With the Thanksgiving holiday over, the North American solid wood commodity

market experiences a slowdown. SPF and half/fir prices are firm and supplies

are limited, while SYP continues to decline.

Sawmills were prepared for this usual annual occurrence, so covered most of

the demand during the start of the week. As industry starts winding down to

year-end, the strategy is to manufacture only enough lumber to serve demand

until the seasonal Holiday shutdowns.

Lumber suppliers do not want to be carrying over wood inventory to the New

Year.

The supply-demand balance seems well positioned to accomplish this, as

sawmills have two to three weeks of production booked and customers are

ordering just the fill-in material they need to finish their ongoing

construction projects.

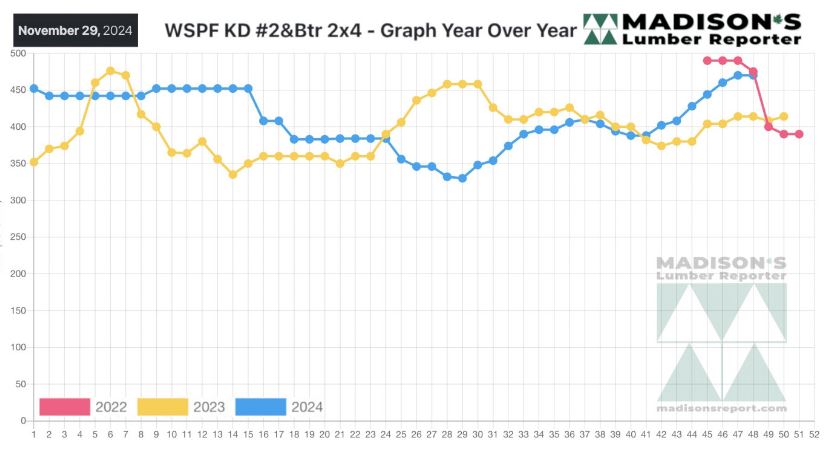

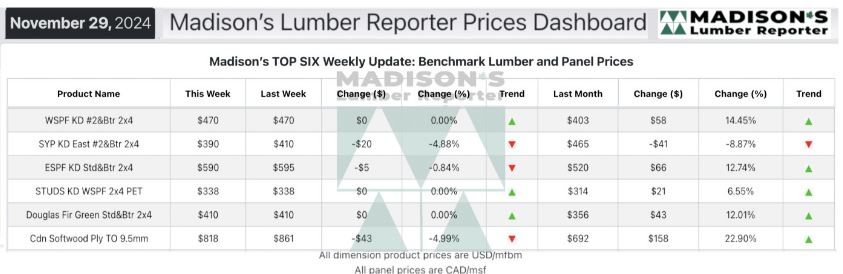

In the week ending November 29, 2024, the price of Western Spruce-Pine-Fir

(SPF) 2x4 #2&Btr KD (RL) remains steady at $470 per mfbm. This marks a $67

increase (+17%) from $403 one month earlier. Compared to the same week in

2023, when the price was $414 per mfbm, it is up $56 (+14%). However, it is

$5 lower (-1%) than the $475 price recorded two years ago.

Southern Yellow Pine (SYP) East Side 2x4 #2&Btr KD (RL) prices decline to

$390 per mfbm, a $20 drop (-5%) from the previous week’s $410. This price

reflects a $75 decrease (-16%) from $465 one month ago and is $40 lower

(-9%) than the $430 recorded during the same week in 2023. Compared to two

years ago, when it stood at $455 per mfbm, the price is down $65 (-14%).

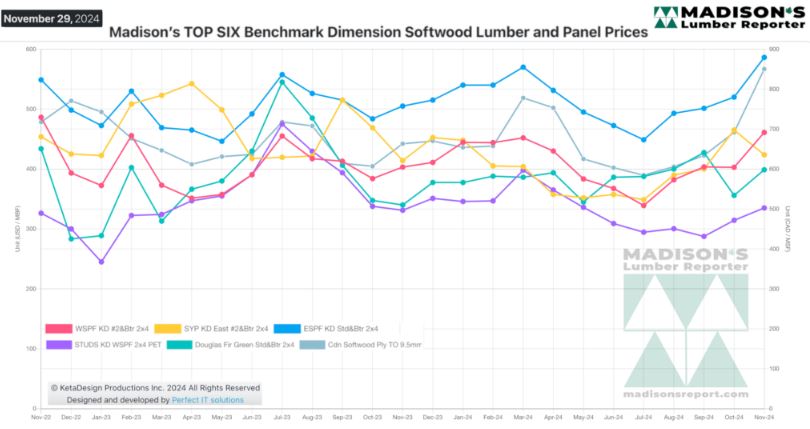

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

KEY TAKE-AWAYS:

Retailers scrambled to find short-term availability with delivery before the

holiday weekend.

Quick shipment times proved to be next to impossible.

Sellers advised building baseline inventories in the range of 45 days rather

than out-waiting sawmills for price drops.

Available supply at sawmills showed very little buildup, remaining in a

relative balance with decreasing demand.

Sawmill order files were in the two- to three-week range.

Transactions for OSB and Plywood were limited to spot deals for shipment

before the end of the year.

Several plywood producers in Western Canada claimed to have no cash wood

left for 2024.

More Reports: