As January drew to a close most benchmark softwood lumber commodity prices

continued flat, staying on-trend to the waning weeks of 2024.

Conversations circled around the repeated threats of tariffs. Some operators

chose to veer on the side of caution, making plans only one-week out. While

others maintained their usual habit of buying, or selling, up to three weeks

into the future. Harsh weather across large parts of the continent continued

to keep construction projects slow, as well as causing transportation

delays. Industry players were happy to see a stability of price trend

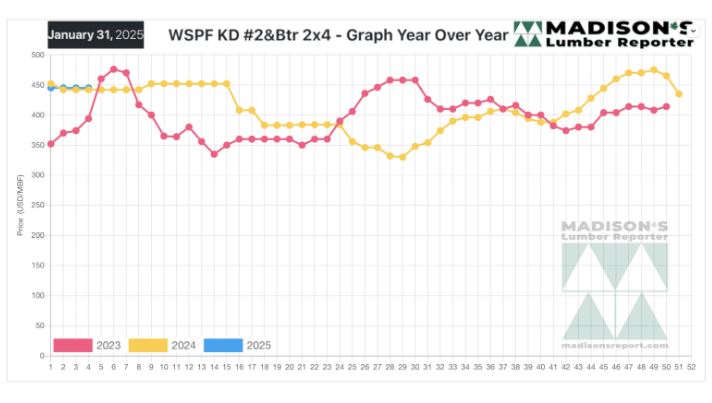

materializing, as the graphs on this page indicate; 2025 started out at

almost the exact same level as 2024.

This makes it much easier for companies to plan their coming spring buying

and selling activity than it was during the extreme volatility of 2020 to

2022.

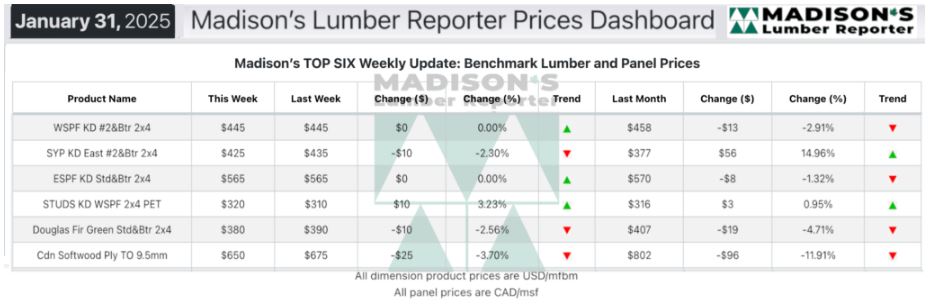

In the week ending January 31, 2025, the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$445 mfbm, which is flat from the previous week,

said weekly forest products industry price guide newsletter Madison’s Lumber

Reporter.

That week’s price is down -$13, or -3%, from one month ago when it was $458.

Compared to the same week last year, when it was US$442 mfbm, that week’s

price was up +$3, or +1%. Compared to two years ago when it was $394, that

week’s price was up +$51, or +13%.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Despite ongoing mentions of tariffs, a growing subset of Western S-P-F

purveyors in the United States returned to business-as-usual.

US producers maintained lead times in the range of one- to three-weeks,

while their counterparts north of the border kept to a one-week-at-a-time

approach.

Both primary and secondary suppliers in Canada were more open to

counteroffers, indicating weakening demand.

Eastern Canadian sawmills kept Eastern S-P-F offerings to a minimum in view

of potential tariffs.

Stateside reloads remained comparatively busy, with plenty of inbound

Canadian material heading into their tariff-protected yards.

Sawmills across all Southern Yellow Pine zones showed buildups of

bread-and-butter items amid weak seasonal demand and scattered availability.

Oriented Strand Board prices started to tick up while that of plywood

continued to soften.

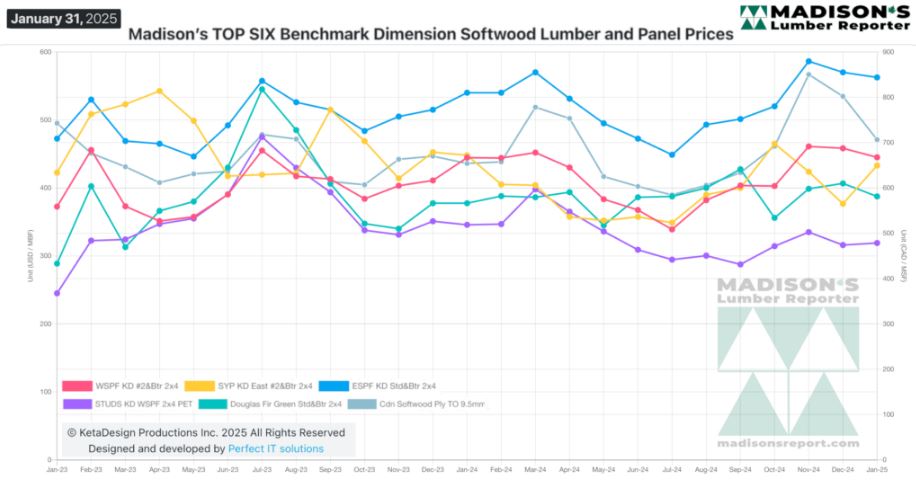

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Source:

madisonsreport.com

More Reports: