Lumber Sales Remained Muted Into Mid-February, As It Seemed Like Many Buyers

Were Waiting On The Sidelines To See What Everyone Else Was Doing.

Inquiry at sawmills was good, however there was not yet much follow-through

with actual sales. The forest products manufacturing industry was poised for

the next home building season, but since that hadn’t quite started yet in

2024 many were taking the chance of not stocking up on lumber inventory. So

many players had been bitten by those sudden, sharp price increases of

recent years, and general macroeconomic conditions are not precisely

encouraging as the increased interest rates seem to be having the effect of

slowing home sales. Thus, while North America remains in

winter weather, most lumber buyers are taking a cautious approach and

delaying true purchases until they see an increase in construction activity.

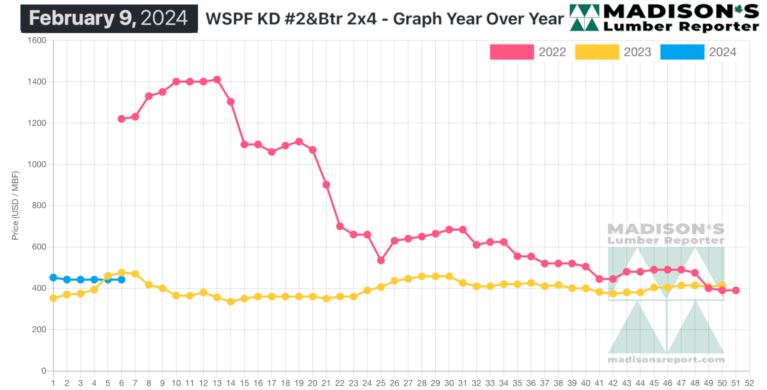

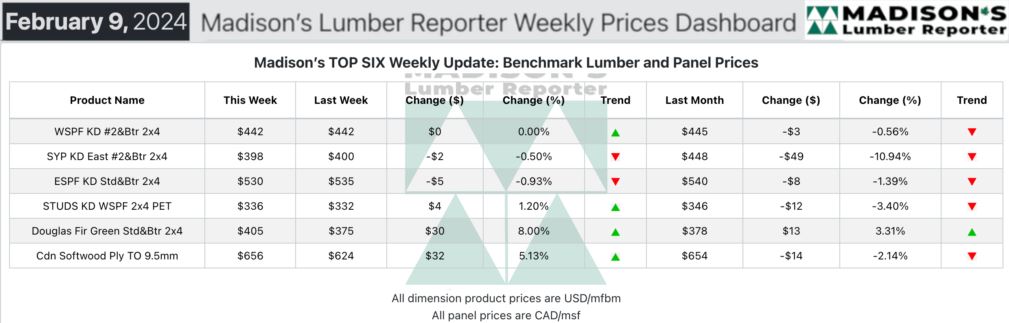

In the week ending February 9, 2024, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$442 mfbm. This is

flat compared to the previous week when it was $442. That week’s price is

down by -$3, or -1%, from one month ago when it was $445.

Different regions and product groups of the lumber market slowly woke up

this week, even as commodity prices were largely flat. Meanwhile, plywood

surged up across the board

Western S-P-F trading was a hit-and-miss affair according to purveyors

in the United States. There was a frustrating lack of flow to business but

at the end of the day, when counting up sales, volumes weren’t bad. Demand

appeared to increase as the week wore on, with suppliers having to chase

orders with less frequency from midweek-on. Customers avoided carrying

inventory however, preferring to short-cover through the distribution

network while the majority of wood remained in the hands of secondary

suppliers.

The position of many producers seemed sneaky strong, as they quietly kept

sales moving and extended order files into late-February. Meanwhile, the US

Department of Commerce, in the fifth annual review of Canadian softwood

lumber imports into the United States, has announced the preliminary

determination of a combined anti-subsidy and anti-dumping duty rate of 13.86

per cent, up from the previous determination of 8.05 per cent.

Western S-P-F lumber slingers in Canada reported a bit of a hodgepodge of

sales. Some buyers remained on the sidelines waiting for prices to slide

while a growing contingent decided it was time to jump in and buy some of

their more pressing medium-term needs. Producers maintained level asking

prices for the most part, with sawmill order files in the range of two

weeks.

Supply chain and transportation disruptions were frequent topics of

discussion; the former more top-of-mind than the latter. For now, delivery

timelines were solid as trucking and rail services have been more reliable

than usual so far this winter.

But supply has already taken several hits so far in 2024, as Tolko’s sawmill

in Williams Lake is the latest casualty. The company announced this week

that it will temporarily lay off 60 workers at that facility, reducing

operations from two 50-hour shifts per week to one.

Suppliers of Western S-P-F studs in Western Canada navigated another grind

of a week as purchasers maintained a cautious approach in covering their

needs. Stud mill asking prices hovered at or on either side of the previous

week’s numbers, with most producers reporting order files in the two-week

range. Demand was again largely confined to the distribution network as

buyers relied heavily on prompt options and quicker shipment. Smooth

transportation and reasonable delivery timelines so far in 2024 have been a

boon to that approach.

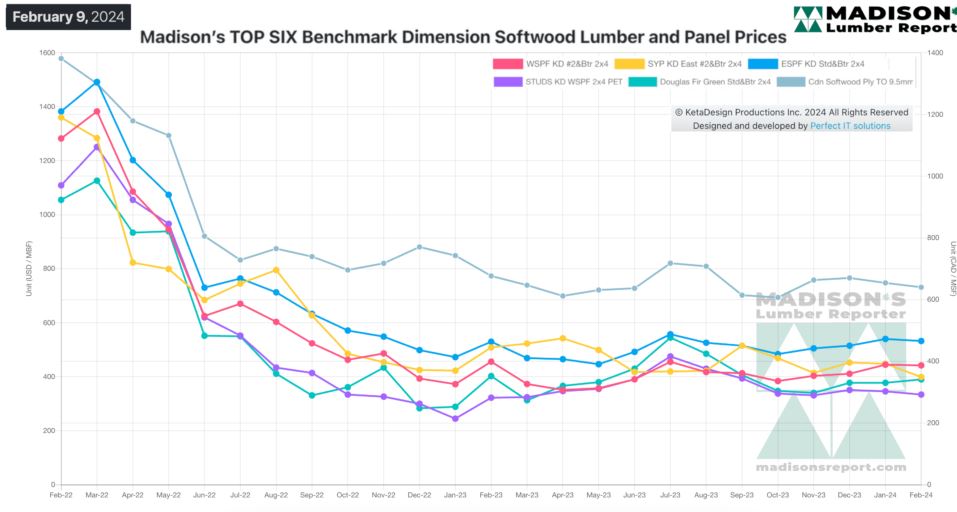

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Compared To The Same Week Last Year, When It Was Us$476 Mfbm, The Price

Of Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending February

9, 2024 Was Down By -$34, Or -7%. Compared To Two Years Ago When It Was

Us$1,220, That Week’S Price Is Down By -$778, Or -64%.

More Reports: