Amid sustained demand and takeaway, most lumber and stud commodity prices

stayed firm or appreciated. Plywood and OSB continued to struggle by

comparison, the latter being particularly frustrating for players in the

North America.

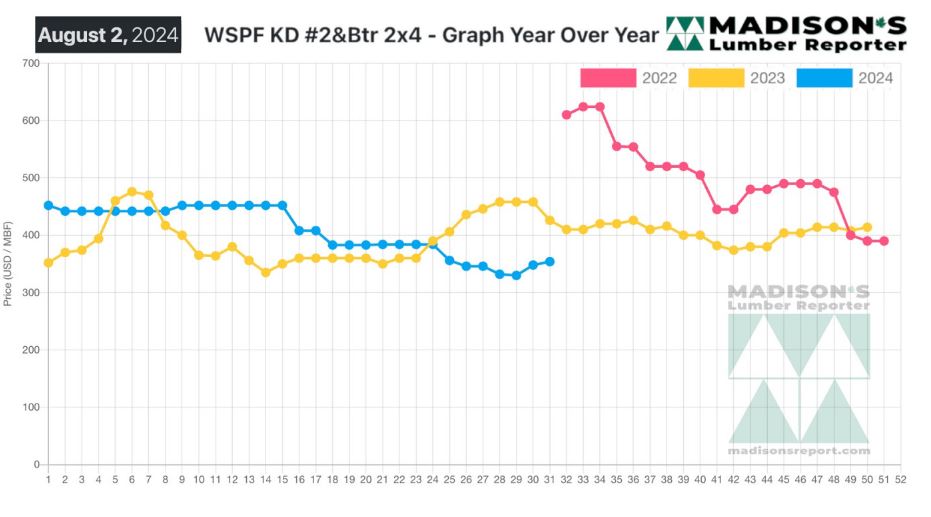

In the week ending August 2, 2024, the price of Western S-P-F 2x4 #2&Btr KD

(RL) was US$354 mfbm, said forest products industry price guide newsletter

Madison’s Lumber Reporter. This is up +$6, or +2%, from the previous week

when it was $348.

That week’s price is up +$15, or +4%, from one month ago when it was US$339

mfbm.

When compared to the same week last year, when it was $426, this week’s

price is down -$72, or -17%.

There was enough sales volumes for suppliers to be able to firm up prices,

potentially providing understanding of the new bottom. A few more

curtailment announcements as well as the annual seasonal holiday break in

Quebec helped correct the supply-demand balance. As they had been warned by

sellers since spring, customers found themselves sorely without inventory.

Those needing specific tallies had a hard time locating precisely the mix of

commodities for their ongoing projects. One thing is for sure: all sawmills

across North America are well stocked up with logs.

So should this latest boost of demand continue, producers will have no

trouble increasing manufacturing volumes to meet.

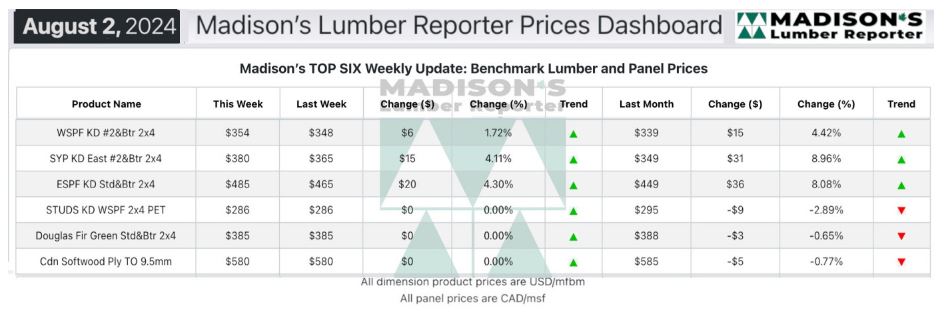

In the week ending August 2, 2024, the price of Southern Yellow Pine East

Side 2x4 #2&Btr KD (RL) was US$380 mfbm. This is up +$15, or +4%,from the

previous week when it was US$365 mfbm.

That week’s price is up +$31, or +9%, from one month ago when it was US$349

mfbm.

When compared to the same week last year, when it was $415, this week’s

price is down -$35, or -8%.

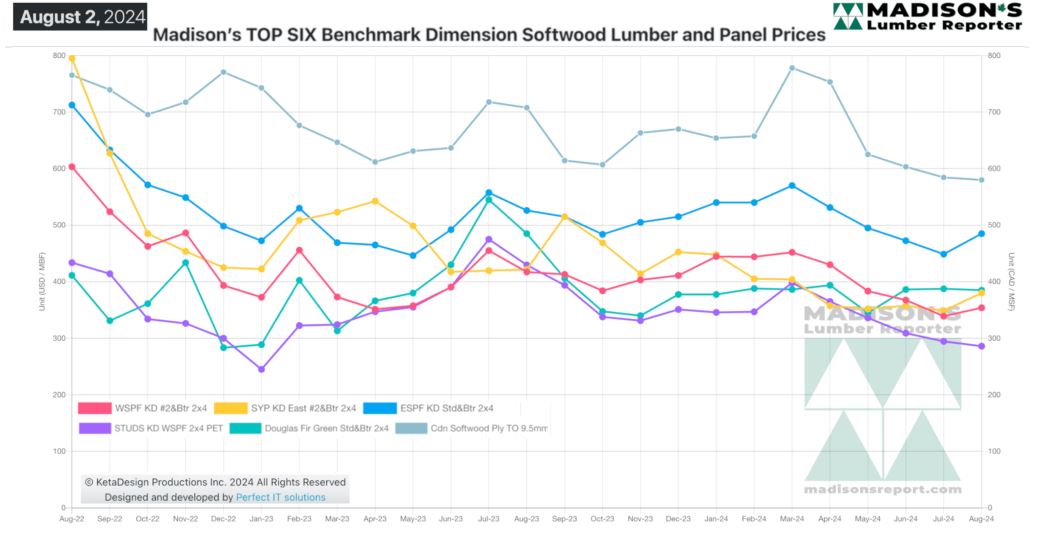

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

KEY TAKE-AWAYS:

Buyers struggled to keep their inventories from utter depletion.

Sawmills experienced firm to slightly-up price levels and order files into

mid-August.

Buyers worked to cover needs that built up when the market was slower and

supply more abundant.

Prompt availability was lower than players have seen in many weeks.

Buyers needing quick coverage scrambled, looking to the distribution

network.

Shipments from many producers were into mid-August or further, with higher

price levels to boot.

Some thought commodity prices were approaching a soft top after several

weeks of advancing.

Sellers reported high truck volume sales.

More Reports: