Into Mid-September Many Of The Ongoing Questions Were Answered As North

America Construction Framing Dimension Softwood Lumber Prices Achieved A

Nice Stable Price Trend Over The Past Couple Of Years.

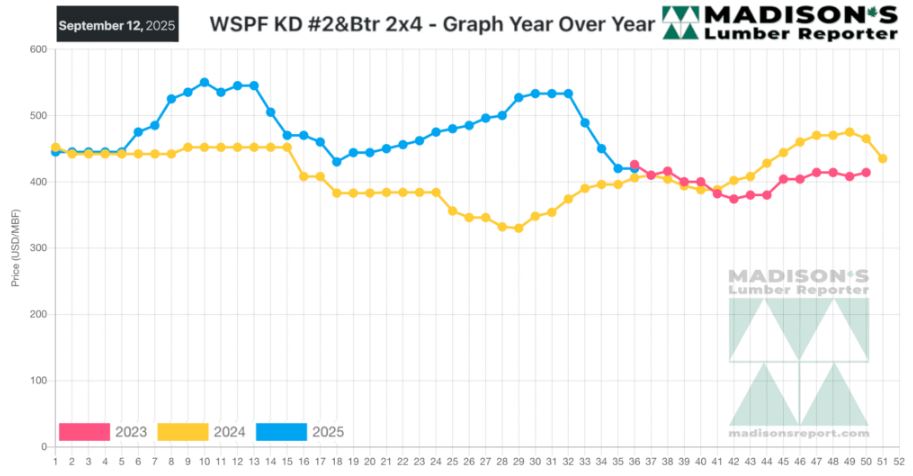

Since the great volatility and many big changes from 2020 to 2022, the

regularity of lumber price trend lines are now much more clear.

From September 2023 to current week, the price high of benchmark Western

S-P-F 2×4 was US$541 mfbm in March 2025, while the low was US$339 in July

2024. A $200 spread between high and low is a return to the historical

range, as it was in 2019 and prior.

Now we head into the traditionally slower time of year for lumber sales.

Unless something dramatic happens,

the next price increase cycle will be at the beginning of 2026.

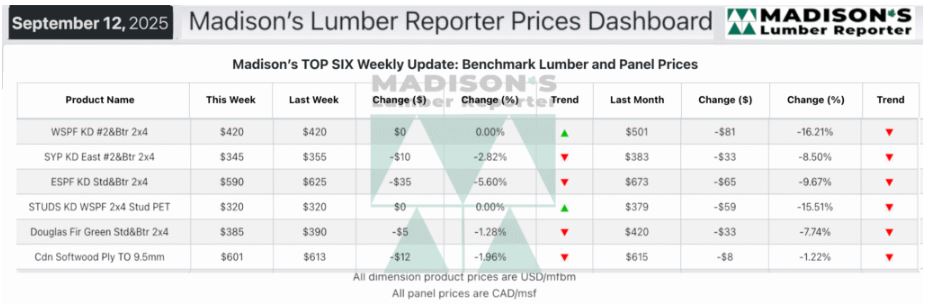

In the week ending September 12, 2025, the price of benchmark softwood

lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$420 mfbm. This

was flat from the previous week when it was $420, said weekly forest

products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price was down -$81, or -16%, from one month ago when it was

$501.

Compared To The Same Week Last Year, When It Was Us$406 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending September 12,

2025 Was Up +$14, Or +3%.

Compared To Two Years Ago When It Was $426, That Week’S Price Was Down -$6,

Or -1%..

..

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Western-SPF traders in the US described a value market, encouraged customers

to cover short-term needs while prices were down and negotiable.

In Canada, Western-SPF sellers reported a surge of inquiry and sales had

materialized.

Buyers agreed with recently lower prices thus bought in volume, so mills

were able to clean up their inventories.

Sawmills in the Pacific Northwest established order files in the two- to

three-week range.

Sales of Eastern-SPF to US buyers were fitful; mills were competitive on

some items while others were priced out by the added Duty cost.

In Southern Yellow Pine, commodity trading was uneventful as the market

remained in a confused state of price discovery.

There was plenty of SYP availabile among both primary and secondary

suppliers.

Stocking wholesalers on the US eastern seaboard had trouble moving product

with any semblance of consistency.

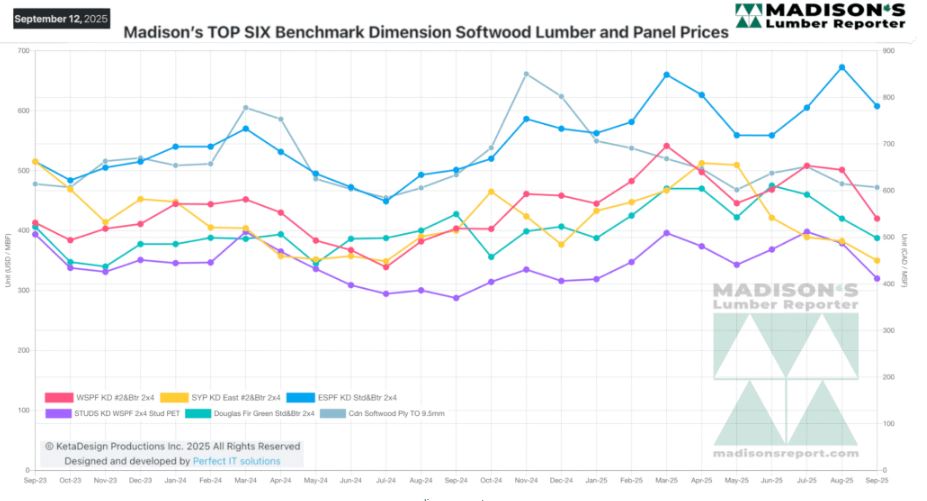

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: