Even As True Spring Arrived Across The Continent, Lumber Sales Remained Slow

For The Time Of Year As Confusion On Trade Issues Remained.

Prices on some lumber commodities softened slightly. Strategies varied among

players; with some having already ordered wood for immediate needs to cross

the border before the beginning of April, and others holding off buying

completely until there was clarity about tariffs. Better weather brought

construction projects to life, especially in the densely-populated US

eastern seaboard.

Some severe storm activity in the south-central US over the weekend caused

significant damage to property and structures. The scale of rebuilding is

not yet known, however at a minimum there will be a large number of homes

which

need new roofs. This reconstruction activity will coincide with the usual

increase in new home building during spring.

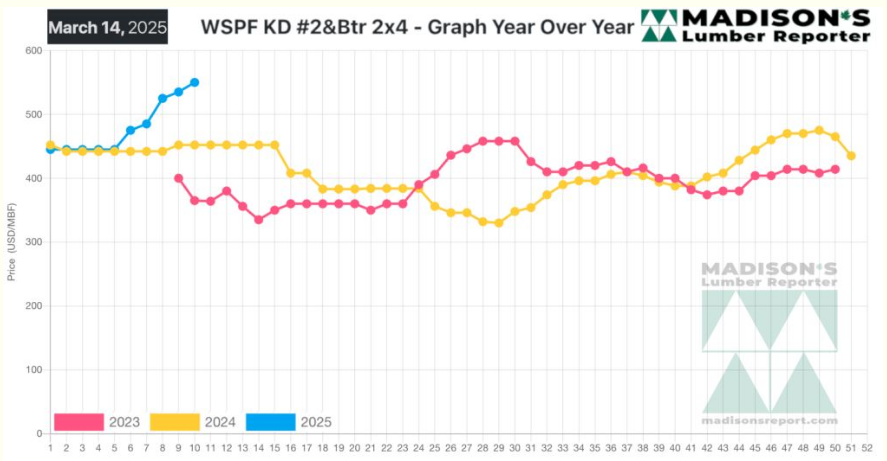

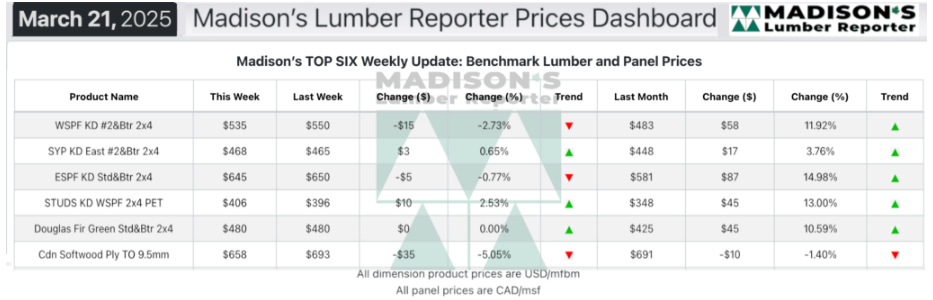

In the week ending March 21, 2025, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$535 mfbm.

This is down -$15, or -3%, from the previous week when it was $550, said

weekly forest products industry price guide newsletter Madison’s Lumber

Reporter.

That week’s price is up by +$53, or +11%, from one month ago when it was

$483.

Compared To The Same Week Last Year, When It Was Us$452 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending March 21,

2025 Was Up +$83, Or +18%.

Compared To Two Years Ago When It Was $364, That Week’S Price Was Up +$171,

Or +47%.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Western S-P-F price levels in the US varied considerably depending on the

source and destination.

In Canada some downward pressure might be building in Western S-P-F standard

and high grades.

Players adopted cautious strategies after covering their near-term spring

needs.

In the east a prominent throughline was the concerning lack of overall

supply.

Canadian Eastern S-P-F sawmills showed thin offer lists.

Demand for Southern Yellow Pine commodities was stable, indeed trending to

the positive.

Sawmill order files in the US south were at approximately two weeks.

Overall, players didn’t see price downside coming, since overall supply was

limited and field inventories were nearly bare.

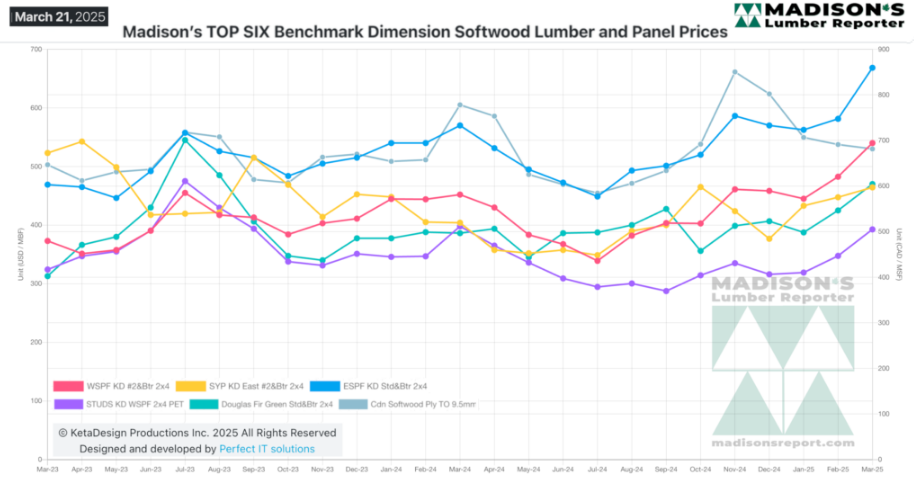

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: