In What Is Normally The Beginning Of True Building Season Across North

America, The End Of April This Year Did Not Bring The Usual High Volumes Of

Lumber Sales.

In What Is Normally The Beginning Of True Building Season Across North

America, The End Of April This Year Did Not Bring The Usual High Volumes Of

Lumber Sales.

Indeed, while recent lower prices did encourage customers to increase

purchasing somewhat, actual sales volumes remained below the seasonal norm.

Participants in the forest products industry and home building alike

question what this means for looming US housing starts. Does this ongoing

muted demand for lumber indicate that new housing construction will be slow

again, as it was last year? It is important to note that across both Canada

and the US the weather has not been much co-operating; as some regions had a

big dump of snow even at the end of April. Elsewhere there was severe storm

activity, which is a bit early compared to the seasonal average.

And, there is a very alarming early start to wildfires in the northwest —

some of which were quite challenging to put out — so lumber industry players

have a lot more questions than answers for the beginning of May 2024.

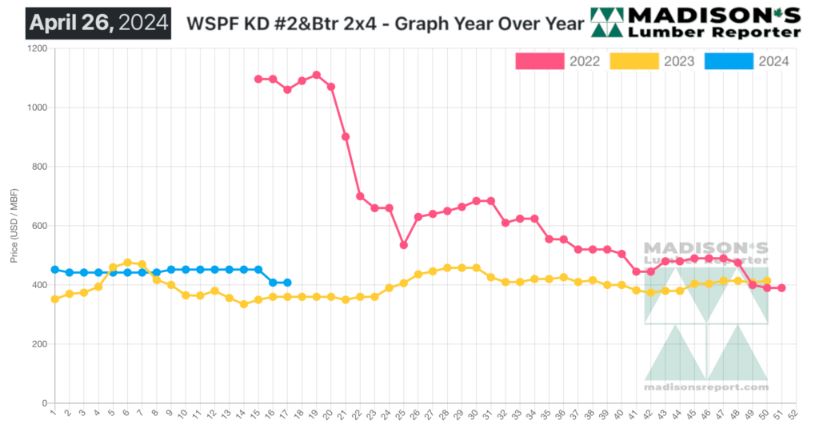

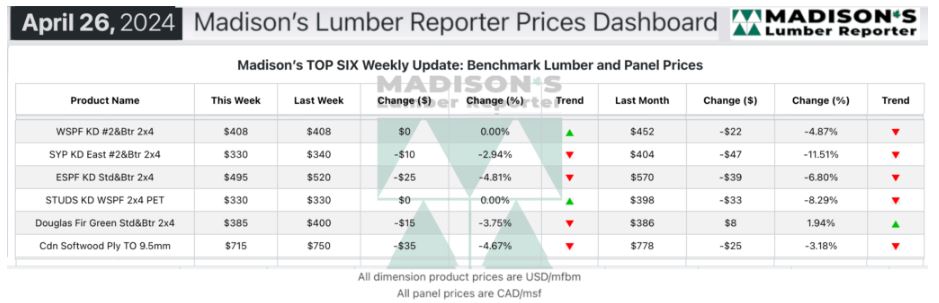

In the week ending April 26, 2024, the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$408 mfbm, which is flat from the previous week when it

was $408.

That week’s price is down by -$44, or -10%, from one month ago when it was

$452.

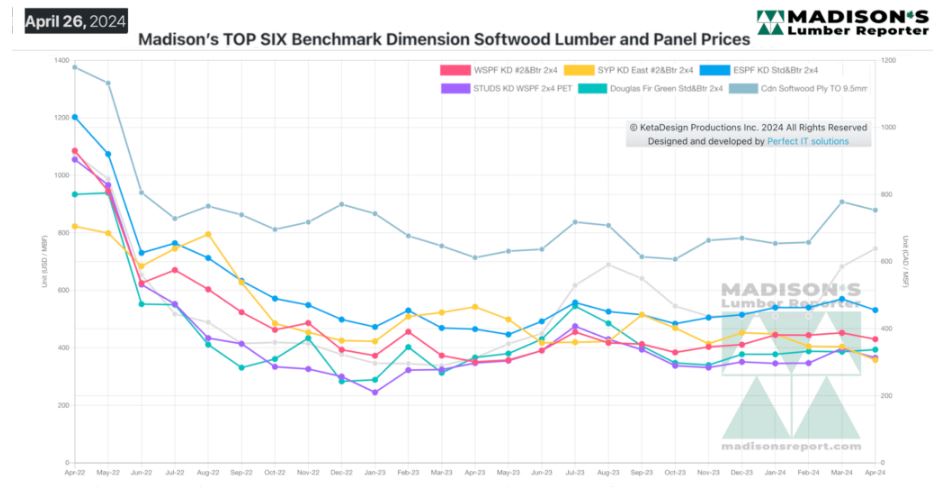

The quiet week capped off a muted month of April, as commodity prices were

flat to down. Plywood prices appeared to be approaching a bottom.

KEY TAKE-AWAYS:

Weak demand for Western S-P-F underscored a broader market trend.

Current prices made it easier to be a buyer than a seller, for the time

being.

In the East, purchasers did bolster their depleted inventories in advance of

expected spring building activity.

Southern Yellow Pine supply remained well ahead of demand; there was no

appetite to put speculative wood on the ground.

Feeling no urgency to shore up their inventories, purchasers patiently held

out for discounted material.

There was almost no pressure from downstream consumers on inventory holders,

so keeping yard stock lean was a relatively safe gambit.

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Compared To The Same Week Last Year, When It Was Us$360 Mfbm, The Price

Of Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending April 26,

2024 Was Up By +$48, Or +13%.

COMPARED TO TWO YEARS AGO WHEN IT WAS $1,060, THAT WEEK’S PRICE IS DOWN BY

-$652, OR -62%.

More Reports: