Following The Thanksgiving Long Weekend In Canada And Columbus Day In The

Us, Sales Of Softwood Lumber In That Shortened Week Improved Somewhat Among

Ongoing Lower Supply.

Prices responded accordingly; rising slightly on almost all construction

framing commodity items. As well, sawmill order files stretched out another

week or so into mid-November. The price trendline of almost all lumber

products has met or passed the same week last year.

This provides good insight into the state of the market, given that

historically at this time of year demand is weakening and prices soften.

Industry players looking back at 2023 are able to use the knowledge of what

happened then to apply to current market conditions. Indeed, now that price

movement is coming closer to what was the normal seasonal trend in the past,

lumber buyers and sellers alike are better able to make their plans for

year-end and look forward to operations in the New Year 2025.

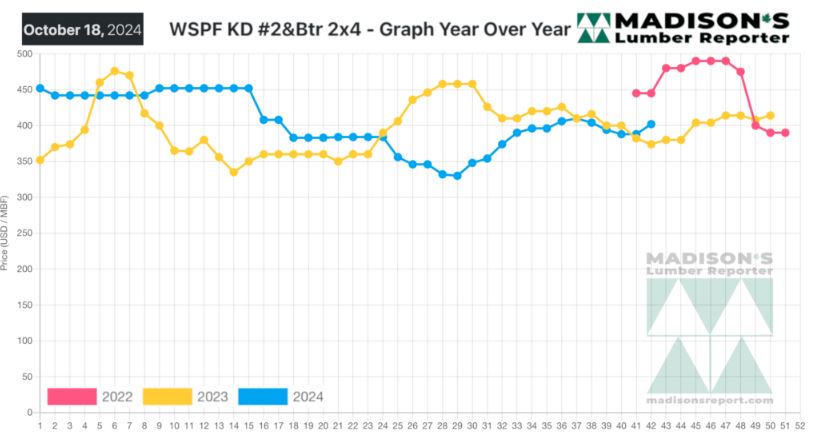

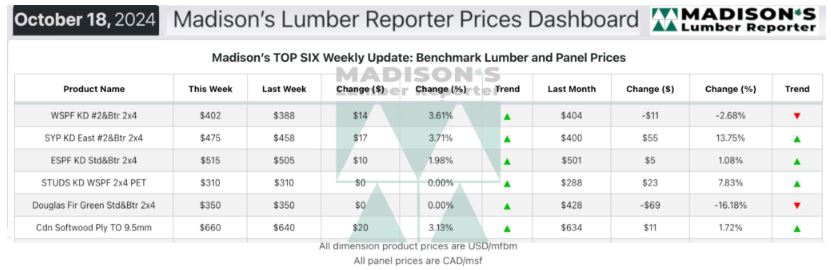

In the week ending October 18, 2024, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$402 mfbm. This is up

+$14, or +4%, from the previous week when it was $388, said weekly forest

products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down -$2, or -0%, from one month ago when it was $404.

Compared To The Same Week Last Year, When It Was Us$374 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending October 18,

2024 Was Up +$28, Or +7%.

Compared To Two Years Ago When It Was $445, That Week’S Price Is Down -$43,

Or -10%.

In the week ending October 18, 2024, the price of Southern Yellow Pine

East Side 2x4 #2&Btr KD (RL) was US$475 mfbm. This is up +$17, or +4%, from

the previous week when it was $458.

That week’s price is up +$75, or +19%, from one month ago when it was $400.

When compared to the same week last year, when it was $455, that week’s

price is up +$20, or +4%. Compared to two years ago when it was $495, this

week’s price is down -$20, or -4%.

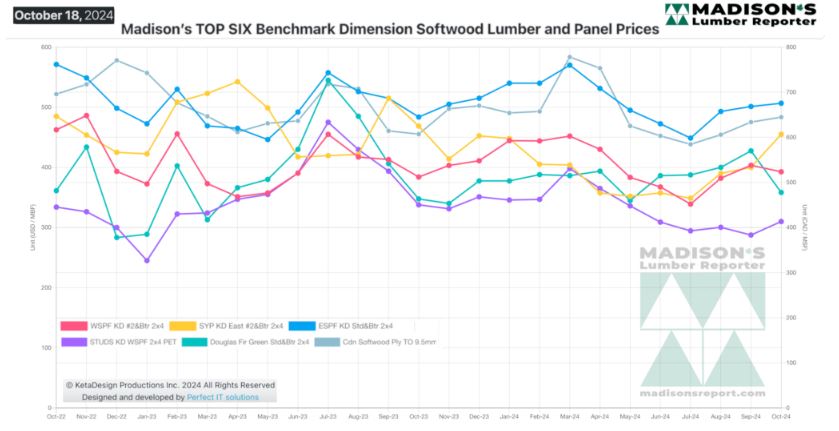

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

KEY TAKE-AWAYS:

The holiday Monday gave sawmills the opportunity to extend order files into

late-October or early-November.

Product availability up and down the supply chain was tenuous at best.

Western Canadian producers showed firm numbers and no wiggle room for

counter-offers.

Hurricane damage significantly affected the production and flow of Yellow

Pine in the Southeastern United States.

Several sawmills in that region faced uncertain timelines for returning to

full production capacity.

Reported SYP prices lagged as numbers on the ground varied wildly depending

on the source and destination.

Due to Hurricane Helene, Norfolk Southern Railway through Asheville, NC,

will be out of service for at least three months.

Demand for ESPF sheet goods was essentially unchanged but prices continued

to climb.

Reduced supply at plywood mills caused order files to extend by around four

weeks.

More Reports: