In advance of yet another round of increased tariffs on Canadian softwood

lumber entering the US, prices rose slightly.

In view of ongoing lower production volumes thus lean supply, the race to

have wood shipped across the border in advance of this new charge was enough

to bring lumber prices higher.

Confusion reigned as the Customs information for these new tariffs was vague

at best.

Operators once again had to decipher which product groups specifically were

subject to the latest announcement; the list of specific HS Codes left room

for interpretation.

Indeed, Madison’s was alerted by a US Customs Broker that T&G (tongue &

groove) lumber was not on the list, meaning that if Canadian sawmills

edge-groove their lumber in the

production process that product is not subject to this new tariff.

Were the US Administration to later add that HS Code to the list, any tariff

can not be applied retroactively.

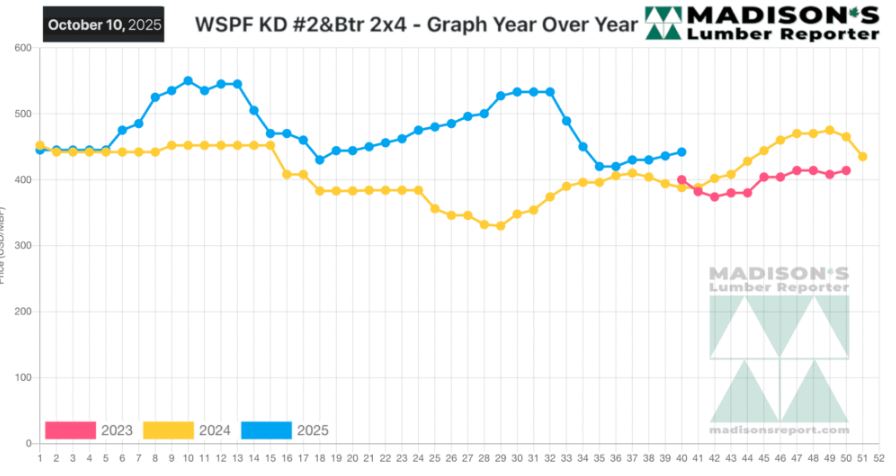

In the week ending October 10, 2025, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$442 mfbm. This was up

+$6, or +1%, from the previous week when it was $436, said weekly forest

products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price was up +$17, or +4%, from one month ago when it was $425.

Compared to the same week last year, when it was us$388 mfbm, the price of

western spruce-pine-fir 2×4 #2&btr kd (rl) for the week ending October 10,

2025 was up +$54, or +14%.

Compared to two years ago when it was $400, that week’s price was up +$42,

or +11%

...

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Plenty of Western-SPF sawmills in the US sold ahead of their current

positions, and extended order files into the back half of October.

Western-SPF producers in Canada booked improved sales and firmed up prices

on several key items.

Perception was that inventories throughout the supply chain were finally

topped up enough to elicit a digestion period.

Canadian sawmills got enough takeaway to extend their order files into late

October, and beyond in some cases.

Eastern-SPF sellers were busy as limited supply and elevated mill asking

prices spurred waves of purchases.

Secondary suppliers had some material remaining at below mill replacement

costs, for purchasers plugging holes in their waning inventories.

Discounted Southern Yellow Pine material dwindled thus commodity prices were

steady or up from the previous week.

Stocking wholesalers at the ports in New Jersey reported buyers were cagey

and noncommittal, demand was subdued, and autumn construction activity was

underwhelming.

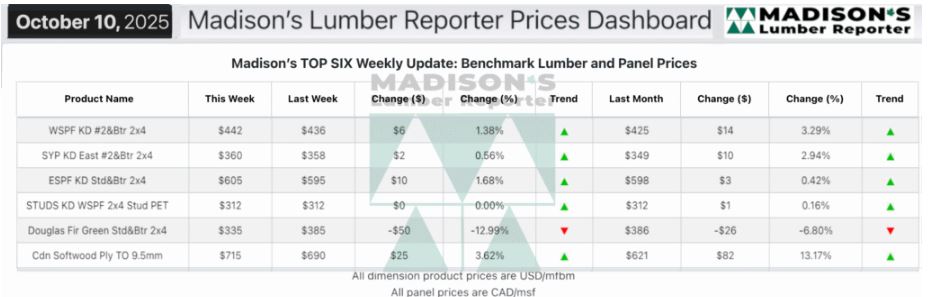

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: