benchmark

WSPF 2? prices were currently higher by approximately 25%.

In the week ending October 24, 2025, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2? #2&Btr KD (RL) was US$487 mfbm. This was

flat from the previous week when it was $487, said weekly forest products

industry price guide newsletter Madison’s Lumber Reporter.

That week’s price was up +$62, or +15%, from one month ago when it was $425.

Compared To The Same Week Last Year, When It Was Us$402 Mfbm, The Price Of

Western Spruce-Pine-Fir 2? #2&Btr Kd (Rl) For The Week Ending October 24,

2025 Was Up +$85, Or +21%.

Compared To Two Years Ago When It Was $374, That Week’S Price Was Up +$113,

Or +30%.

...

KEY TAKE-AWAYS:

Western-SPF buyers and sellers in the US who left no stone unturned stacked

up a lot of orders.

Autumn construction levels followed good weather patterns in many key

regions.

As month-end approached Western-SPF sawmills in Canada were able to lean on

two- to three-week order files.

Strengthening commodity prices seemed to be supported by steady takeaway.

Purchasers continued to operate in short timeframes and avoid any semblance

of speculative buying.

Higher Eastern-SPF commodity prices meant buyers searched for longer to

unearth deals.

Southern Yellow Pine supply remained relatively tight as prices seemed firm.

There was a feeling of confusion as to the longer term direction of the

market.

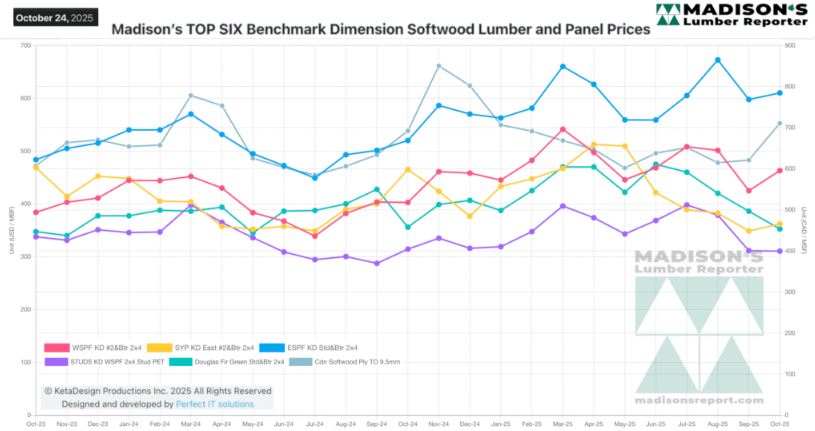

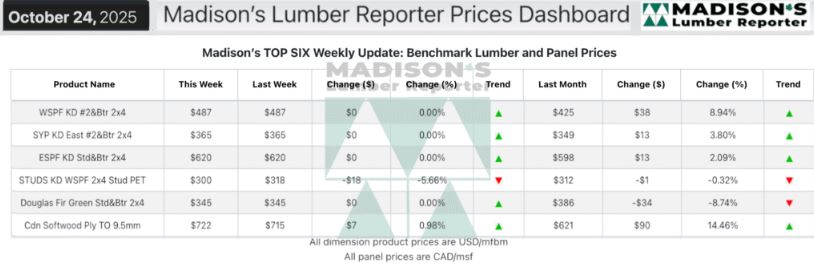

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: