The frenzied tone of lumber sales attenuated in most product categories.

Supply remained tight as a drum and prices were firm or up.

Due to ongoing restricted supply, prices continued their upward trend of the

past month or so.

Producers looked toward the usual seasonal Holiday downtime as they made

their manufacturing plans to end the year having sold out of any remaining

inventory; the usual practice for year-end.

For their part, customers continued to buy only the wood they needed for

ongoing projects. All eyes were on January 2025, with a general consensus

that business would continue to pick up. The strategy at sawmills was to

manage order files toward

mid-December, in time for Holiday closures, while keeping prices generally

moderated. Some specialty item production was starting to book for early

next year.

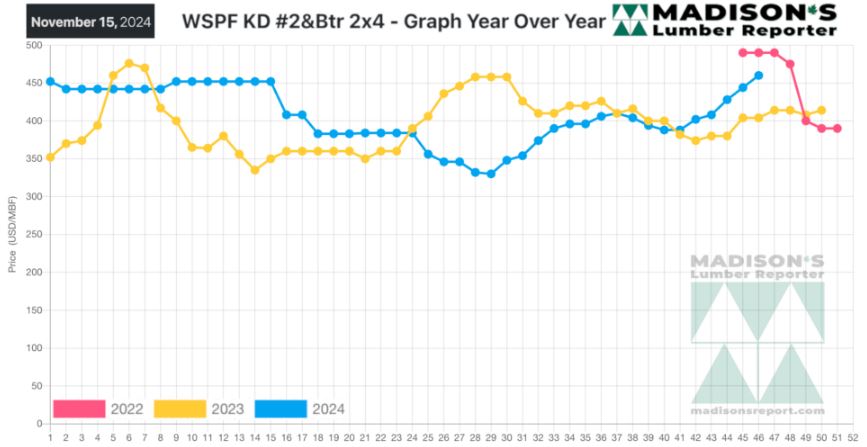

In the week ending Nov. 15, the price of benchmark softwood lumber item

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$460 mfbm. This is up $16,

or four per cent from the previous week when it was $444. That week’s price

is up $57, or 14 per cent from one month ago when it was $403.

Compared to the same week last year when it was $404 mfbm, that week’s price

was up $56, or 14 per cent. Compared to two years ago when it was $490, that

week’s price was down $30, or six per cent.

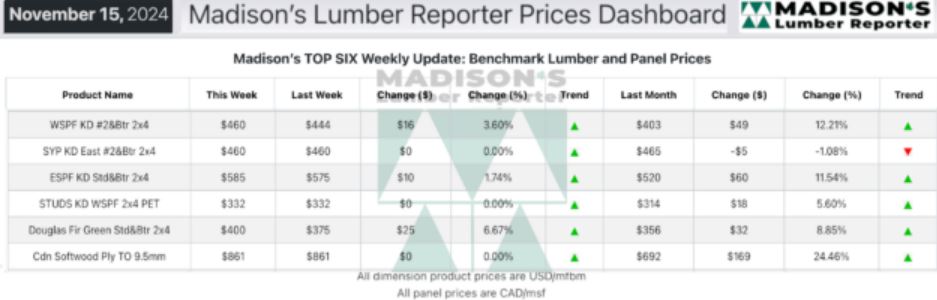

In the week ending Nov. 15, the price of Southern Yellow Pine East Side 2×4

#2&Btr KD (RL) was $435 mfbm. This is down $25, or five per cent from the

previous week when it was $460. That week’s price is down $30, or six per

cent from one month ago when it was $465.

When compared to the same week last year when it was $405, that week’s price

was up $30, or seven per cent. Compared to two years ago when it was $455,

that week’s price was down $20, or four per cent.

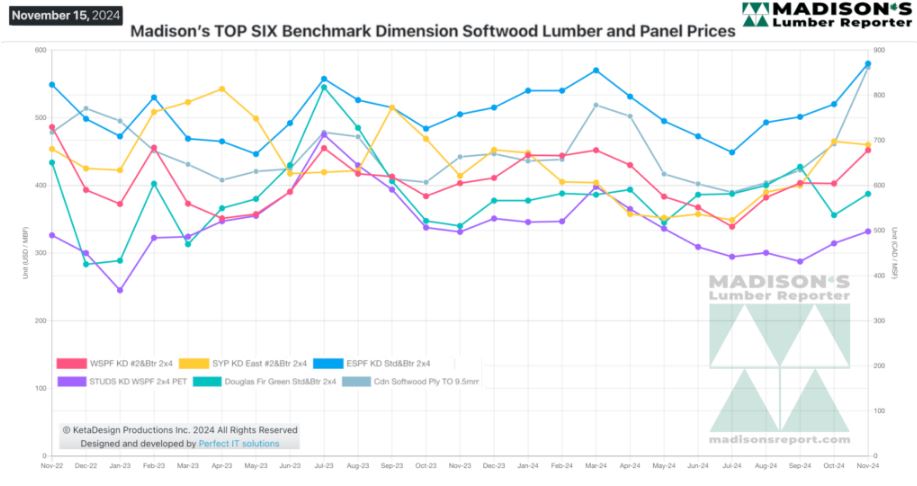

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

KEY TAKE-AWAYS:

Producer order files were extended to early-December.

Demand weakened slowly, but was still well-ahead of scanty supply.

Sawmills felt no urge to be aggressive, and buyers were content to sit on

the sidelines.

Sales lead times were in the three- to five-week range.

Positive moves in lumber futures underscored the buoyant tone in business.

Southern Pine prices continued to correct after rising higher than the

market could bear.

SYP suppliers without on-ground inventory had to entertain significant

counteroffers.

More Reports: