March Arrived With Still More Questions Than Answers For The North American

Construction Framing Softwood Lumber Market.

Even as spring thaw brought an increase in lumber buying, the ongoing amount

— and severity — of unknowns continued to plague industry.

Sawmills and home builders alike were very unclear about the potential for

another round of punishing tariffs.

As such, responses varied according to individual choices of players; some

bought wood for expected delivery before the next tariff threat at the

beginning of April, while others held off to see what would unfold at that

time. Despite all this, the

usual seasonal price increases came on, as reflection of growing demand

ahead of spring construction activity.

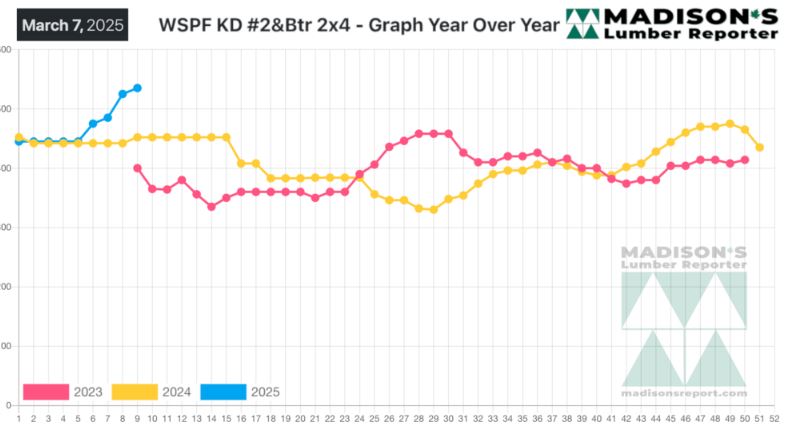

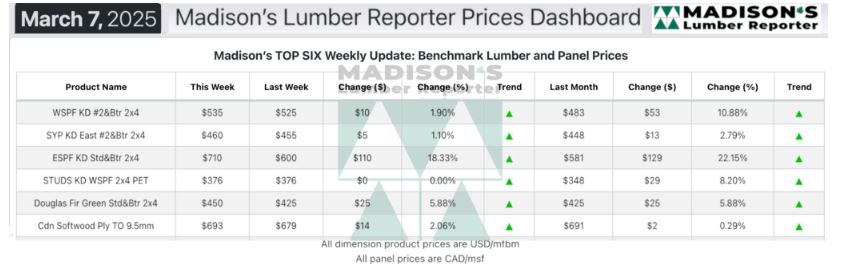

In the week ending March 07, 2025, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$535 mfbm. This is up

by +$10, or +2%, from the previous week when it was $525, said weekly forest

products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$53, or 1%, from one month ago when it was $483.

Compared To The Same Week Last Year, When It Was Us$442 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending March 07,

2025 Was Up +$93, Or +19%.

Compared To Two Years Ago When It Was $400, That Week’S Price Was Up +$135,

Or +34%.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

The lumber market was roiled by this on-off tariffs all week; lumber futures

seesawed wildly, while WSPF commodity prices varied significantly and

frequently.

Sawmill asking prices were resoundingly up, with some producers apparently

off the market as of midweek.

Western Canadian suppliers were beyond frustrated, with price lists flying

hither and thither and no real solid basis to numbers.

Eastern Canadian purveyors of lumber and studs were exhausted with the

on-again, off-again tariff yo-yo.

The cash market in the US was busy amid limited availability and rising

prices; several suppliers were impressed by the amount of customers who

ordered at higher numbers.

Spruce buyers in the US continued to shift to Southern Yellow Pine.

In the US Northeast the up-and-down nature of trade disputes in North

America kept business to a dull roar.

Construction activity was lumbering to life in the tri-state area; for

builders spring inventory needs were a burning question.

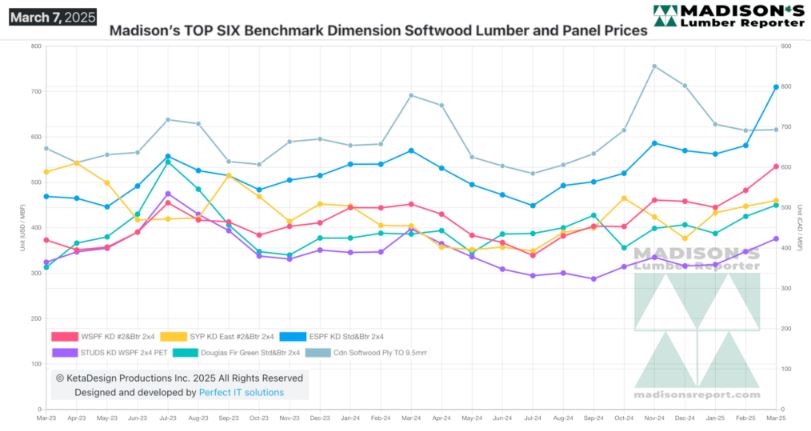

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: