As Expected, The Week Following The Big Us Thanksgiving Break Brought A Drop

In Sales Of Lumber Across North America.

The usual seasonal slow-down arrived, as both suppliers and customers looked

forward to the annual Holiday closures. While 2024 was not exactly a year of

robust lumber sales, at least the price trendlines returned to some normalcy

in comparison to historical. Players felt confident about making New Year

plans.

The now regular practice of sawmills to curtail when demand was low; with

the goal of keeping manufacturing volumes in line with slumping sales, was

successful in at least preventing prices from dropping below

cost-of-production. While still muted,the expectation for lumber sales in

2025 is for improvement over the past two years.

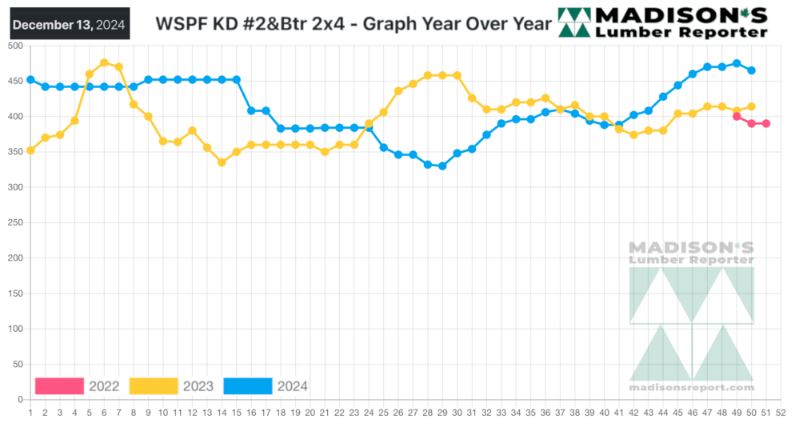

In the week ending December 6, 2024, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$475 mfbm. This is up

+$5, or +1%, from the previous week when it was $470, said weekly forest

products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up +$14, or +3%, from one month ago when it was $461.

KEY TAKE-AWAYS:

KEY TAKE-AWAYS:

Post-US Thanksgiving inquiry took a noticeable dip.

Vast swathes of the North American construction industry began their

seasonally-typical slowdowns.

Buyers were phoning around to distributers and wholesalers for coverage of

small-volume fill-in needs.

Savvy players warned of considerable volatility in the New Year as the

market appeared to be more oversold than overbought.

Most sales occurred at the distribution level as buyers focussed on

quicker-shipping orders with more tally-flexibility.

For buyers, short-term replenishment was the name of the game.

Delivery times were unfortunately more troublesome as winter weather set in.

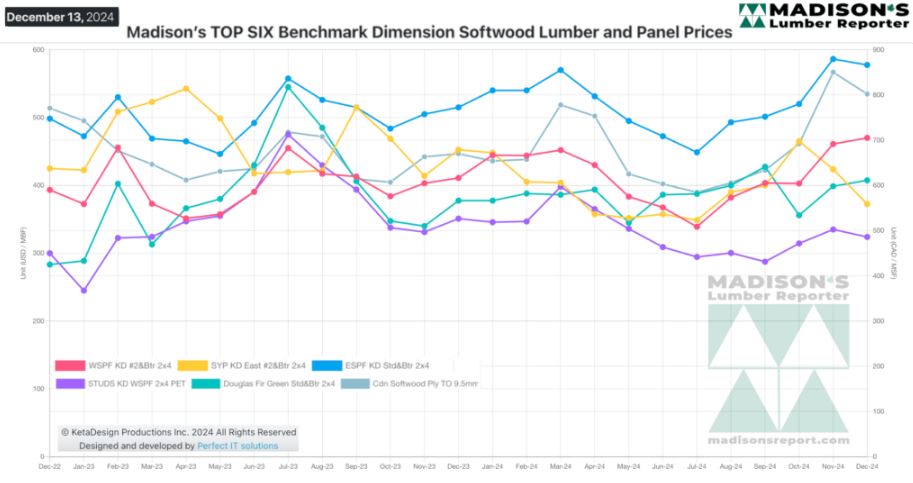

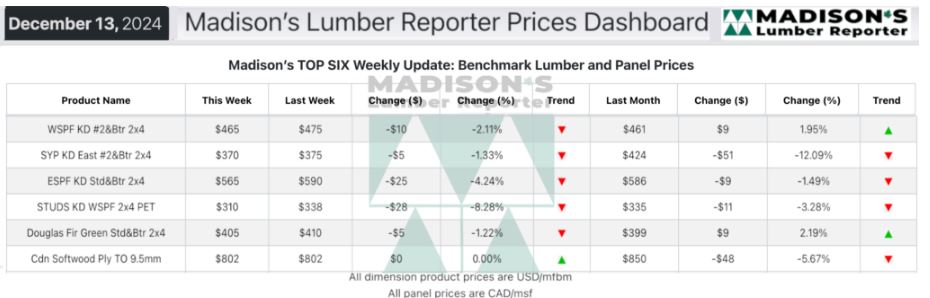

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

More Reports: