The Latest Increased Lumber Tariff Came Into Effect, This Time Another 10%

On Canadian Dimension Lumber And Cabinets/Furniture, Yet It Was Limited

Supply Which Drove Prices Up Further.

The rush to have lumber imports from Canada cross the border into US in

advance of the new, additional, duty, was enough to push demand higher than

existing supply. During this time of ongoing uncertainty, both with housing

construction and with trade barriers, customers continued to keep their

inventories are lean as possible.

As repeatedly warned by Madison’s over the past couple of years; this

practice of caution can become a problem if the bulk of customers book an

increase in orders at the same time. Since even wholesalers are not stocking

inventory, the rush to purchase goes to the sawmills which then can only

push prices higher.

While the new, additional, duty did play a role in this latest price

increase, it was the continued lack of supply in the field which caused this

latest rise.

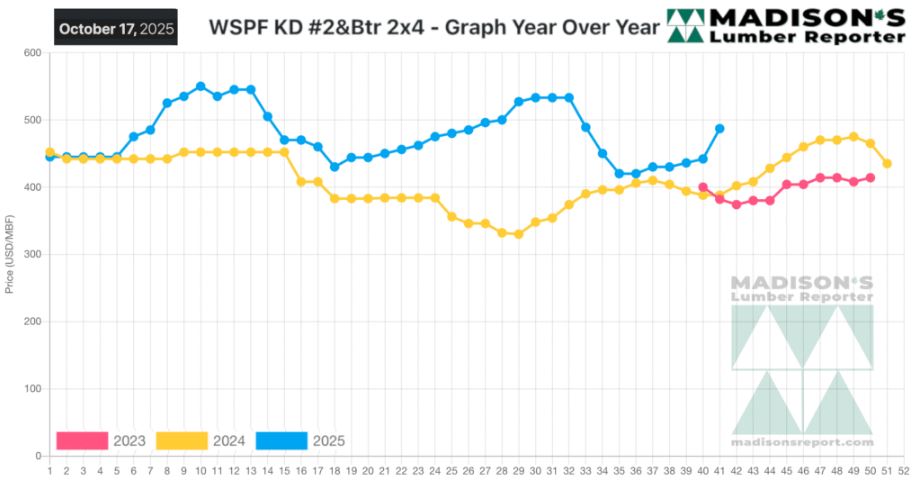

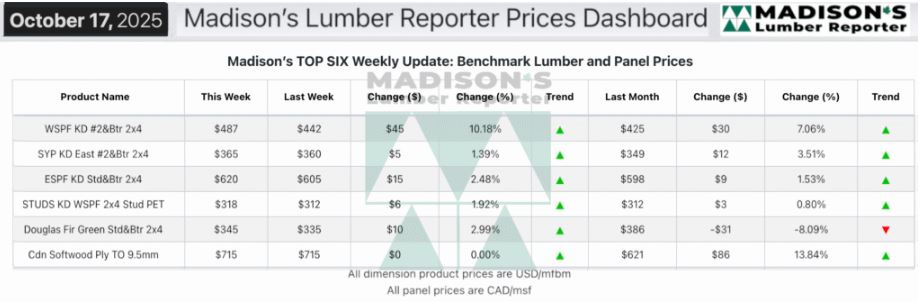

In the week ending October 17, 2025 the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$487 mfbm, which was up +$45, or +10%, from the

previous week when it was $442, said weekly forest products industry price

guide newsletter Madison’s Lumber Reporter.

That week’s price was up +$62, or +5%, from one month ago when it was $425.

Compared To The Same Week Last Year, When It Was Us$388 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending October 17,

2025 Was Up +$99, Or +26%.

Compared To Two Years Ago When It Was $382, That Week’S Price Was Up +$105,

Or +27%.

...

KEY TAKE-AWAYS:

Ongoing shift adjustments, curtailments, and even sawmill shutdowns for

Western-SPF producers in Canada reduced capacity across the lumber industry.

The Canadian Thanksgiving holiday Monday ensured that shunting more wood

across the border into stateside reloads before Tuesday was a difficult task

for US customers.

The need for more dimension lumber was apparent, even if US buyers were

hesitant to act so soon after the increase in cost was applied.

Eastern-SPF suppliers in Canada tried to get as much product across the

border as they could in a slim timeframe.

US buyers scoured the landscape for the best deals as demand was focussed on

finding lower priced items.

Prices varied widely between sources, with little to no consistency among

the mills leading to greater reliance on the distribution network.

Demand from US customers was expected to increase once they find their

post-tariff footing.

Southern Yellow Pine buyers remained keyed in on cash wood with quick

shipment, even as demand seemed better overall.

Most of the buildups that resulted in discounted material seen through

September were cleaned up, although certain producers showed accumulations

on their sales lists.

The all-important treater market, which consumes a substantial portion of

total SYP production, was busy buying and processing before colder weather

arrives.

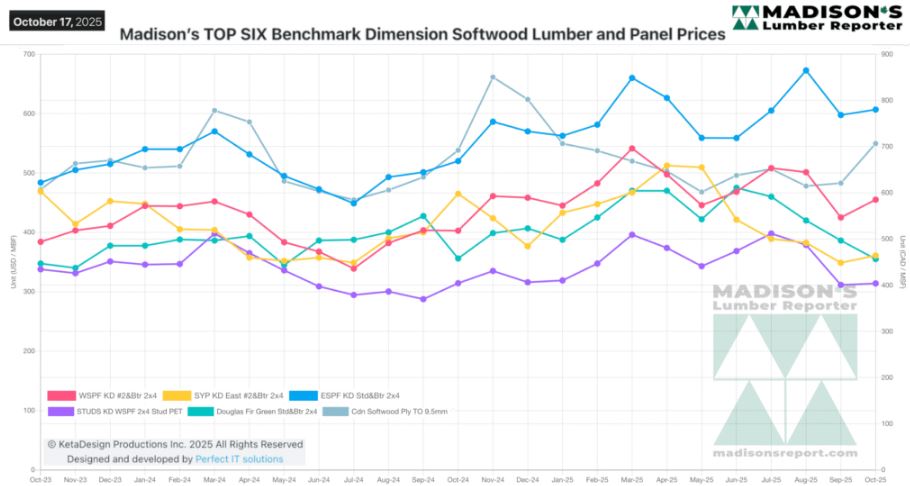

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: