There Was No Notable Increase In Demand For Lumber In Advance Of The Dual

Canada And Us National Holidays.

Veteran players continued to shake their heads in wondering when, and/or if,

there will be the usual seasonal lumber sales push at all this year. Indeed,

at this time last year prices were rising.

The overall tone in Western S-P-F trading remained unenthusiastic as supply

outpaced demand in a trend that has persisted for months.

The number of transactions and their individual volumes was well-shy of

typical levels for this time of year. At the same time, accumulated material

also seemed to be dwindling among suppliers, underscoring the sense of

leaner supply.

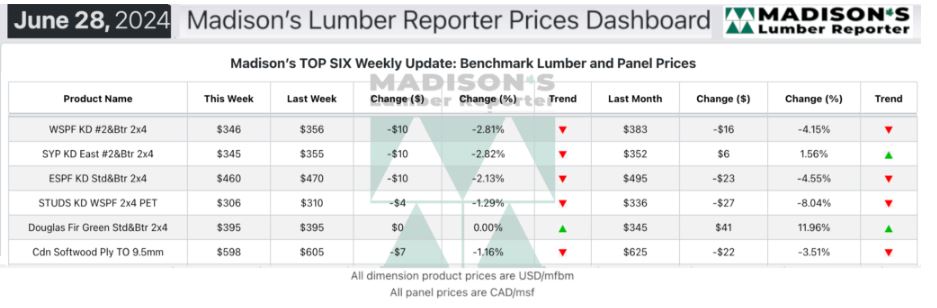

In the week ending June 28, 2024, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$346 mfbm. This is

down -$10, or -3%, from the previous week when it was $356.

That week’s price is down -$38, or -10%, from one month ago when it was

$383.

The lumber market remained unbalanced, with consistent reports of oversupply

in most species and categories.

KEY TAKE-AWAYS:

A negative showing in Futures made buyers even more leery of taking

longer positions in dimensional lumber and studs.

Sawmills kept their order files around two- to three-weeks on many items.

The number of transactions and their individual volumes was well-shy of

typical levels for this time of year.

Fickle business so far this year had folks on edge.

Buyers apparently weren’t interested in covering much more than one- to

two-week’s worth of material.

Many reload and distribution network were inventories cleaned out thanks to

opportunistic participation from multi-family sector buyers.

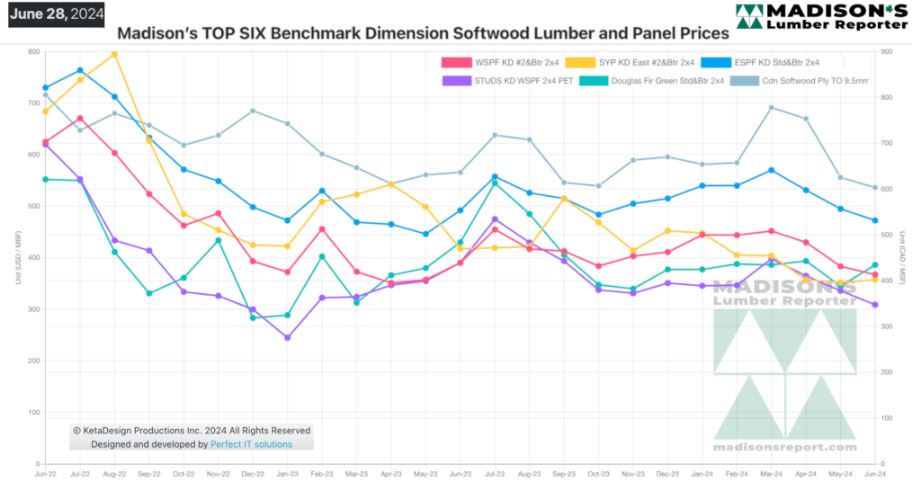

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

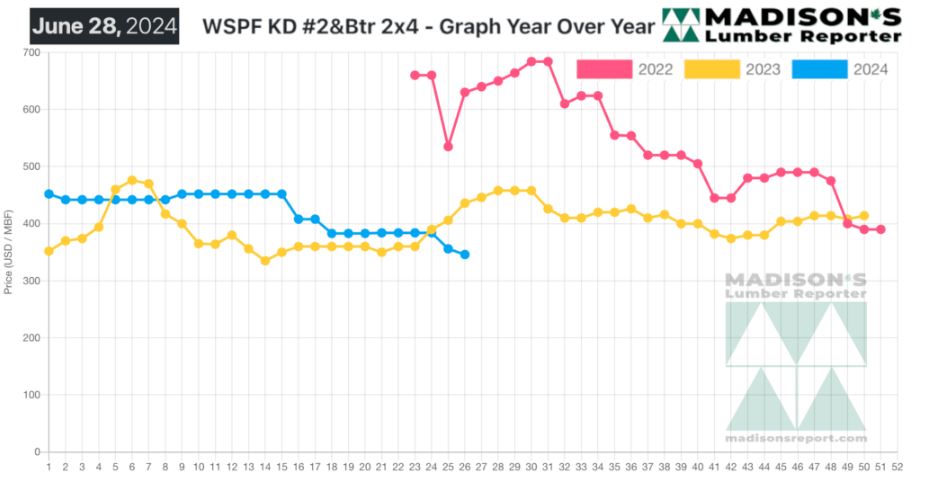

Compared To The Same Week Last Year, When It Was Us$436 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending June 28, 2024

Was Down -$90, Or -21%.

Compared To Two Years Ago When It Was $630, That Week’S Price Is Down -$284,

Or -45%.

More Reports: