As Winter Weather Is Ending Across Most Of The Continent And Building

Projects Start To Come Back To Life, Many Customers Of Construction Framing

Dimension Lumber Products Remain Circumspect.

After the great shocks of extreme price volatility from 2020 to 2022, buyers

of wood remain quite cautious. Because the previously “normal” historical

price trends, which generally followed the seasons, has not been evident for

the past three years, customers are wary of another shock.

Mainly they are unsure if lumber prices will fall lower, thus are holding

off on any large-volume purchases.

Since customers are choosing to continue with just-in-time buying for

immediate needs, and since there is no stocking up of inventory yet for this

year,sales volumes at sawmills and wholesalers are not robust enough yet to

push prices up. Thus most lumber prices remained flat yet again in

mid-March.

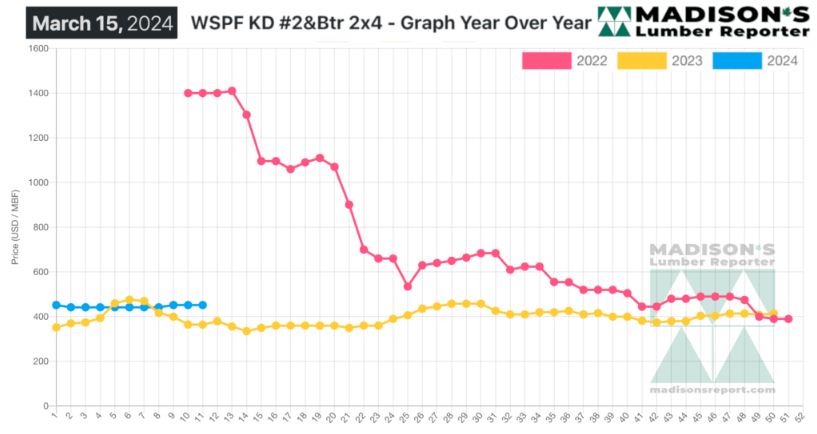

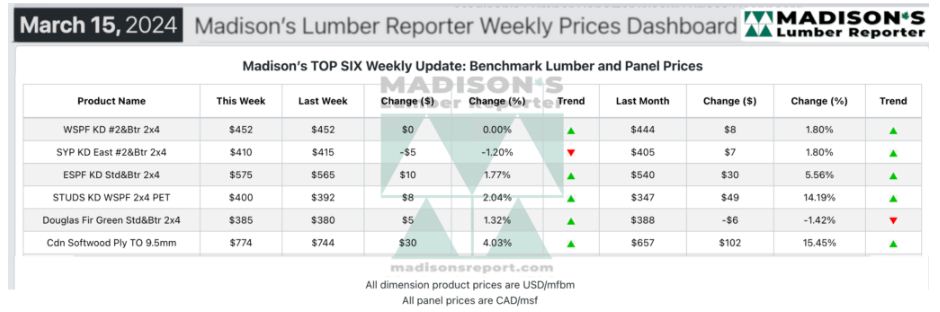

In the week ending March 15, 2024, the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$452 mfbm, which is flat from the previous week when it

was $452.

That week’s price is up by +$8, or +2%, from one month ago when it was $444.

Demand and takeaway improved tangibly in most categories as strong

market machinations continued to be driven mostly by lack of supply. Panels

were on a weird, wild ride of strong demand and rising prices.

The Spruce-Pine-Fir market continued to be largely supply-side driven,

with several ongoing curtailments among major producers helping to keep log

decks thin. Buyers continued to favour distribution channels, hoping to wait

out mills until supply levels catch up. Scuttlebutt surrounding limited

supply convinced heretofore less-motivated purchasers to get off the fence

and look at securing some of their anticipated spring needs.

As always, the tone of business for Southern Yellow Pine sales varied widely

from zone to zone, with most opportunities for value on narrows in the

Central and Eastern regions.

Multiple reports reinforced the West as its own pocket of liquidity due to

the abundance of sawmills there. Amid ongoing issues with supply of

large-diameter logs, the tightest in supply was 4x4s as demand from treaters

ramped up recently amid ongoing issues with supply of large-diameter logs.

Demand for Sheet goods in Eastern Canada was up-and-down, with most inquiry

and takeaway still coming from US markets. Sticker shock abounded among

buyers as prices vaulted another four to five points in both categories.

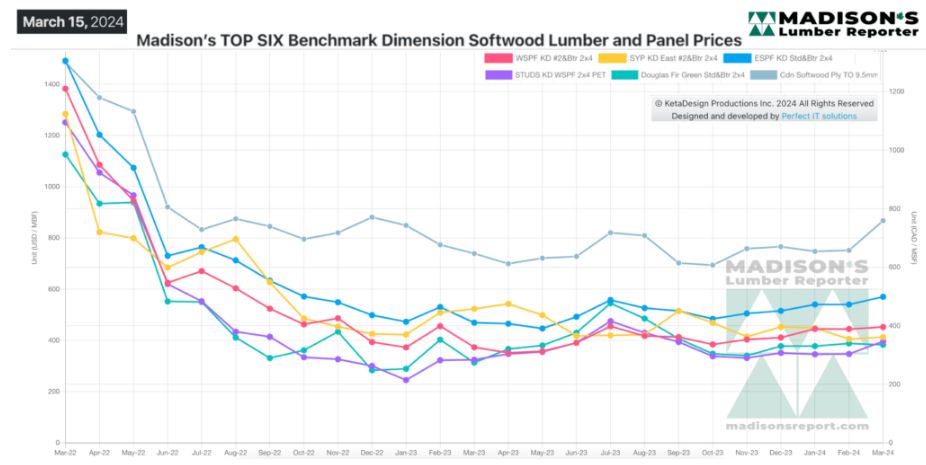

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Compared To The Same Week Last Year, When It Was Us$364 Mfbm, The Price

Of Western Spruce-pine-fir 2×4 #2&btr Kd (Rl) For The Week Ending March 15,

2024 Was Up By +$88, Or +24%.

Compared To Two Years Ago When It Was Us$1,400, That Week’s Price Is Down By

-$948, Or -68%.

More Reports: