As September Waned The Focus Of Lumber Commodity Buyers Shifted From

Replenishing Their Chronically Lean Inventories To Macro-Conditions.

The focus of lumber commodity buyers shifted from replenishing their

chronically lean inventories to macro-conditions; such as looming interest

rate cuts, the US Presidential election, and the potential work-stoppage at

ports on the US eastern seaboard. Thankfully the dockworkers’ job action on

the US East Coast was soon resolved.

However, the damage to transportation infrastructure — roads, highways,

railways — from Hurricane Helene is not yet tabulated even to this date. As

power is restored in storm-affected areas, it is clear there has been

interruption in manufacturing at lumber producers. There are three major

sawmills and more than 10 medium-sized facilities in those locations.

Given that lumber buyers have been keeping extremely low inventories for

more than a year, there was an immediately-felt shortage of supply. As a

result, Southern Yellow Pine prices did increase somewhat. There was also a

jump in sales of Eastern Spruce-Pine-Fir, but those prices remained flat.

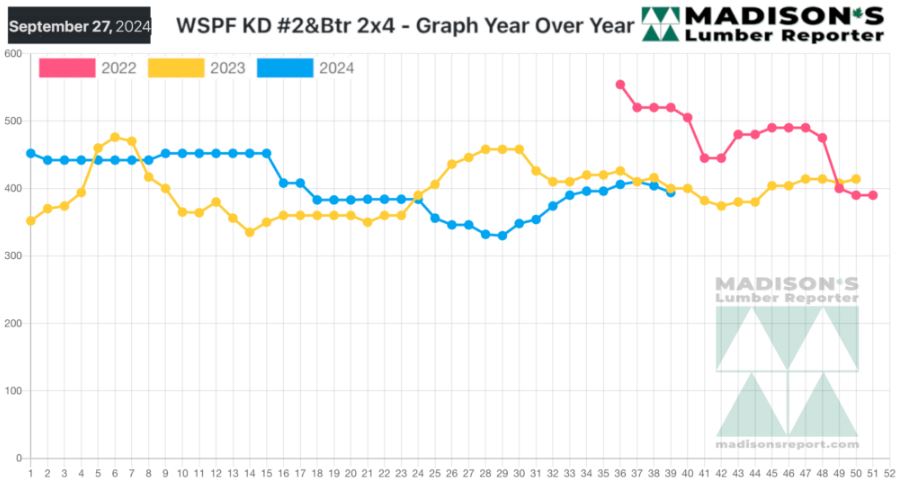

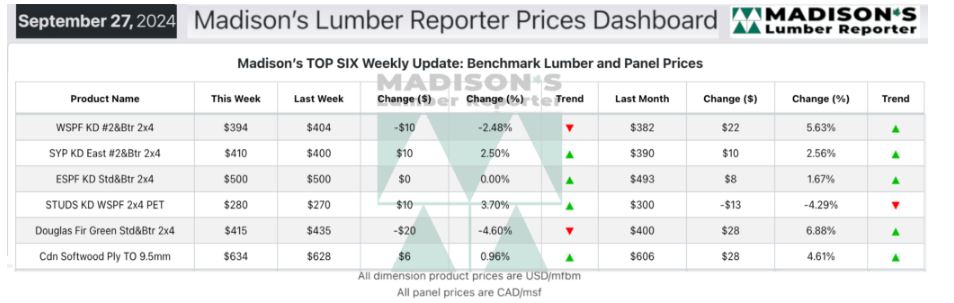

In the week ending September 27, 2024, the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$394 mfbm, which is down -$10, or -2%, from the

previous week when it was $404, said weekly forest products industry price

guide newsletter Madison’s Lumber Reporter.

That week’s price is up +$12, or +3%, from one month ago when it was $382.

Compared To The Same Week Last Year, When It Was Us$400 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending September 27,

2024 Was Down -$6, Or -2%.

Compared To Two Years Ago When It Was $520, That Week’S Price Is Down By

-$126, Or -24%.

KEY TAKE-AWAYS:

Producers felt no pressure to change prices, as sawmill order files were

into early- or mid-October.

There was ample discounted material available.

Buyers continued to replenish bare minimum inventories from secondary

suppliers.

A decent if underwhelming sales clip kept material flowing out of vendor

yards.

Players maintained that scanty supply would limit further potential

downside.

Low-key urgency of Southern Yellow Pine buyers was buttressed by the number

of no quotes purchasers received from sawmills.

Plywood sellers in the East reported late-October production order files.

Cash wood offerings of Oriented Strand Board were nonexistent from panel

mills in the West.

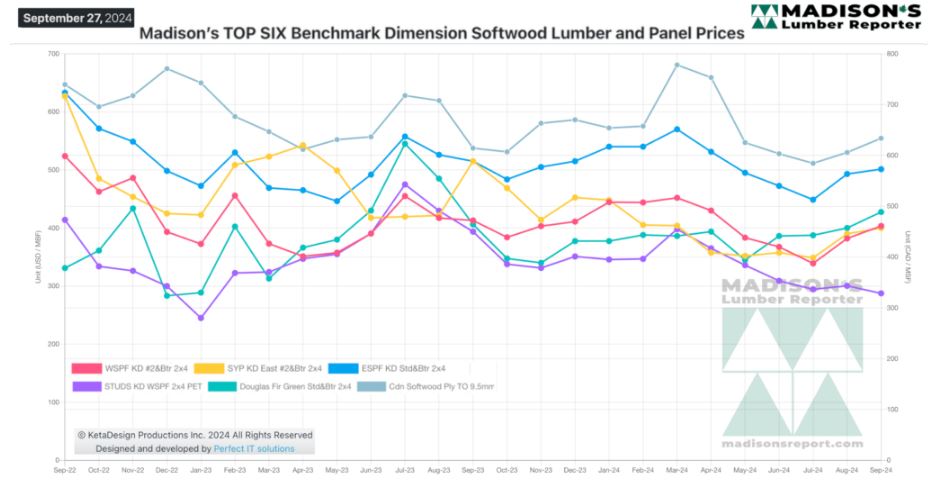

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

More Reports: