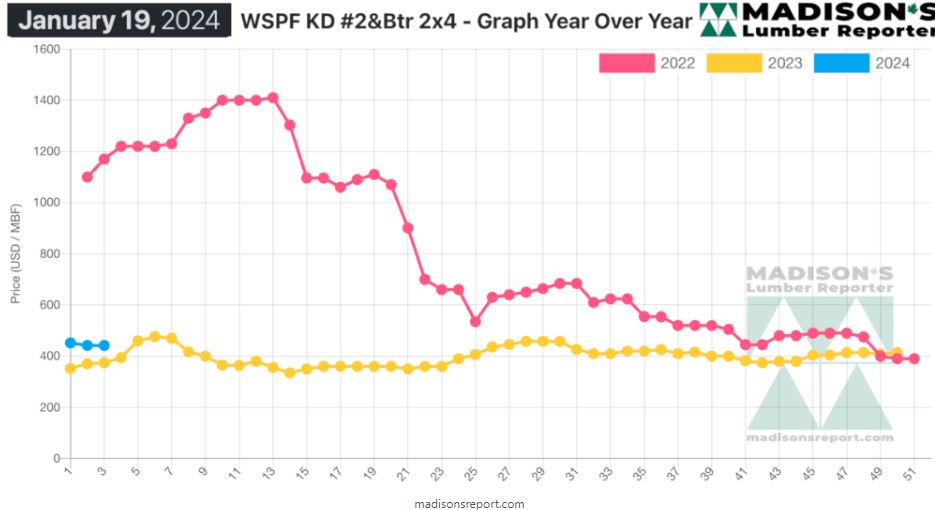

As Business In January 2024 Got Going After The Annual Holiday Break, The

Price Trendline For Benchmark Construction Framing Dimension Lumber

Commodity Item Western Spruce-Pine-Fir Kd 2×4 #2btr Continued Nicely From

Where It Ended Last Year.

A quick look at the graph above to compare the yellow line of 2023 to the

blue line of this year, shows there is a return to stability and the more

regular price changes that were normal until the disruptions of the Covid

era. Given that the great volatility of that time is behind us, expectations

are that — going forward — both the wood products manufacturing and the home

building industries will be once again able to plan ahead for their future

business dealings.

Much of the North American lumber market was frozen in place as frigid

weather descended across the continent. Commodity prices were flat or on

either side of the previous week’s levels, while supply and demand both went

into hibernation mode.

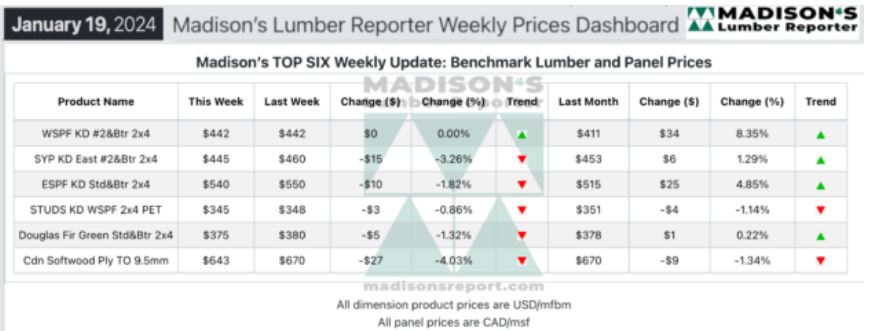

In the week ending January 19, 2024, the price of Western Spruce-Pine-Fir

2×4 #2&Btr KD (RL) was US$442 mfbm, which is flat from the previous week

when it was $442.

That week’s price is up by +$31, or +8%, from one month ago when it was

$411.

Much of the North American lumber market was frozen in place as frigid

weather descended across the continent. Commodity prices were flat or on

either side of the previous week’s levels, while supply and demand both went

into hibernation mode.

Western S-P-F purveyors in the United States were under a blanket of snow,

blunting the overall pace of business noticeably. Still, there were those

traders who were pleasantly surprised with inquiry levels considering the

time of year. Western mills maintained their numbers for the most part,

loathe to go any lower as they were barely in the black as it was.

Suppliers advised their charges to buy through Valentine’s Day and then

reevaluate the market. They hoped that by that time there will be a clearer

picture as to the direction of multi-family construction in 2024. In the

meantime, trucking lanes and rail lines in most regions ground to a halt as

the mercury dropped.

Western Canadian suppliers of Western S-P-F lumber navigated a muted market

muffled by winter weather. Sawmills held most of their asking prices flat

while a narrow trading range was reported at the secondary supplier level.

A small contingent of active buyers shopped their needs aggressively on

specific tallies, finding limited availability among wholesalers and

distributers.

Producers maintained order files in the three week range, while minimal

takeaway caused their offer lists to grow marginally. Delivery times

increased as rough road conditions caused headaches in the trucking sector.

Demand for the Eastern S-P-F slowed down tangibly as frigid weather

descended on the Eastern reaches of North America. Many US players were also

absent early in the week while they observed Martin Luther King Day, further

dampening the tone of business. Mill offer lists weren’t exactly robust as

production volumes were affected by the cold, but inquiry and follow through

were also quiet, leading to a relative balance. Sluggish demand was reported

as the week wore on, with sawmills getting more aggressive and amenable to

counter offers from midweek-on.

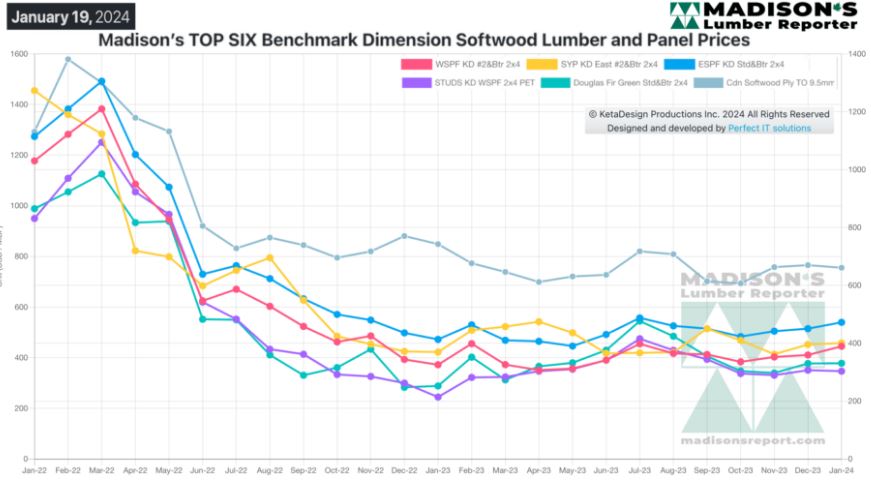

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Compared To The Same Week Last Year, When It Was Us$374 Mfbm, The Price

Of Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending January

19, 2023 Was Up By +$68, Or +18%. Compared To Two Years Ago When It Was

$,170, That Week’S Price Is Down By -$728, Or -62%.

More Reports: