The Beginning Of April Passed With The Agonizing Confusion About Potential

Trade Disruptions Resolved; Lumber And Forest Products Were Not Included In

The Latest Us Tariffs.

Industry and traders breathed a sigh of relief even while the unknowns

continued to unfold. Buyers and sellers alike worked to find where the true

market value of solid wood commodities will land. Other uncertainties

remain; specifically US home building activity for this spring, and interest

rates.

As such, the caution exhibited by customers for the past almost two years

remained. While retailers did step back in to make significant purchases,

reloads and wholesalers kept on with their practice of only buying what they

needed.

As yet no one is stocking inventory.

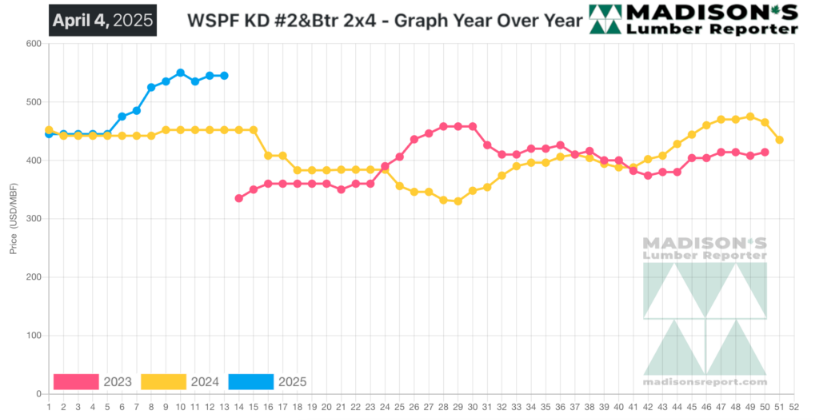

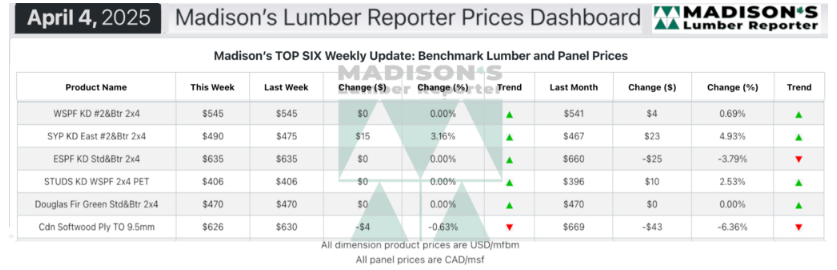

In the week ending April 4, 2025, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$545 mfbm. This is

flat from the previous week when it was $545, said weekly forest products

industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$4, or +1%, from one month ago when it was $541.

Compared To The Same Week Last Year, When It Was Us$452 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending April 4, 2025

Was Up +$93, Or +21%.

Compared To Two Years Ago When It Was $380, That Week’S Price Was Up +$165,

Or +43%.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Suppliers were encouraged by the news of no tariffs for Canadian lumber, but

had to wait for surging inquiry to turn into actual sales.

Follow-through remained pokey as buyers were leery of potential future trade

disruptions after months of mixed messaging from the US.

Inventory holders were increasingly relegated to supply management while

uncertainty continued to paralyze the market.

Stateside suppliers shuffled around volumes amid awakening spring demand.

Freak, early-spring, ice storms in Ontario and Quebec brought a halt to

trading activity in those areas.

Most Southern Yellow Pine players worked to keep their inventory positions

lean.

Demand in the US Northeast remained subpar for the time of year according to

Eastern stocking wholesalers

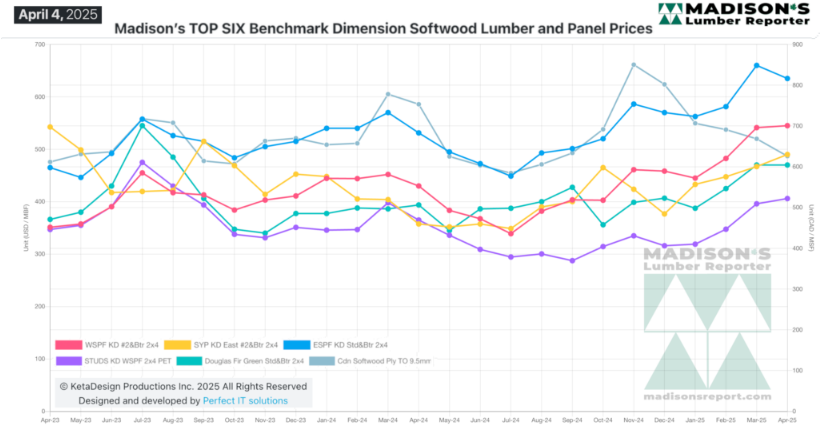

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: