January 2025 Marched On To Demonstrate A Good Stability Of Lumber Prices,

Even As Possible Looming Trade Barriers Were Discussed By Politicians.

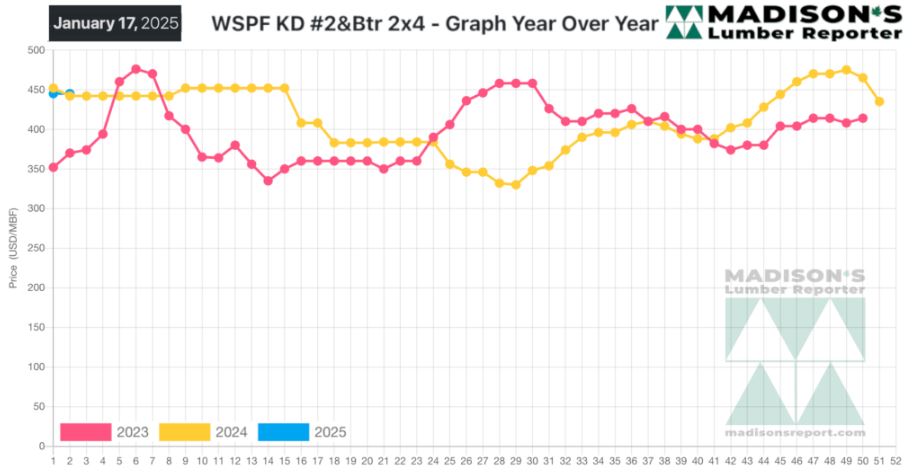

The generally even-keel of most construction framing dimension softwood

lumber prices across North America that was established at the end of last

year continued into this year. Indeed, the annual seasonal price changes, of

approximately $150 per mfbm throughout the year, returned in both 2024 and

2023. Players were very thankful to be able to once again see

previously-normal price swings so they could make their future business

plans in a similar way to how it was done prior to the extreme price spikes

of 2020 to 2022.

Expectations, meanwhile, for new home building this year are bullish; the

latest data for US housing starts shows a

significant spike for December and solid growth last year compared to 2023.

Historically the biggest home builders in the US start making their

large-volume purchases in February, so the level of demand in the next few

weeks will reveal a lot about construction activity in the spring.

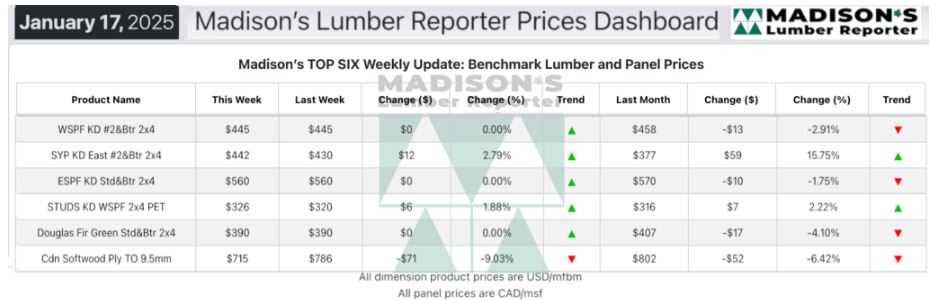

In the week ending January 17, 2025, the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$445 mfbm, which is flat from the previous week.

That week’s price is down -$13, or -3%, from one month ago when it was $458.

KEY TAKE-AWAYS:

Customers navigated a confusing landscape with widely varying prices between

large and small producers, and between primary and secondary suppliers.

Commodity prices hovered around the previous week’s levels, adding to

buyers’ sense of uncertainty.

Most Eastern Canadian sawmills secured enough business to see them past

January 20th.

Secondary ESPF suppliers and distributors with stateside inventories

reported a steady flow of volumes in and out of their yards.

The profile of Southern Yellow Pine increased noticeably over recent weeks

as buyers in the United States expanded their search to include species that

won’t be impacted by the proposed tariffs.

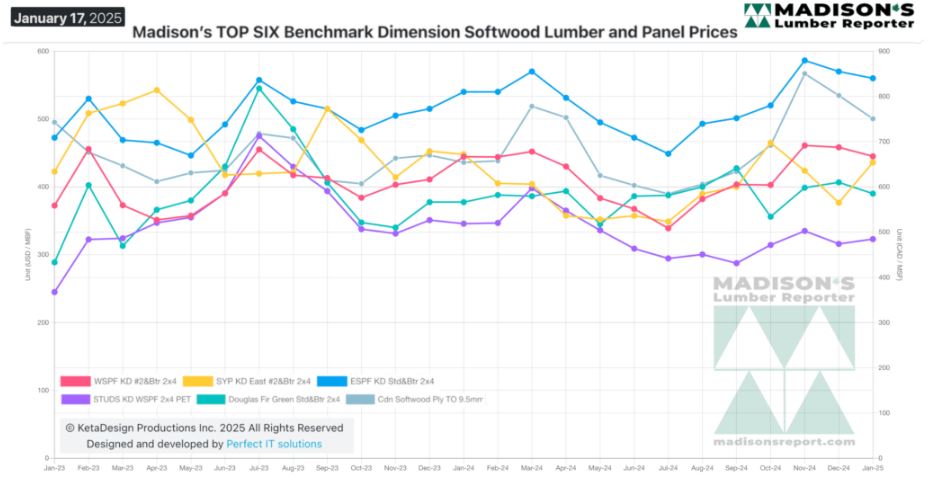

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

More Reports: