As April waned and talk of potential tariffs on canadian lumber entering the

us faded, prices of north american construction framing dimension softwood

lumber settled down to proper levels given existing supply-demand

conditions.

As April waned and talk of potential tariffs on canadian lumber entering the

us faded, prices of north american construction framing dimension softwood

lumber settled down to proper levels given existing supply-demand

conditions.

The fact that demand remained quite soft, particularly for the time of year

when new home building normally would be increasing, was lost on no one. The

recent shift in buying by US customer interest toward Southern Yellow Pine

and away from Spruce-Pine-Fir had topped out, with prices responding out of

correction mode.

There remained more questions than answers; specifically regarding

macro-economic conditions and the ongoing muted housing starts.

While some uncertainty was resolved, expectations for coming spring building

season remained unclear.

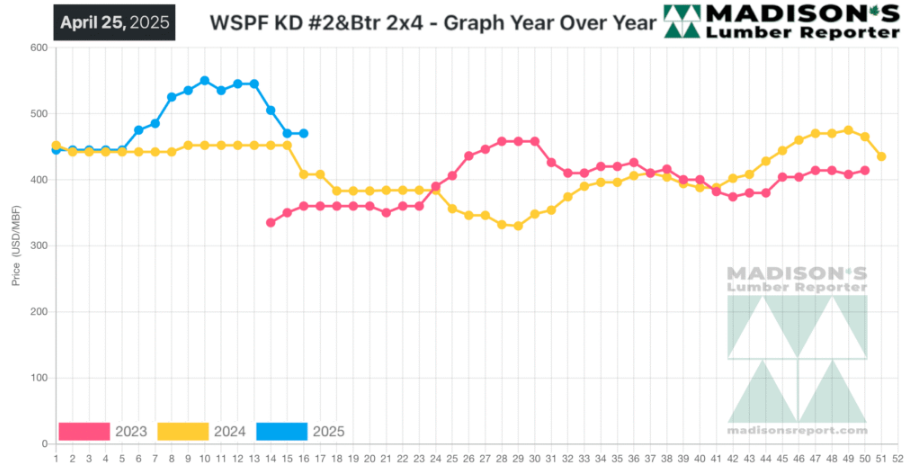

In the week ending April 25, 2025 the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$470 mfbm, which is flat from the previous week when it

was $470, said weekly forest products industry price guide newsletter

Madison’s Lumber Reporter.

That week’s price is down -$71, or -13%, from one month ago when it was

$541.

Compared To The Same Week Last Year, When It Was Us$408 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending April 25,

2025 Was Up +$62, Or +15%.

Compared To Two Years Ago When It Was $360, That Week’S Price Was Up +$110,

Or +31%.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

The lumber market was characterized by low-key but stable trading.

Commodity prices varied significantly between primary and secondary

suppliers, further ensconcing buyers on the sidelines.

More consistent trading ranges were hammered out; buyers and sellers worked

together to get deals done.

Takeaway remained subpar, thus Canadian Western S-P-F sawmills continued to

quietly accumulate material.

Already-reticent buyers held off making purchases in hopes of further price

corrections.

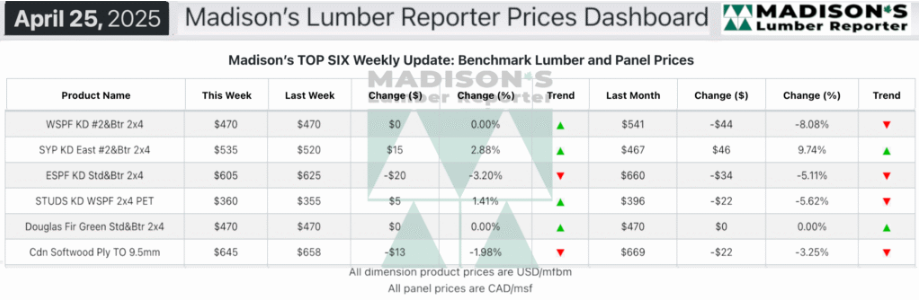

Substantial demand for Eastern S-P-F was reported.

Demand for Southern Yellow Pine continued to outperform that of the rest of

the North American lumber market.

Among the busiest buyers of SYP were treaters, who make up a large portion

of the market base and played a large role in keeping prices elevated.

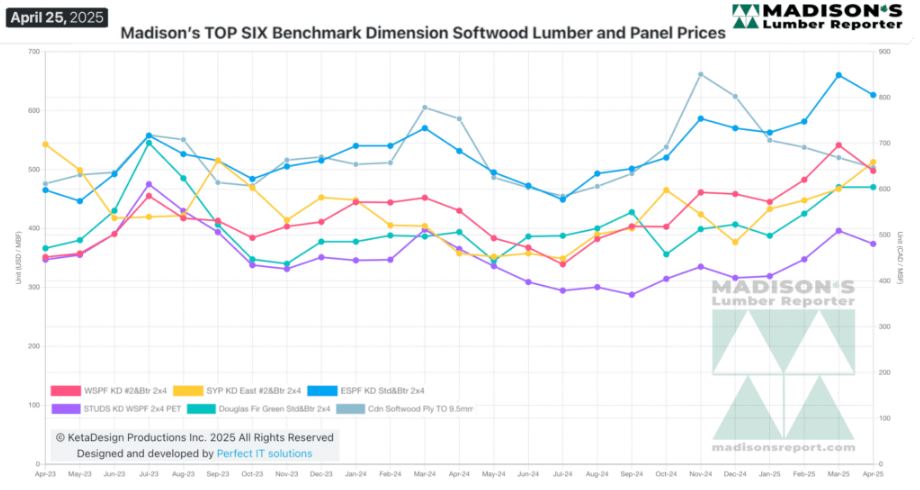

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: