In Yet Another Departure To What Would Historically Be Considered

“Normal” Seasonal Trend Cycle, Lumber Prices Dropped — By Quite A Bit — In

The Middle Of April 2024.

In Yet Another Departure To What Would Historically Be Considered

“Normal” Seasonal Trend Cycle, Lumber Prices Dropped — By Quite A Bit — In

The Middle Of April 2024.

Producers especially had done what they could to keep prices up,

specifically by keeping manufacturing volumes lower in the face of this

ongoing soft demand. However, secondary suppliers were undercutting the

sawmills by lowering prices to entice customers in their direction.

For their part, lumber buyers continued with the practice established in

mid-2023 when interest rates starting rising; of booking orders only for

existing projects.

Sawmills and wholesalers both have been warning customers not to let their

inventories run too lean, because in the event of an increase in demand

there will not be enough wood in the supply chain to serve and prices could

rise sharply.

So far this year these warnings go unheeded. Lumber users have felt a sense

of confidence due to these ongoing lower prices, thus have been willing to

take their chances on getting caught short of wood during this summer.

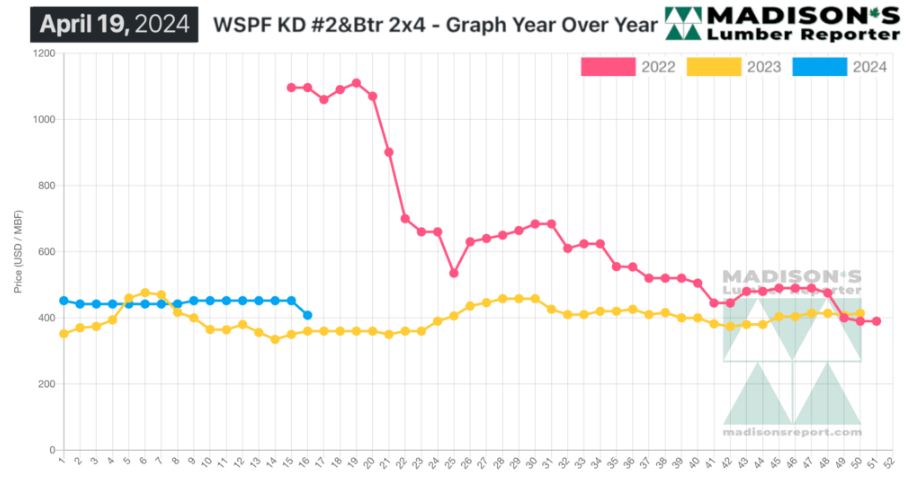

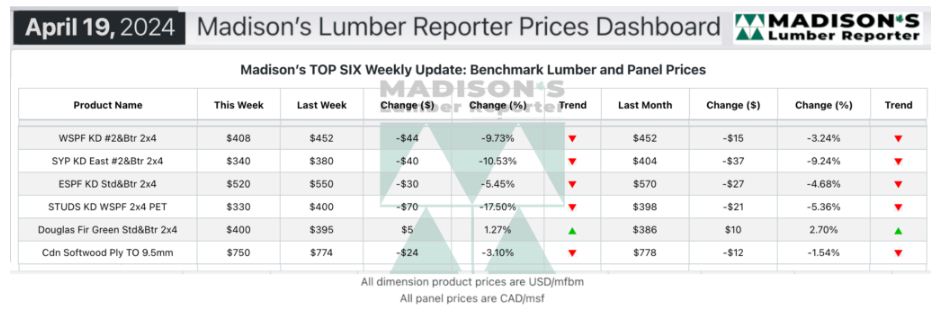

In the week ending April 19, 2024, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$408 mfbm. This is

down by -$44, or -10%, compared to the previous week when it was $452.

That week’s price is down by -$44, or -10%, from one month ago when it was

$452.

Demand remained subdued. Strangely, double-digit price drops caused buyers

to retreat even further to the sideline

KEY TAKE-AWAYS:

Buyers largely stuck to the sidelines in hopes of further price corrections.

Sawmills showed ample availability, which retail customers began to pick off

large sales blocks at attractive prices later in the week.

Sawmill order files shrunk again.

The market felt uncertain as demand came in fits and starts.

Supply remained a massive question mark, as players worried that even a mild

uptick in demand would clean up all available material with alacrity.

Producers seemed to be hoping for business to come to them, expecting

underbought purchasers to suddenly realize they need material.

Adding to buyers’ hesitation was the drop in the latest single-family

housing starts and permits data.

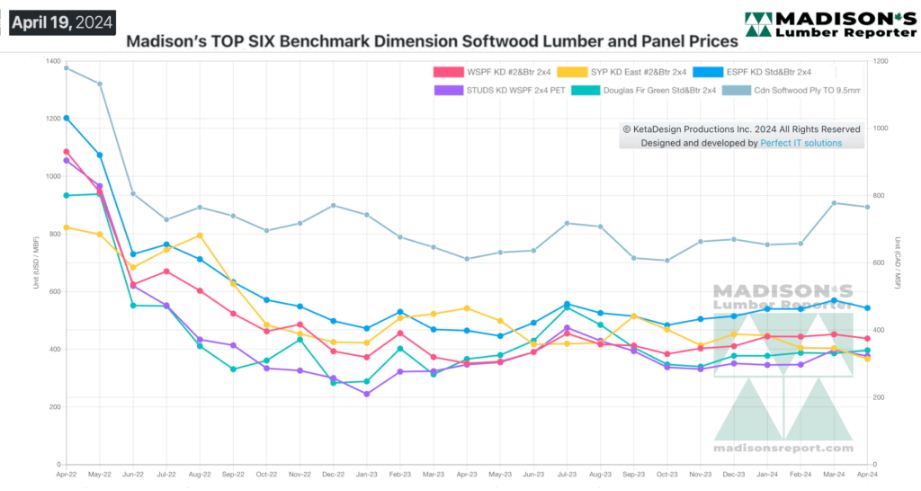

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Compared To The Same Week Last Year, When It Was Us$360 Mfbm, The Price

Of Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending April 19,

2024 Was Up By +$48, Or +13%.

More Reports: