February Drew To A Close And Across The Continent Weather Conditions

Improved So The Usual Buying Of Lumber In Advance Of Approaching Spring

Building Season Got Going.

As such, lumber prices also increased. The ongoing situation of depleted

inventories and cautious purchasers made the reality of limited supply even

more stark. Customers had to hunt around at sawmills and wholesalers to find

the exact tallies of wood they needed.

Confusion continued to reign regarding potential / actual tariffs, and what

that meant for Canadian wood crossing the border into the US. The added —

and unnecessary — constraints caused by politics, rather than business

conditions, did nothing to improve already difficult circumstances for the

building materials industry.

Players complained about spending so much time navigating the daily changing

landscape with lumber trade, instead of just getting on with regular

operating.

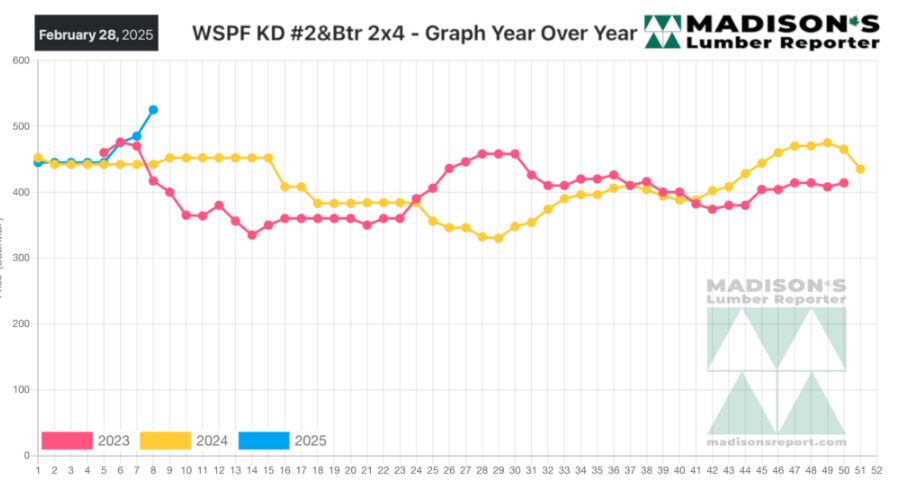

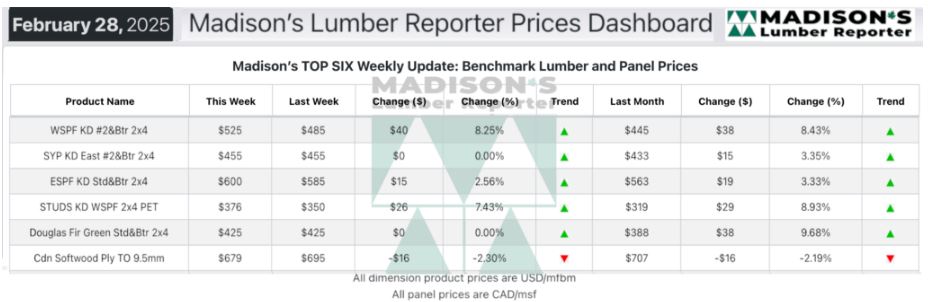

In the week ending February 28, 2025 the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$525 mfbm, which is up +$40, or +8%, from the

previous week when it was $485, said weekly forest products industry price

guide newsletter Madison’s Lumber Reporter.

That week’s price is up +$80, or +18%, from one month ago when it was $445.

Compared to the same week last year, when it was us$442 mfbm, the price of

western spruce-pine-fir 2×4 #2&btr kd (rl) for the week ending February 28,

2025 was up +$83, or +19%.

Compared to two years ago when it was $417, that week’s price was up +$108,

or +96%.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Buyers in the US increasingly turned to stateside producers; the wood cost

more but brought guaranteed shipment.

With spring construction on the horizon, purchasers on both sides of the

border lamented slim inventories and a tariff deadline.

There was a persistent worry that limited overall supply won’t be enough to

cover spring needs.

Canadian sawmills saw decreasing US inquiry as the early-March tariff

deadline approached.

Demand was further disrupted by frigid winter weather across much of Eastern

Canada and the Northeastern United States.

Traders in the Eastern United States anticipated a lack of prompt Euro wood

in early March due to logistical delays.

Southern Yellow Pine sawmills varied considerably by region; some held firm

on asking prices while others were more open to counter-offers.

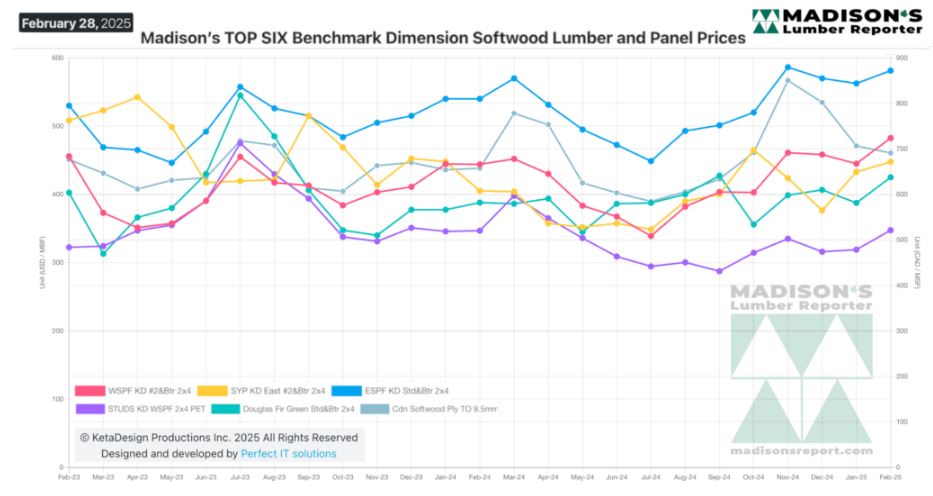

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: