Hurricane Helene Cut A Path Much Further Inland Than Is Normal For Such

Storms, Affecting Areas Which Do Not Typically Have This Type Of Weather

Event.

As a result, Florida, Georgia, North Carolina, and Tennessee all suffered

significant damage to infrastructure; specifically transportation and power

supply. There are three major sawmills in these areas; two West Fraser mills

and one Canfor. One of the West Fraser mills, in Florida, was very recently

curtailed.

There are also more than 10 medium-sized mills and a large number of smaller

mills throughout these states. More than a week after Helene, much of these

locations were still without power, not to mention inability to transport

timber into the mill and lumber out. As a result, prices of Southern Yellow

Pine started to rise immediately.

This is due to the ongoing customer habit of not stocking inventory, so any

need for wood brought an increase in orders to producers. Naturally, demand

flowed to Eastern S-P-F as customers sought value as well as availability.

This, however, did not increase prices even while sales volumes rose.

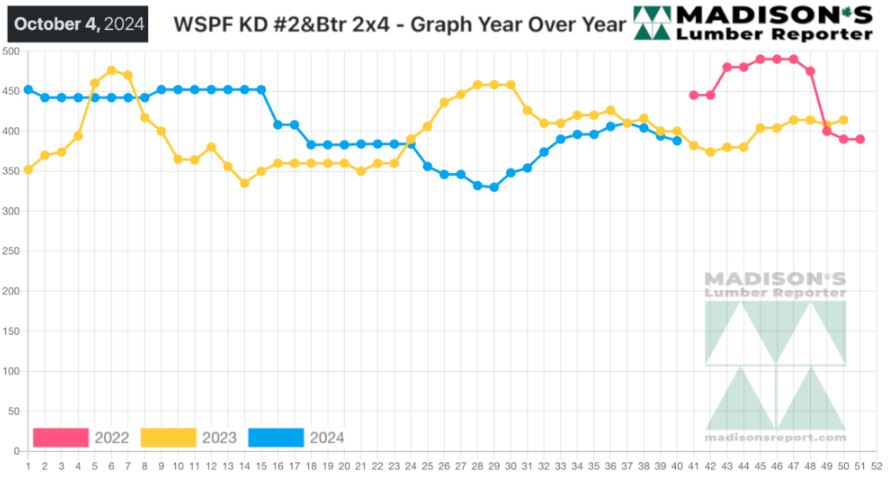

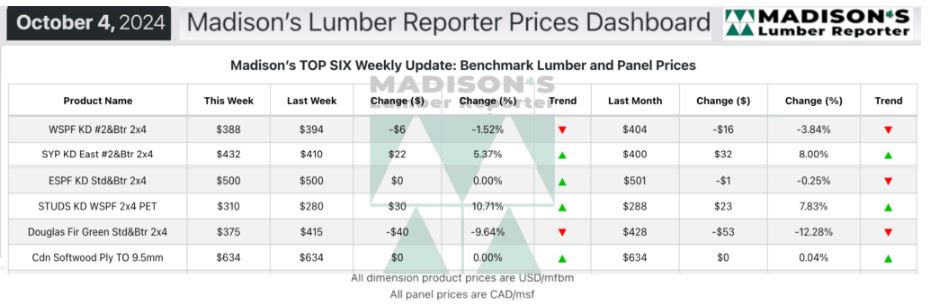

In the week ending October 4, 2024, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$388 mfbm. This is

down -$6, or -2%, from the previous week when it was $394, said weekly

forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down -$16, or -4%, from one month ago when it was $404.

Compared To The Same Week Last Year, When It Was Us$400 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending October 4,

2024 Was Down -$12, Or -3%.

Compared To Two Years Ago When It Was $520, That Week’S Price Is Down -$116,

Or -22%.

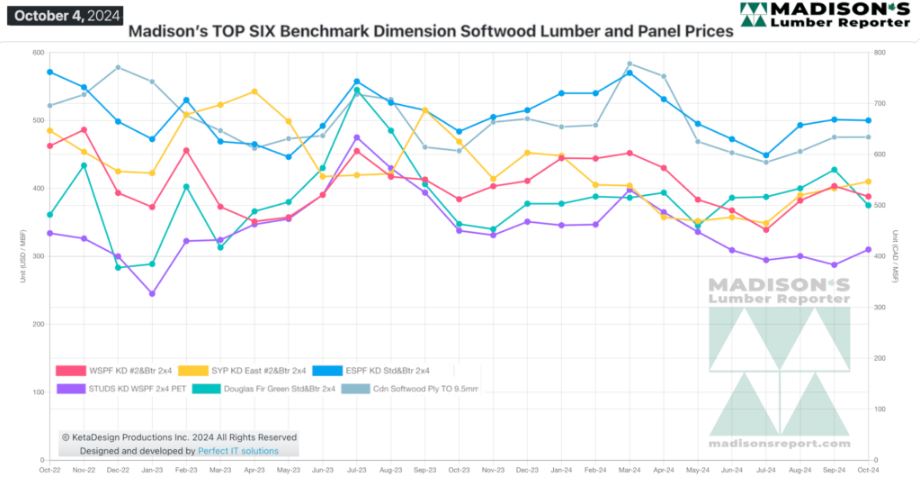

In the week ending October 4, 2024, the price of Southern Yellow Pine

East Side 2x4 #2&Btr KD (RL) was US$432 mfbm. This is up +$22, or +5%, from

the previous week when it was US$410 mfbm.

That week’s price is up +$32, or +8%, from one month ago when it was US$400

mfbm.

When compared to the same week last year, when it was $505, that week’s

price is down -$73, or -14%. Compared to two years ago when it was $620,

that week’s price is down -$220, or -35%.

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

KEY TAKE-AWAYS:

In the West players had heavy hearts and prayers for those affected by

Hurricane Helene. As well, the East Coast port strike resulted in much

handwringing, and the looming presidential election diverted attention.

Steady hand-to-mouth purchasing at the distribution level kept orders

flowing to sawmills; resultant dimension prices remained around the previous

week’s levels.

Buyers hoped for another round of corrections in four-inch; suppliers felt

there wasn’t much more downside potential.

Future availability of Eastern species was squeezed further by reduced

supply in the US Southeast in the wake of Hurricane Helene.

Robust demand of ESPF was noted as the week wore on, with a hectic pace to

inquiry by Friday.

The longshoremen strike affected dozens of ports along the Eastern seaboard,

adding urgency.

Uncertainty surrounded the operation of many Southern Yellow Pine sawmills

following the horrific flooding and resultant Hurricane damage in Florida,

Georgia, North Carolina, and Tennessee.

A potential future logistical nightmare loomed due to washed out or

completely destroyed roads over a vast swath of the US Southeast.

Cash wood availability of Southern Yellow Pine evaporated.

More Reports: