Since Mid-2022 When Interest Rates, Especially Mortgage Lending Rates,

Starting Going Up Home Builders And Lumber Buyers Became Extremely Cautious

In Their Purchasing Of Manufactured Wood Products.

In general players avoided stocking up on lumber inventory, mostly out of

concern that prices might fall and they might get stuck with expensive

material they would have to sell at a loss.

Specifically veteran players, who were accustomed to prices at much lower

levels than currently, chose to hold off buying to see if prices would drop

back to what was historic.

The fact is however, that since 2020 to 2022 there is a new floor, and

lumber prices will never return to what were the lows in 2010. This is

because the cost-of-production for sawmills has essentially doubled in the

past five years.

The ongoing uncertainty of macroeconomic conditions nationally and warfare

globally is doing nothing to restore confidence.

For the time being customer demand is served promptly by sawmills and lumber

manufacturers; however if there is a bounce — even a small one — in sales of

wood, either for new home building or for reconstruction after storms,

shortages will appear almost immediately. Should this happen, anyone caught

without wood they need for ongoing projects could be facing quite a price

shock.

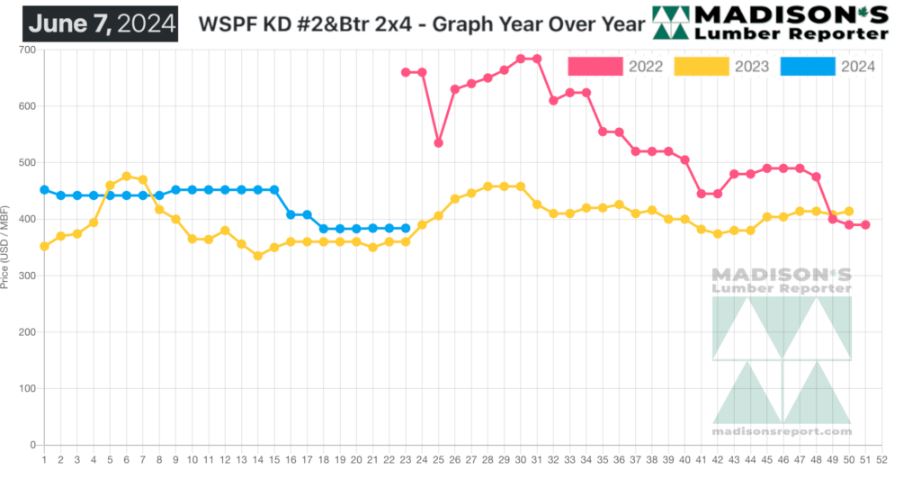

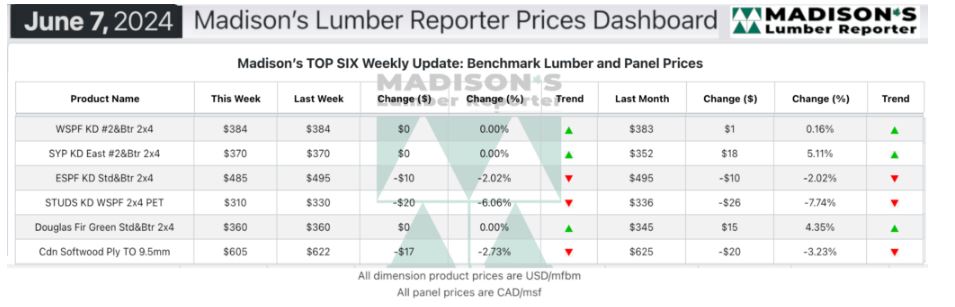

In the week ending June 14, 2024, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$384 mfbm. This is

flat from the previous week when it was $384.

That week’s price is up +$1, or 0%, from one month ago when it was $383.

The prevailing sentiment in solid wood commodity trading was uncertain to

negative this week. Sales of panels remained conspicuously sloppy compared

to dimension and studs.

KEY TAKE-AWAYS:

Overall sentiment remained uncertain to negative.

Mild discounts were prevalent as producers looked to move some of their

built-up material.

Supply was palpably ahead of subpar demand.

Field inventories remained exceptionally lean.

Opportunistic buyers flitted from supplier to supplier, feeling they had the

upper hand.

Producers did their best to hold the line in terms of price, often not

succeeding.

Sawmill order files continued to shrink as it remained a struggle to extend

lead times on anything..

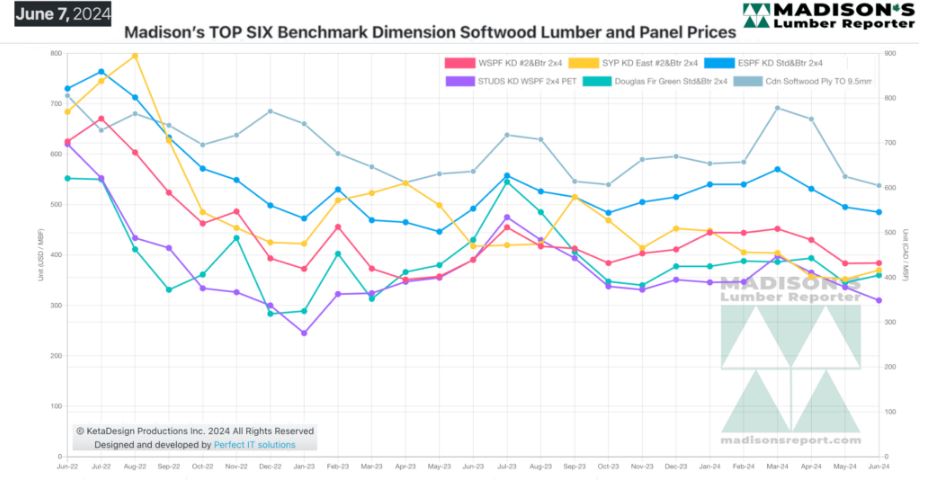

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Compared To The Same Week Last Year, When It Was Us$390 Mfbm, The Price Of

Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending June 14, 2024

Was Down -$6, Or -2%.

Compared To Two Years Ago When It Was $660, That Week’S Price Is Down By

-$276, Or -42%.

More Reports: