Even As Persistent Low Lumber Supply And Depleted Inventories Continued, the

U.S. Thanksgiving holiday brought the usual seasonal demand drop. Prices in

most SPF and Hem/Fir items were firm to slightly up, while prices of SYP

remained conspicuously soft.

As sellers and buyers both prepared to head out for the extended long

weekend, sales of construction framing dimension softwood lumber remained

for immediate needs only. Some prices perked up slightly, as was the trend

in recent weeks, but most producers focussed on booking production right up

to year-end and the annual Holiday shutdowns rather than trying to get

prices higher.

There were no significant delays in transportation, indeed delivery times

were better than is often the case at this time of year. As well, the

sawmills across North America are well stocked with logs; so the expectation

to the end of this year is a smooth wind-down by running wood production out

of log decks currently on the ground at manufacturers.

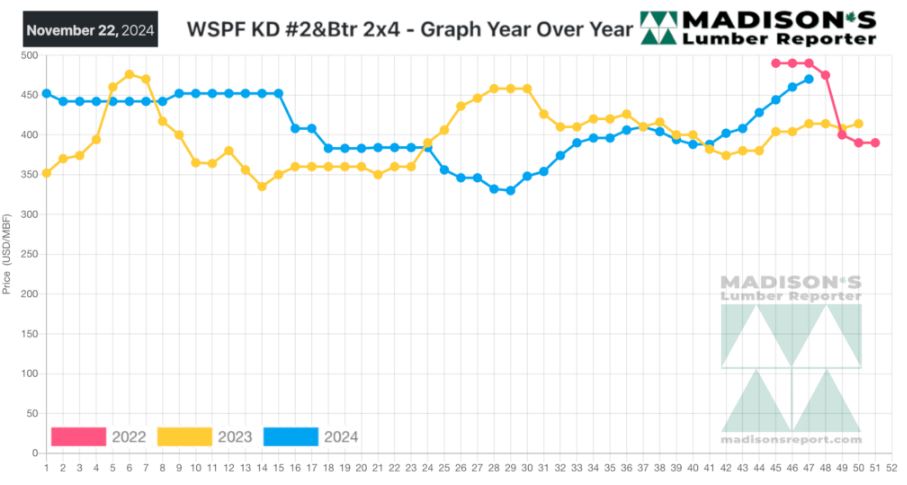

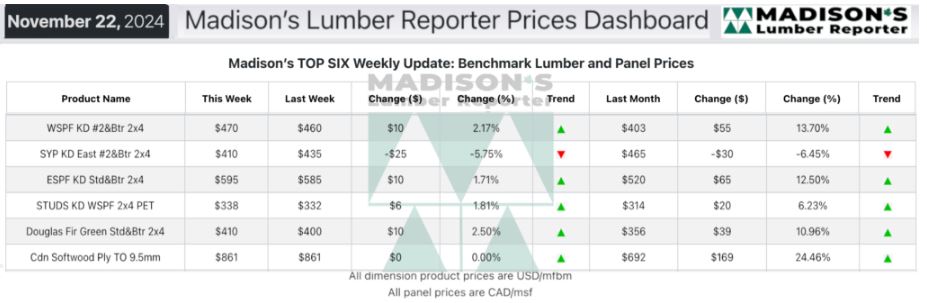

In the week ending November 22, 2024, the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$470 mfbm, which up +$10, or +2%, from the previous

week when it was $460, said Madison’s Lumber Reporter.

That week’s price is up +$67, or +17%, from one month ago when it was $403.

Compared to the same week last year, when it was us$414 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&btr kd (rl) for the week ending November 22,

2024 was up +$56, or +14%.

Compared to two years ago when it was $490, that week’s price was down -$20,

or -4%.

In the week ending November 22, 2024, the price of Southern Yellow Pine East

Side 2x4 #2&Btr KD (RL) was $410 mfbm. This is down $25, or 6%, from the

previous week when it was $435. That week’s price is down $55, or 12%, from

one month ago when it was $465.

When compared to the same week last year, when it was $415, that week’s

price was down $5, or 1%. Compared to two years ago, when it was $455, that

week’s price was down $45, or 10%.

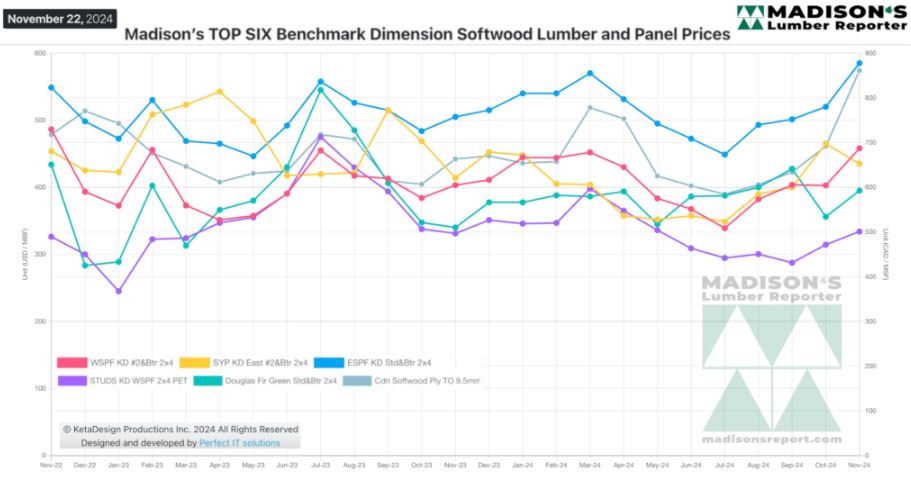

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

KEY TAKE-AWAYS:

The tone was optimistic, encouraged by strengthening market conditions in

the wake of the US presidential election.

Purchasers stuck to short-term coverage as best they could amid ongoing

limited supply.

The trend of scarce availability outstripped by winter demand persisted for

Eastern S-P-F.

Reloads were basically out of quick-shipping material .

Sawmill order files were deep enough to extend through December and into

early-2025.

Southern Yellow Pine producers were more flexible with their discounted

material as they focussed on moving floor stock.

Supply of plywood remained tighter than Oriented Strand Board.

More Reports: