The Enduring Extremely Low Inventory Levels Of Lumber Throughout The Supply

Chain Served To Raise Prices Somewhat After The Seasonal Turning-Point Of

Labour Day, But Demand Remained Tepid At Best.

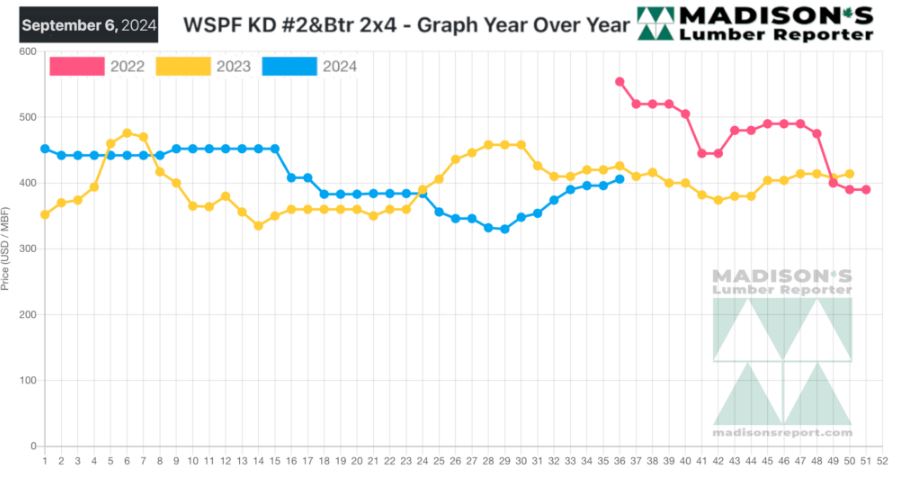

Into the beginning of September the benchmark lumber commodity WSPF 2×4

price approached quite close to the same week last year, potentially

providing indication of stability returning to the lumber marketplace.

Manufacturing volumes remain lower than historical, as sawmill downtime and

curtailment announcements continue. Traditionally in the past demand for

construction framing dimension softwood lumber started slowing down during

this time of year.

Of course, nothing has been usual for the past four years. How the rest of

this year will play out for sawmills remains to be seen.

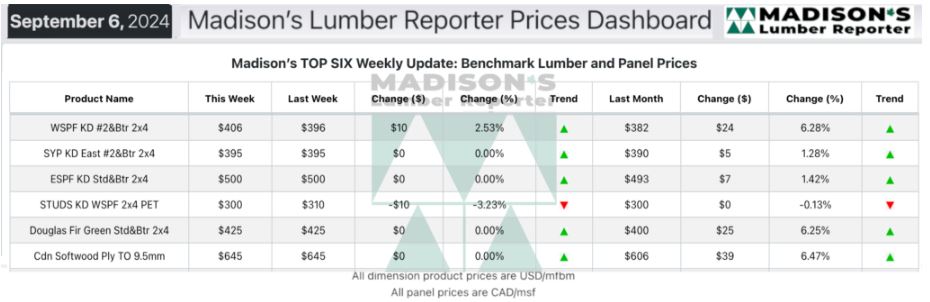

In the week ending September 6, 2024, the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$406 mfbm, which is up +$10, or +3%, from the

previous week when it was $396.

That week’s price is up +$24, or +6%, from one month ago when it was $382.

KEY TAKE-AWAYS:

The supply-demand balance was maintained for the most part.

Availability of material from sawmills and secondaries was largely the same

while demand was quiet.

Eastern S-P-F buyers concentrated on fill-in material from the distribution

network where they could source highly-mixed loads quickly.

There were large spreads across the market for various reasons.

Buyers stuck to their just-in-time strategies.

Prompt material was limited, lending an air of strength to the supply-side.

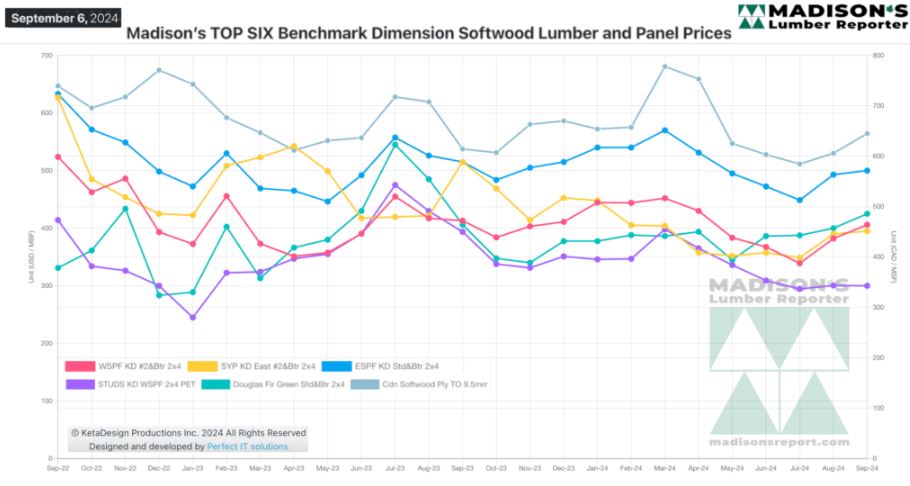

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Compared To The Same Week Last Year, When It Was Us$426 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending September 6,

2024 Was Down -$20, Or -5%.

Compared To Two Years Ago When It Was $554, That Week’S Price Is Down By

-$148, Or -27%.

More Reports: