As The New Year 2025 Dawned, Lumber Prices Achieved A Good Stability.

Price levels on most construction framing softwood lumber commodities were

quite even compared to the same time in 2024, providing industry players

some clarity to be able to plan for the coming home building season.

Meanwhile, dramatic events unfolded across North America; with severe bad

weather in some locations, horrifying fires in the Los Angeles area, and

many questions about trade barriers between Canada and the US. At the same

time, the Canadian dollar dropped quite a bit lower than it had been in

recent years. Exchange rate is a significant variable for Canadian

producers, as all dimension lumber sales by sawmills or stocking wholesalers

are in US dollars.

In that regard are interest rates also important, as this impacts home sales

which drives housing construction therefore lumber sales and prices.

Indications are from US and Canadian lenders that current interest rates are

expected to hold for the rest of this year.

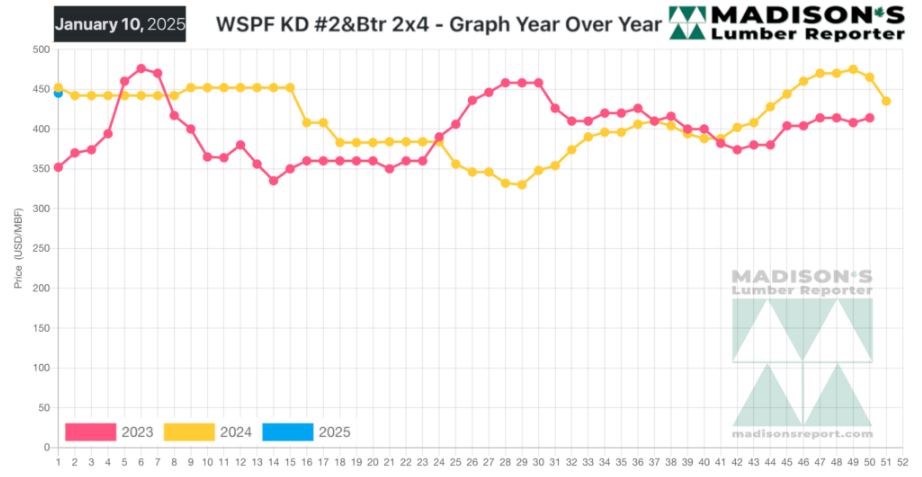

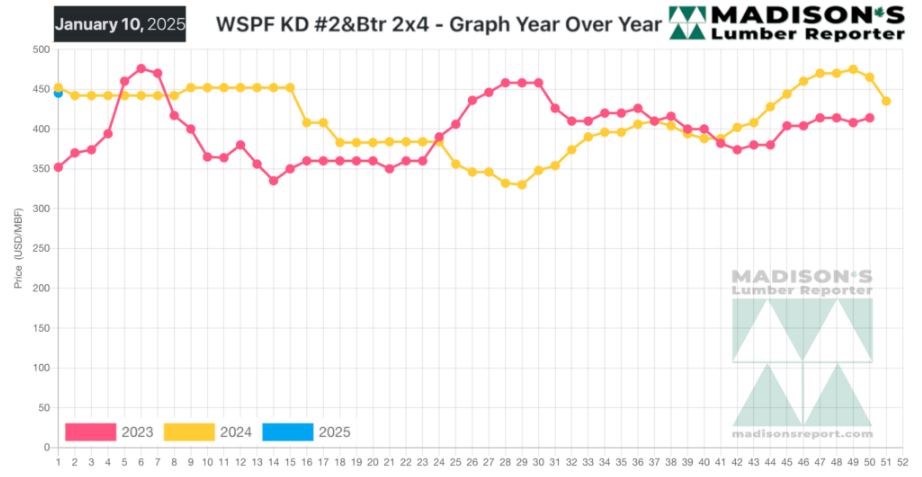

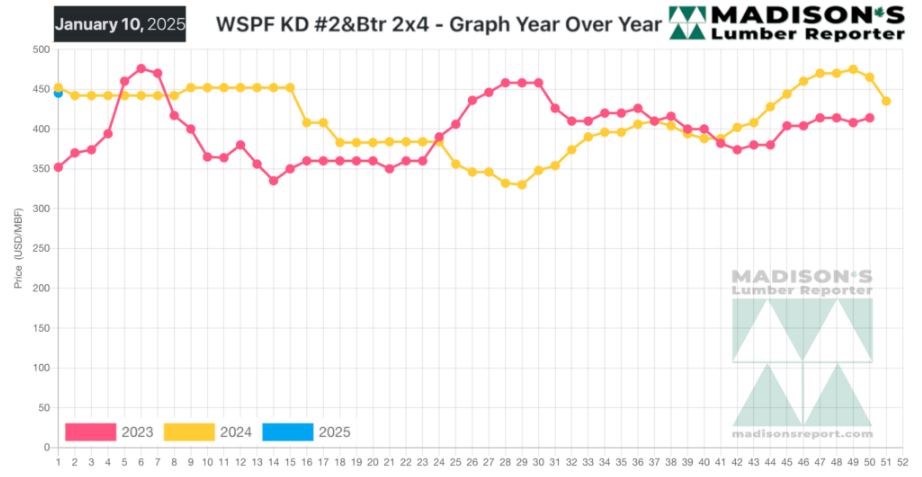

In the week ending January 10, 2025, the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$445 mfbm, which is up +$10, or +2%, from the

previous week when it was $435.

That week’s price is down -$13, or -3%, from one month ago when it was $458.

KEY TAKE-AWAYS:

In the West at the beginning of the New Year, asking prices largely similar

to sawmill lists in December 2024.

Sawmill order files into the week of January 20th.

The Canadian dollar had tumbled several percentage points versus the US.

In the East, producers were ready to haggle with buyers who offered

reasonable counter-offers.

In the South, sawmills boosted their asking prices over the break as holiday

curtailments and planned maintenance helped to balance out supply & demand.

Southern Yellow Pine sawmill order files were in the one-week range.

Studs producers were content with three- to four-week order files.

In panel, both Oriented Strand Board and Plywood prices weakened noticeably

over the Holiday break.

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

More Reports: