The Annual Seasonal Lumber Price Trend Is Returning To The More Predictable

Changes Historically Recognized By Industry Players.

Producers and end-users alike are finally seeing some stability, which

provides confidence and makes it easier to plan into the mid-term future.

The big question on everyone’s minds, and the main driver to this ongoing

attitude of caution, is “what is the new price bottom?”.

Even as prices levelled off, and the facts of markedly increased

cost-of-production at sawmills are widely known, customers have remained

wary of what might be the next shock. Players would rather get caught short

of the lumber they need for ongoing building projects, than to stock up on

wood only to see prices drop.

This has meant lumber manufacturers are keeping production volumes lower to

stay in line with this soft demand, in order to prevent prices from falling

below manufacturing costs.

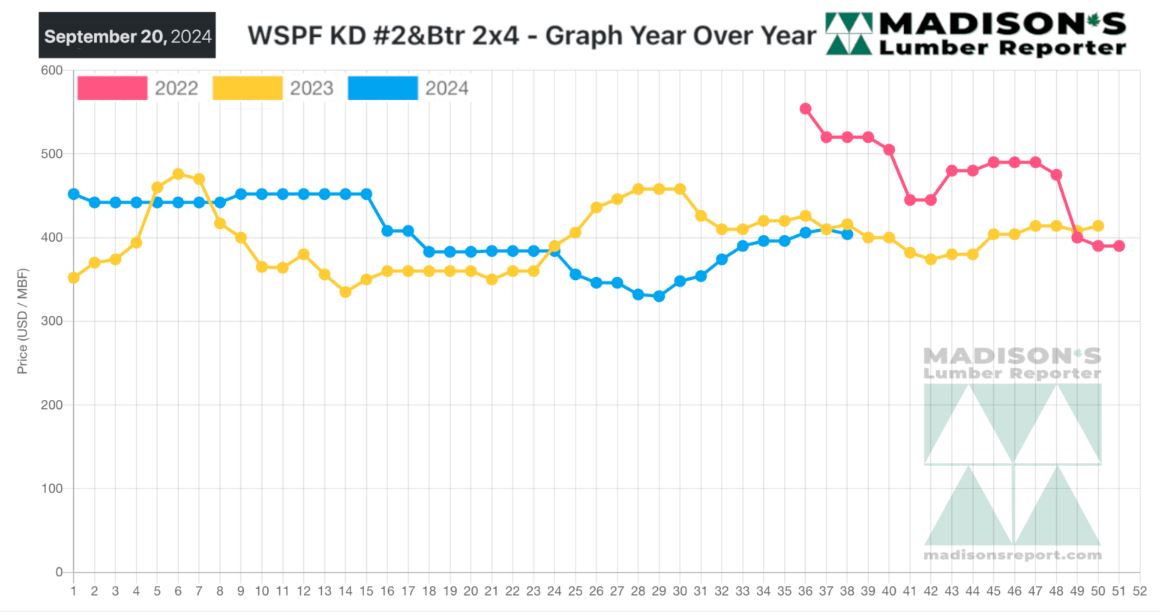

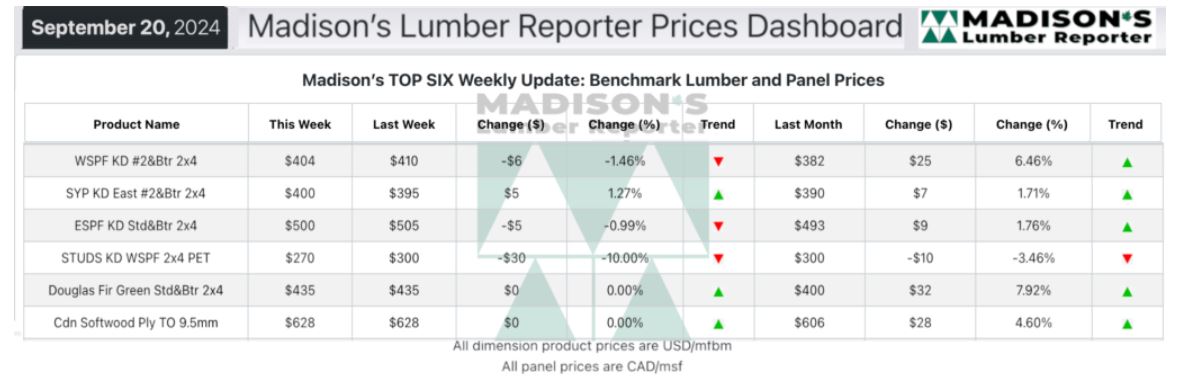

In the week ending September 20, 2024, the price of benchmark softwood

lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$404 mfbm. This

is down -$6, or -1%, from the previous week when it was $410, said weekly

forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up +$22, or +6%, from one month ago when it was $382.

When compared to the same week last year, when it was $416, that week’s

price is down -$12, or -3%. Compared to two years ago when it was $520, that

week’s price is down -$116, or -22%.

In the week ending September 20, 2024, the price of Southern Yellow Pine

East Side 2x4 #2&Btr KD (RL) was US$400 mfbm. This is up +$5, or +1%, from

the previous week when it was US$395 mfbm.

That week’s price is up +$10, or +3%, from one month ago when it was US$390

mfbm.

When compared to the same week last year, when it was $535, that week’s

price is down -$135, or -25%. Compared to two years ago when it was $620,

that week’s price is down -$220, or -35%.

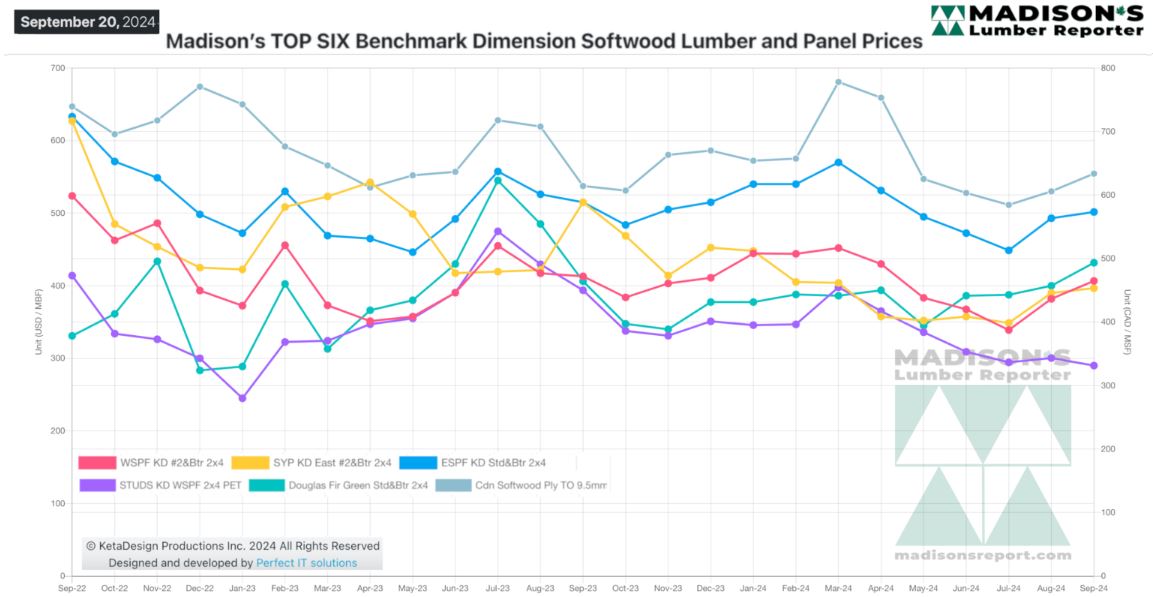

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

KEY TAKE-AWAYS:

Commodity prices were mostly unchanged as producers were content to cruise

at current levels.

Secondary suppliers moved good volumes amid light counteroffers from

purchasers.

Sawmill offer price lists varied considerably from producer to producer.

Buyers mostly remained on the fence even after the news of lower interest

rates and better housing starts data.

Secondary suppliers posted much greater price variability as they continued

to empty their inventories of older, lower-priced, material in preparation

of inbound orders from the sawmills.

Buyers in the US Northeast refrained from building any volume.

More Reports: