Actual Sales Of Construction Framing Dimension Softwood Lumber Did

Improve At The End Of February, Even As Prices Remained Flat.

Actual Sales Of Construction Framing Dimension Softwood Lumber Did

Improve At The End Of February, Even As Prices Remained Flat.

Suppliers fielded good volumes of calls, many of which followed through to

actual sales. Customers dropped their recent habits of buying only the wood

absolutely needed for ongoing projects. As the first signs of spring have

not yet arrived, the momentum of North American lumber sales shifted from

just-in-time buying to beginning to stock up on inventory. Prices did remain

essentially flat however. Expectations are that rampant sawmill curtailment

will first cease, bringing manufacturing levels up closer to previous spring

volumes, before prices rise significantly.

There is a good volume of wood production available to come back online as

spring building season approaches.

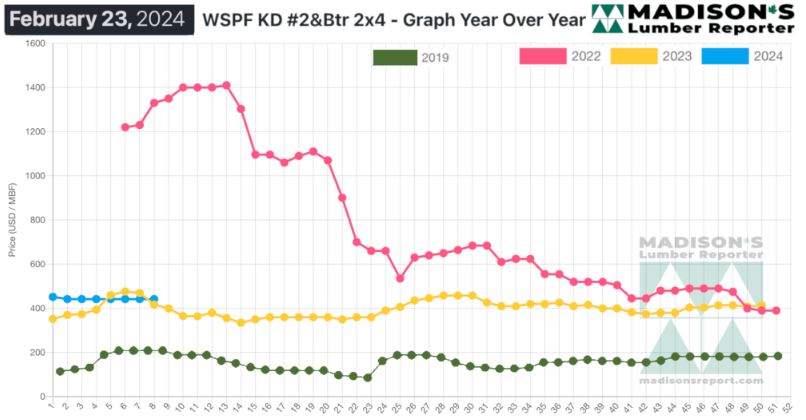

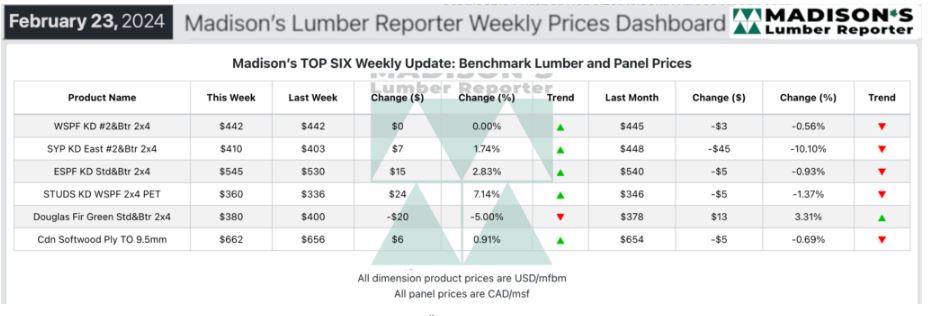

In the week ending February 23, 2024, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$442 mfbm. This is

flat compared to the previous week when it was $442. That week’s price

is down by -$3, or -1%, from one month ago when it was $445.

Commodity prices were flat or on either side of the previous week’s

levels as the standoff between supply and demand persisted. Players waited

with bated breath for the floodgates to open.

Western S-P-F purveyors in the United States noted an improving

sentiment among buyers and suppliers. Demand from end-users stubbornly

lacked momentum however. Discounted material was less prevalent at the

sawmill level, and availability continued to dwindle. Lean field inventories

were common as weak financial forecasts and waffling economic indices sapped

buyers’ optimism.

While the market appeared flat on the surface, players waited with bated

breath for the floodgates of sales to open. Secondary suppliers encouraged

their customers to cover 2×4 and 2×6 dimension as this remained the cheapest

plate stock in North America, aside from Southern Yellow Pine.

Suppliers of Western S-P-F lumber in Western Canada navigated an unclear

market. Buyer sentiment changed day-to-day, from confident to sour and back

again. The standoff between relatively balanced supply and demand persisted,

with both sides waiting for the next litmus test moment to show a clearer

direction. Sawmills maintained a cautiously optimistic tone amid firm prices

and order files in the range of two weeks.

One large producer in Western Canada was apparently off the market from

midweek-on. Mill curtailments and shutdowns continued to come down the pike,

but players said those developments hadn’t affected the supply-demand

equation much – yet.

Overall demand for Western S-P-F studs was low as buyers maintained a

cautious approach through this holiday-shortened week. Razor thin field

inventories were reported across the board, with customers preferring to let

the distribution network carry material rather than stocking up themselves.

Producers apparently fielded sneaky-strong takeaway; asking prices on nearly

every trim advanced between $10 and $24.

Eight-foot studs were the strongest seller while demand for nine-footers

took the backseat.

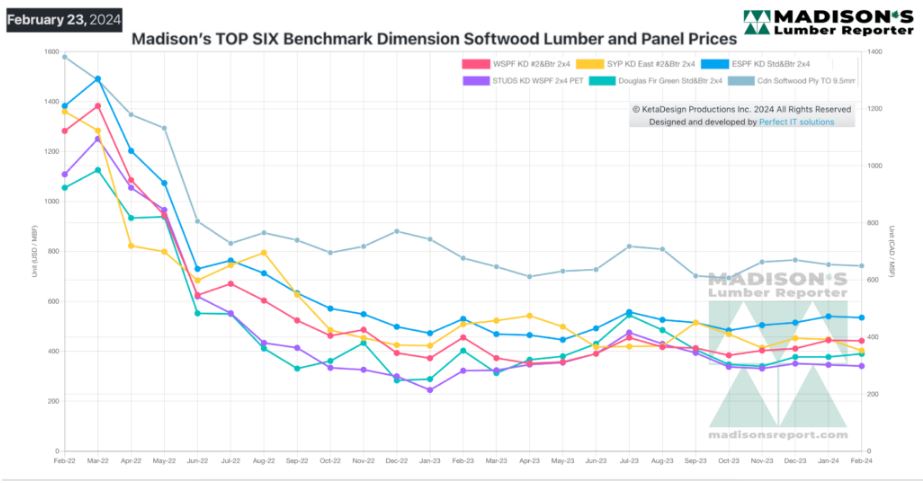

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Compared To The Same Week Last Year, When It Was Us$417 Mfbm, The Price

Of Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending February

23, 2024 Was Up By +$25, Or +6%. Compared To Two Years Ago When It Was

Us$1,330, That Week’S Price Is Down By -$888, Or -67%.

More Reports: