The post-holiday litmus test of improving demand was a resounding dud.

Prices of dimension and studs continued to sputter while that of panels

showed further weakness.

Sawmills and wholesalers alike prepared to hang “Gone Fishing” signs at

their desks, so little inquiry did they entertain in mid-July. The rotating

production curtailments and downtime did at least prevent lumber prices from

falling too much below cost-of-production, but low sales volumes did not

provide encouragement for any immediate improvement.

Sawmills and wholesalers alike prepared to hang “Gone Fishing” signs at

their desks, so little inquiry did they entertain in mid-July. The rotating

production curtailments and downtime did at least prevent lumber prices from

falling too much below cost-of-production, but low sales volumes did not

provide encouragement for any immediate improvement.

While no one is stocking inventory, and supply is quite tight, demand is

soft enough to not cause concern among customers. So far this season the

builders and contractors have been able to get the wood they needed for

ongoing construction jobs from sawmills and wholesalers easily enough, so

feel no urgency to hold inventory.

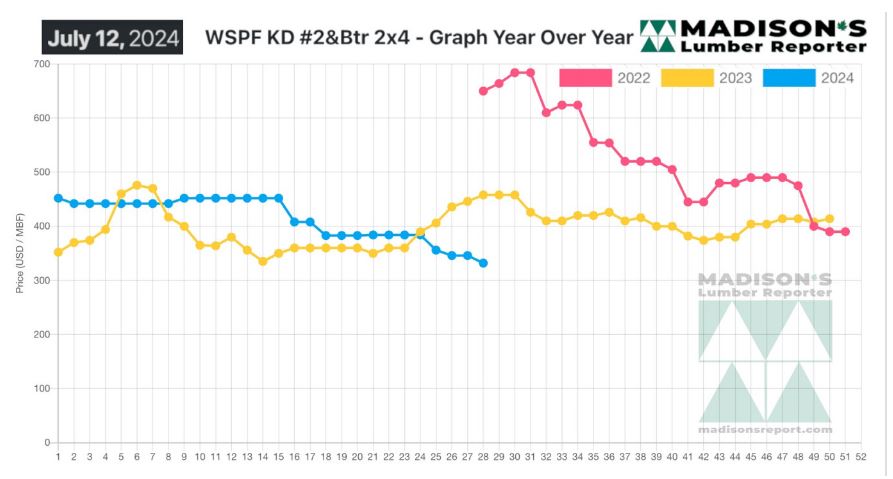

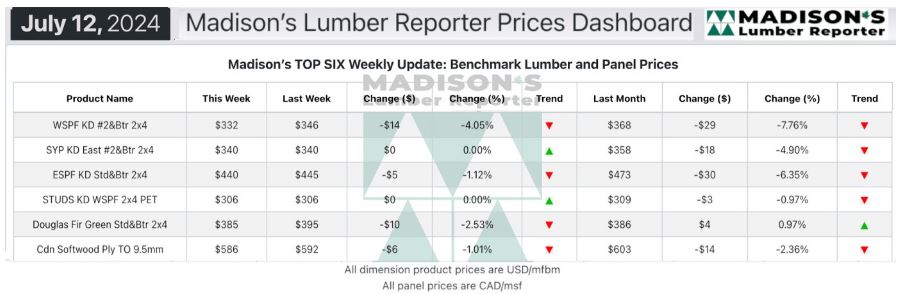

In the week ending July 12, 2024, the price of Western S-P-F 2x4 #2&Btr KD (RL)

was US$332 mfbm, said forest products industry price guide newsletter

Madison’s Lumber Reporter. This is down -$14, or -4%, from the previous week

when it was $346.

That week’s price is down -$36, or -10%, from one month ago when it was

US$368 mfbm.

When compared to the same week last year, when it was $458, this week’s

price is down by -$126, or -28%. Compared to two years ago when it was $650,

this week’s price is down by -$318, or -49%.

In the week ending July 12, 2024, the price of Southern Yellow Pine East

Side 2x4 #2&Btr KD (RL) was US$340 mfbm. This is flat from the previous week

when it was US$340 mfbm.

That week’s price is down -$18, or -5%, from one month ago when it was

US$358 mfbm.

When compared to the same week last year, when it was $418, this week’s

price is down by -$78, or -19%. Compared to two years ago when it was $700,

this week’s price is down by -$360, or -51%.

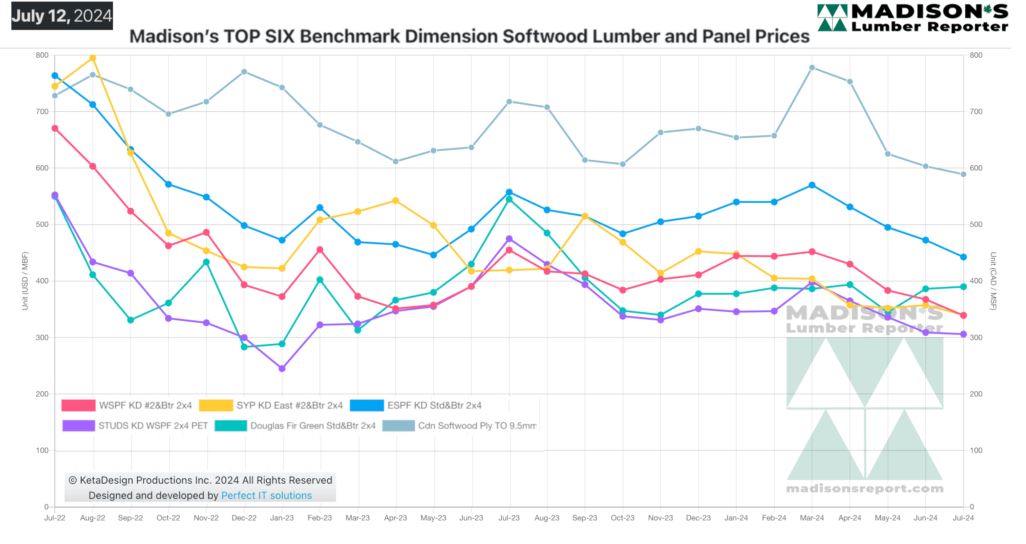

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

KEY TAKE-AWAYS:

Commodity prices remained conspicuously cheap across all products.

Wide dimension was the only remotely profitable group.

Buyers had a prevailing and reinforced expectation of quick truck shipments

at a discount.

Sawmill asking prices a mixed bag.

Downside momentum abating due to persistently low numbers, general fatigue,

and less Euro wood coming into Eastern ports.

Too many suppliers competing for limited business.

Discounted plywood and OSB material flowed into US markets.

More Reports: