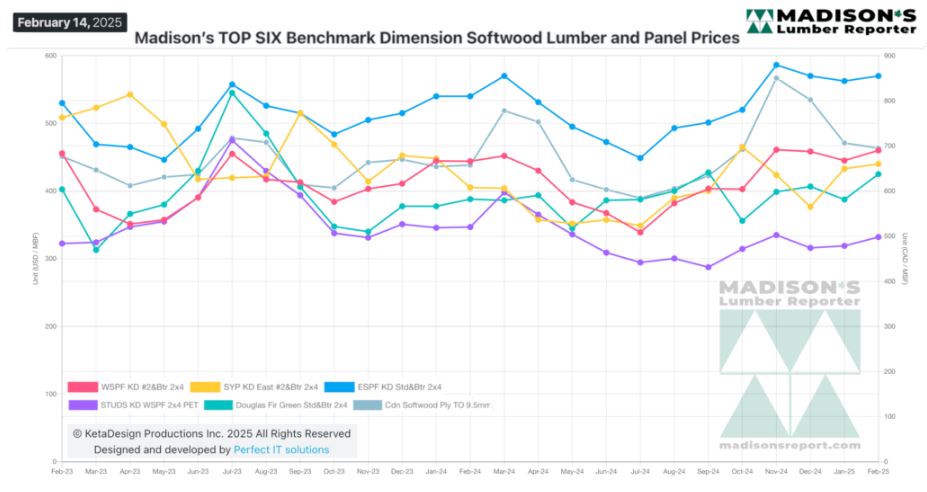

While Benchmark Softwood Lumber 2×4 Prices Popped Up In Mid-February, The

Price Trend Line For The Past Two Years Has Been Very Stable.

Following the extreme volatility of 2020-2022, this return to a normal

seasonal price changes annually up and down by approximately US$150 mfbm was

most welcome by producers and customers alike. The most important thing to

note is that manufacturing volumes remain low compared to optimal.

For the past almost two years, as mortgage lending interest rates were going

up, the demand for new housing starts was low. Now that interest rates will

remain stable — in the US — and are turning down in Canada, home buyer

appetite is returning to the real estate market. There is a significant

amount of sawmill production in the US and especially in Canada which is

available to come back online.

Expectations are that first the mills will ramp up manufacturing volumes and

only after that increase can be sustained consistently would lumber prices

increase beyond what it had been for the past two years.

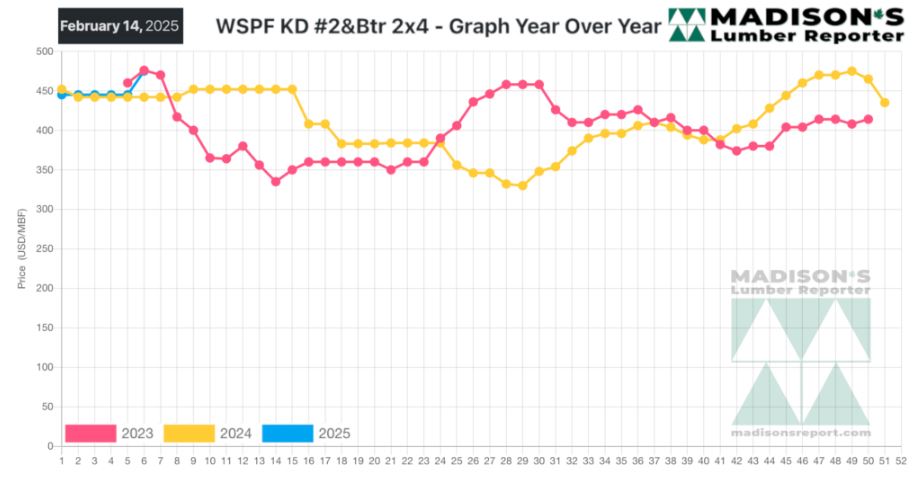

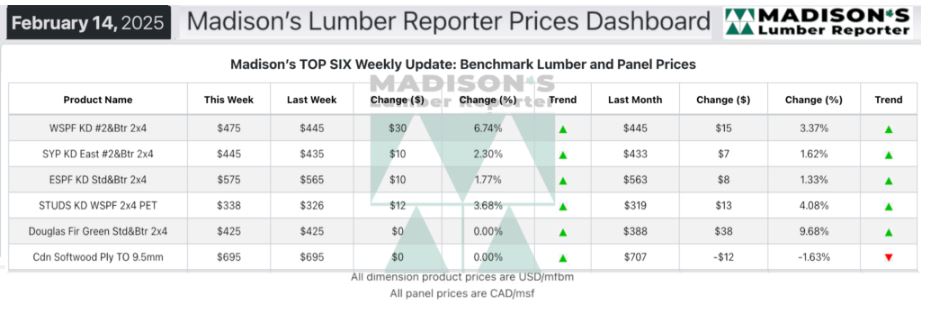

In the week ending February 14, 2025, the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$475 mfbm, which is up +$30, or +7%, from the

previous week when it was $445, said weekly forest products industry price

guide newsletter Madison’s Lumber Reporter.

That week’s price is up +$30, or +7%, from one month ago when it was

$445.

Compared To The Same Week Last Year, When It Was Us$442 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending February 14,

2025 Was Up +$33, Or +7%.

Compared To Two Years Ago When It Was $476, That Week’S Price Was Down -$1,

Or 0%..

KEY TAKE-AWAYS:

Softwood lumber buyers further ensconced on the sidelines to digest inbound

shipments and assess their inventory positions.

Producers continued to show limited supply of most items on their lists.

Discounted material was less abundant as sawmills cleaned up any serious

inventory accumulations.

Severe winter weather across the continent ground rail cars and trucks to a

halt in many regions.

Following a surge of good Southern Yellow Pine sales volumes, suppliers were

disappointed in the lack of follow through as mid-February approached.

In the Douglas fir species ground, the all-important California consumption

regions appeared to be actively inquiring.

Eastern stocking wholesalers at the ports in New Jersey reported that many

Canadian sawmills had gone off the market.

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: