While customers continued to be very cautious, preferring to only order wood

for building projects ongoing, suppliers warned of potential looming

shortages.

For their part, buyers were concerned that prices might fall — despite being

quite flat for most of this year — thus were reluctant to stock up on

inventory.

Producers, meanwhile, have been quite disciplined with keeping manufacturing

volumes low, in line with this muted demand since mid-2022.

As the spring home construction season starts to come on, suggestions of low

field inventories thus potential lack of supply seem valid.

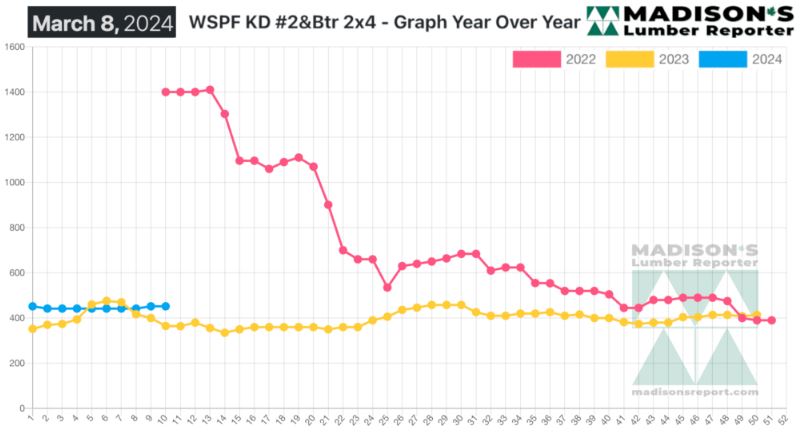

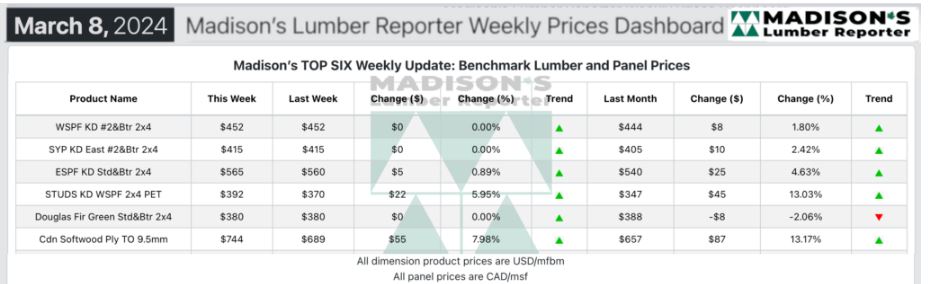

In the week ending March 8, 2024, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$452 mfbm. This is

flat compared to the previous week when it was $452. That week’s price is up

by +$8, or +2%, from one month ago when it was $444.

Panel prices soared, amid widespread confusion. As rising demand outstripped

limited supply, lumber and stud prices gained momentum.

As demand slowly improved Western S-P-F purveyors in the United States

had much the same posture as they did the previous week. Inventory-holders

with wood on the ground were in the driver’s seat, especially as dwindling

availability gave buyers fewer options.

Rising demand for studs ran up against subpar supply, pushing prices up.

Many buyers tried to stay circumspect, but those who were slow to purchase

missed out and usually ended up capitulating to higher prices. Even large

secondary suppliers reported atypically low inventories.

Suppliers of Western S-P-F lumber in Western Canada noted a strong uptick in

inquiry and takeaway of all product lines. Prices of standard- and

high-grade numbers were flat to slightly up, with sawmills showing

confidence in their positions as overall supply was perceived to be limited.

In what many called the busiest week for dimension lumber sales so far in

2024, sales of narrows led the charge.

Late-March order files were widely reported by sawmills, even as another

bout of winter weather in the West pressed pause on construction activity in

several areas. Snowfall disrupted transportation in those same regions, but

not to an egregious degree.

Traders of kiln dried Hemlock/Fir commodities were slammed with orders as

buyers kept extremely busy. While demand continued to heat up palpably,

producers extended their order files into late-March or early-April.

Experienced players voiced their expectations of a good spring run given

this recent surge in business. Those forecasts were lent more credence by

the pervasive lack of material up and down the supply chain. Everyone from

large suppliers to end users had lower-than-average inventories.

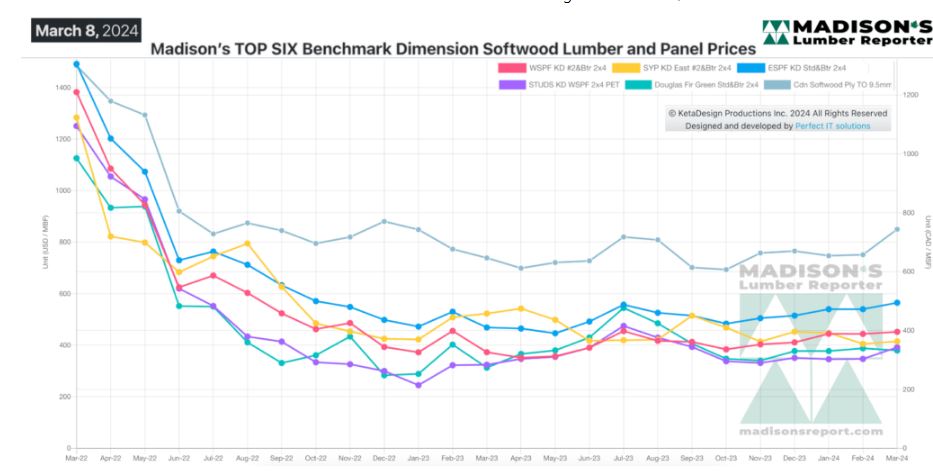

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Compared To The Same Week Last Year, When It Was Us$365 Mfbm, The Price

Of Western Spruce-pine-fir 2×4 #2&btr Kd (Rl) For The Week Ending March 8,

2024 Was Up By +$87, Or +24%. Compared To Two Years Ago When It Was

Us$1,400, That Week’s Price Is Down By -$948, Or -68%.

More Reports: