In Mid-September Some Big Questions About What Is Happening With The Lumber

Market And Lumber Prices Were Answered; When The Benchmark Lumber Price

Reached The Exact Amount Of The Same Week In 2023.

In a week of otherwise slow sales, another sawmill-closure announcement

generated increased demand early on.

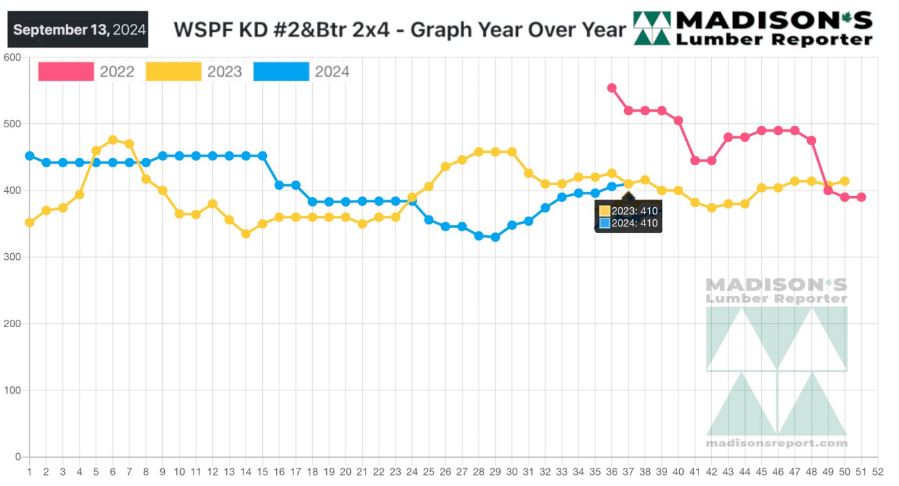

The sales price (FOB sawmill) of Western Spruce-Pine-Fir KD 2×4 #2&Btr was

US$410 mfbm, just as it was in mid-September last year. Producers and

customers alike have been asking since mortgage interest rates started

rising in summer of 2022, “what will the new lumber market look like, at

what price levels?”

Since the effects of the extreme volatility and stark changes during Covid

and due to the destruction of transportation from the atmospheric river in

British Columbia, now that these one-time circumstances are in the past,

industry and watchers are

better able to understand the current situation. And from there, make some

assessments of how the rest of this year will play out for lumber sales and

prices.

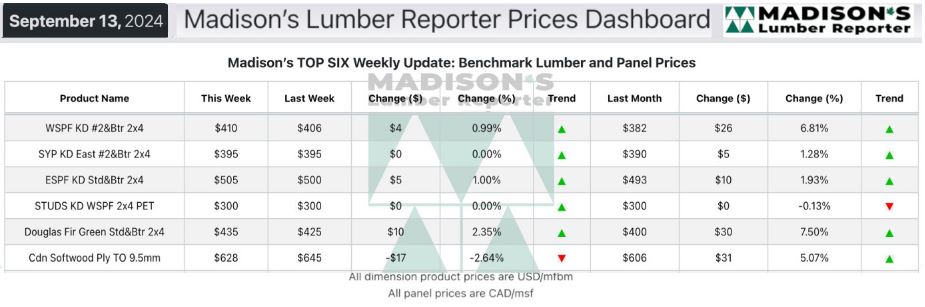

In the week ending September 13, 2024, the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$410 mfbm, which is up +$4, or +1%, from the

previous week when it was $406, said weekly forest products industry price

guide newsletter Madison’s Lumber Reporter.

That week’s price is up +$28, or +7%, from one month ago when it was $382.

When compared to the same week last year, when it was $410, that week’s

price is flat. Compared to two years ago when it was $520, that week’s price

is down -$110, or -21%.

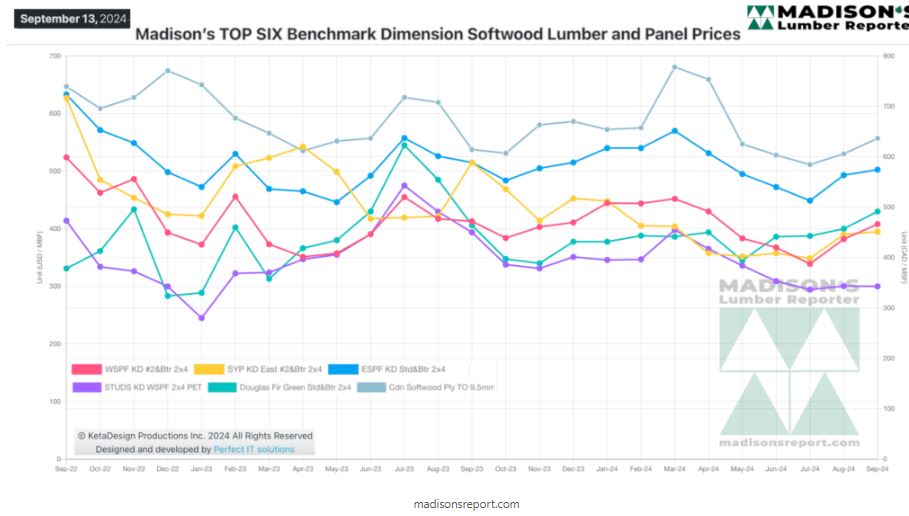

In the week ending September 13, 2024, the price of Southern Yellow Pine

East Side 2x4 #2&Btr KD (RL) was US$395 mfbm. This is flat from the previous

week when it was US$395 mfbm.

That week’s price is up +$5, or +1%, from one month ago when it was US$390

mfbm.

When compared to the same week last year, when it was $515, that week’s

price is down -$120, or -23%. Compared to two years ago when it was $655,

that week’s price is down -$260, or -40%.

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

KEY TAKE-AWAYS:

A major sawmill closure announcement pushed some buyers to find coverage

amid limited supply.

Sales remained at a slow-but-steady pace despite ongoing tight field

inventories.

Buyers continued to focus on immediate needs, filling inventory holes only.

To keep feeding just-in-time material to end users, secondary suppliers

replenished their own stocks from producers.

Mill offer lists were often slim, forcing traders to shop around for the

specific coverage they needed.

Many large retail customers step in recently to buy up bigger volumes of

discounted material.

Buyers continued to rely on the distribution network to furnish their

hand-to-mouth needs.

More Reports: