Cold weather, looming tariffs, and holiday Mondays on both sides of the

border kept the North American lumber market quiet.

The market has been muted as home buyers held off until interest rates

stopped going up. So while the traditional annual seasonal change of prices

up and down by US$150 mfbm has returned, the manufacturing volumes have been

lower than optimal.

In response to the muted demand, sawmills across the US, and especially in

Canada, took significant amounts of production offline to prevent the price

from falling too low. The tactic since mid-2023 was to keep supply in line

with demand. This year, the harsh winter weather did nothing to boost

construction activity.

As spring weather approaches, North American lumber manufacturers are ready

to increase manufacturing to meet jump in demand.

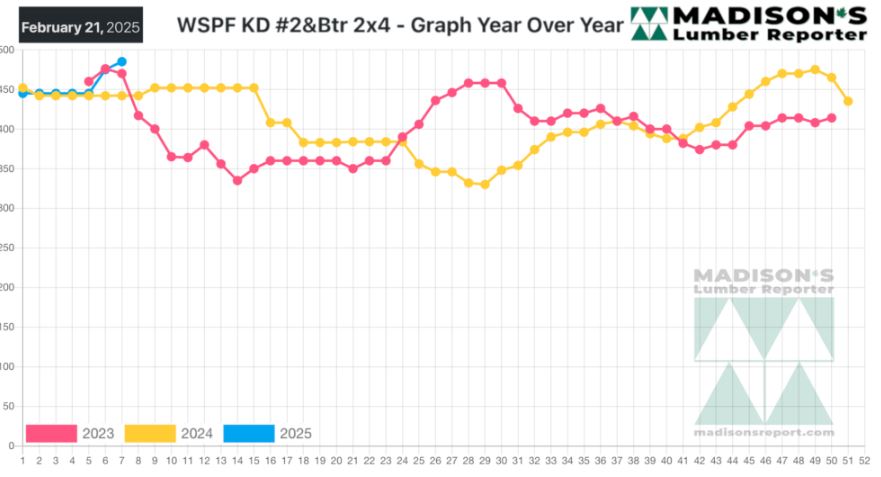

In the week ending February 21, 2025, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$485 mfbm. This is up

by +$10, or +2%, from the previous week when it was $475, said weekly forest

products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$40, or +9%, from one month ago when it was

$445.

Compared to the same week last year, when it was us$442 mfbm, the price of

western spruce-pine-fir 2×4 #2&btr kd (rl) for the week ending February 14,

2025 was up +$33, or +7%.

Compared to two years ago when it was $476, that week’s price was down -$1,

or 0%.

KEY TAKE-AWAYS:

Overall supply of Western S-P-F lumber and studs remained limited, thus

prices showed firm or upward trends.

Winter weather slowed down production and transportation, which helped delay

a sense of urgency for many buyers.

Frustrating freeze-thaw cycles in Interior British Columbia caused myriad

troubles for sawmills.

Suppliers in the East struggled to dig out rail spurs and keep their yards

clear.

Buyers were waking up to their thin inventory positions and the need to

secure spring building materials supply.

Canadian Eastern S-P-F sawmills showed increasingly slim offer lists, and

started quoting March wood to US customers.

Southern Yellow Pine sawmill order files stretching into the two- to

three-week range.

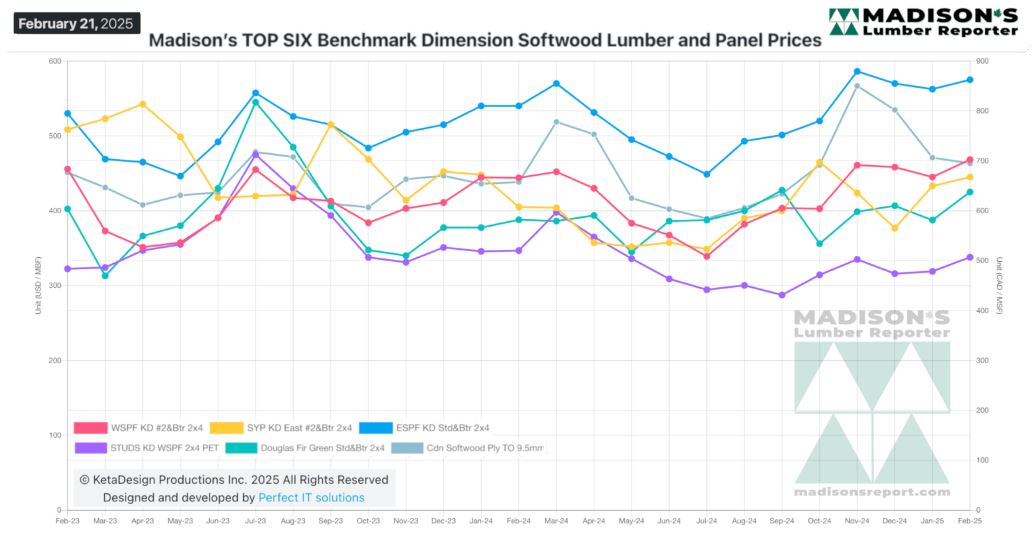

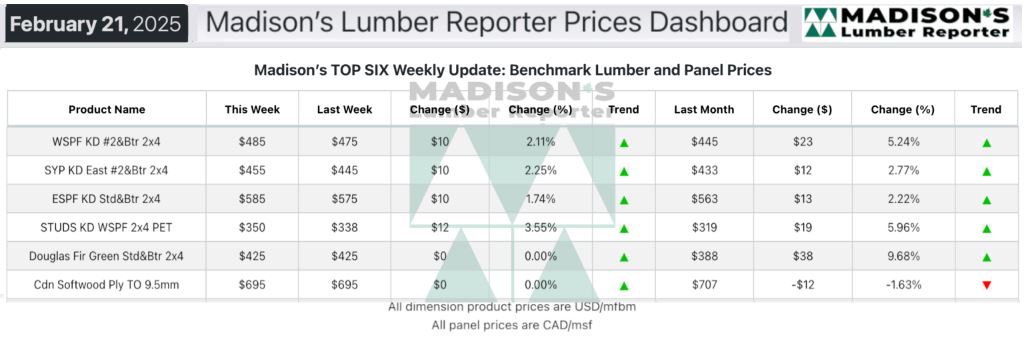

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: